In this month's update, we discuss the RBI's decision to keep the repo rate unchanged, the divergence between bank credit and deposit growth, the decline in inflation below RBI’s 4% target, and the rising stock market valuations. We also provide guidance on managing your loans, investing in fixed deposits, and focusing on long-term investments.

Let's break down each of these key events and explore what they mean for your personal finances:

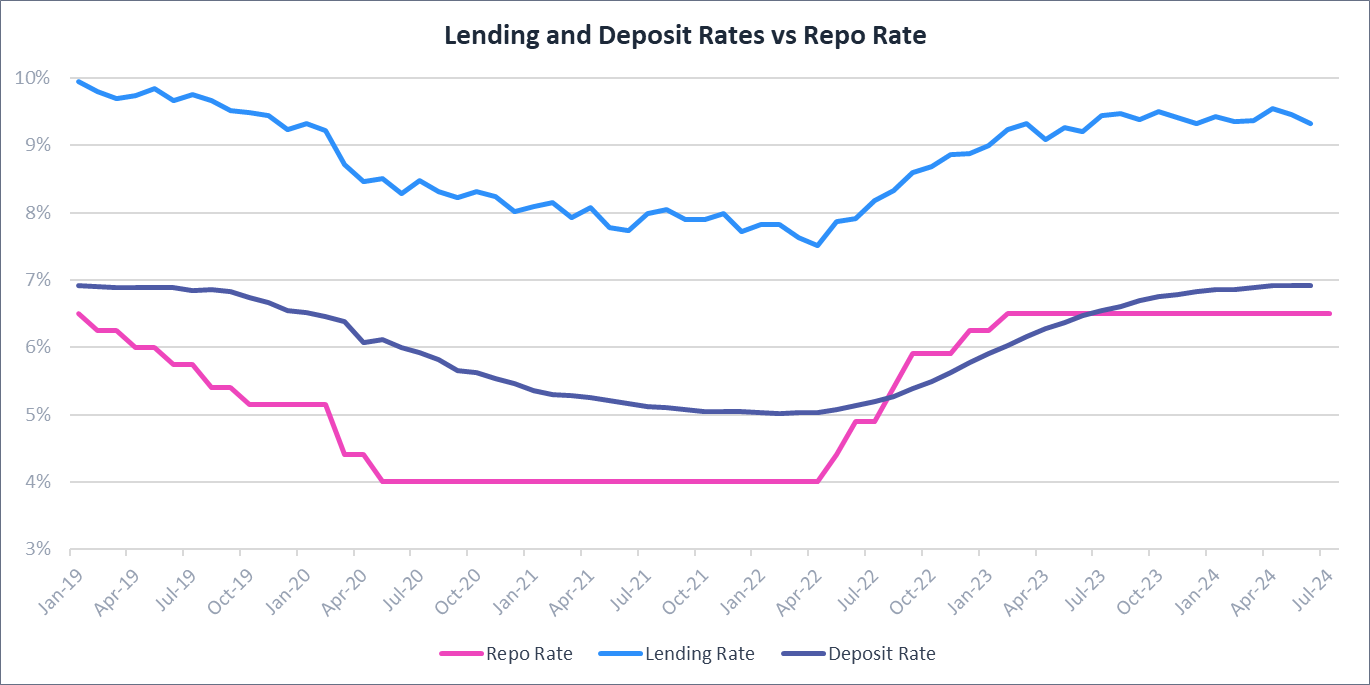

RBI Keeps Repo Rate Unchanged

Interest rates to remain high

The Reserve Bank of India (RBI) has maintained the repo rate at 6.5% in its August Monetary Policy Committee (MPC) meeting, indicating that borrowing costs will likely remain high. Here are some strategies to manage your loans effectively:

- For existing floating-rate home loans - Interest rates may not decrease for a few months. Keep an eye on rates offered by lenders on new loans for potential refinancing opportunities. If refinancing isn't beneficial, consider using extra cash to prepay your loan to reduce interest burden and loan tenure.

- For new home loans - Opt for a floating-rate loan to benefit from potential future rate cuts by the RBI.

- For fixed-rate loans (e.g. personal & auto loans) - Be aware of any prepayment penalties before making prepayment decisions.

Source: CMIE Economic Outlook, 1 Finance Research

Recommended for you

Readers also explored

The Fed’s 2025 Rate Cut and Why It Matters Now

World GDP Breakdown 2025: Who Powers the Global Economy?

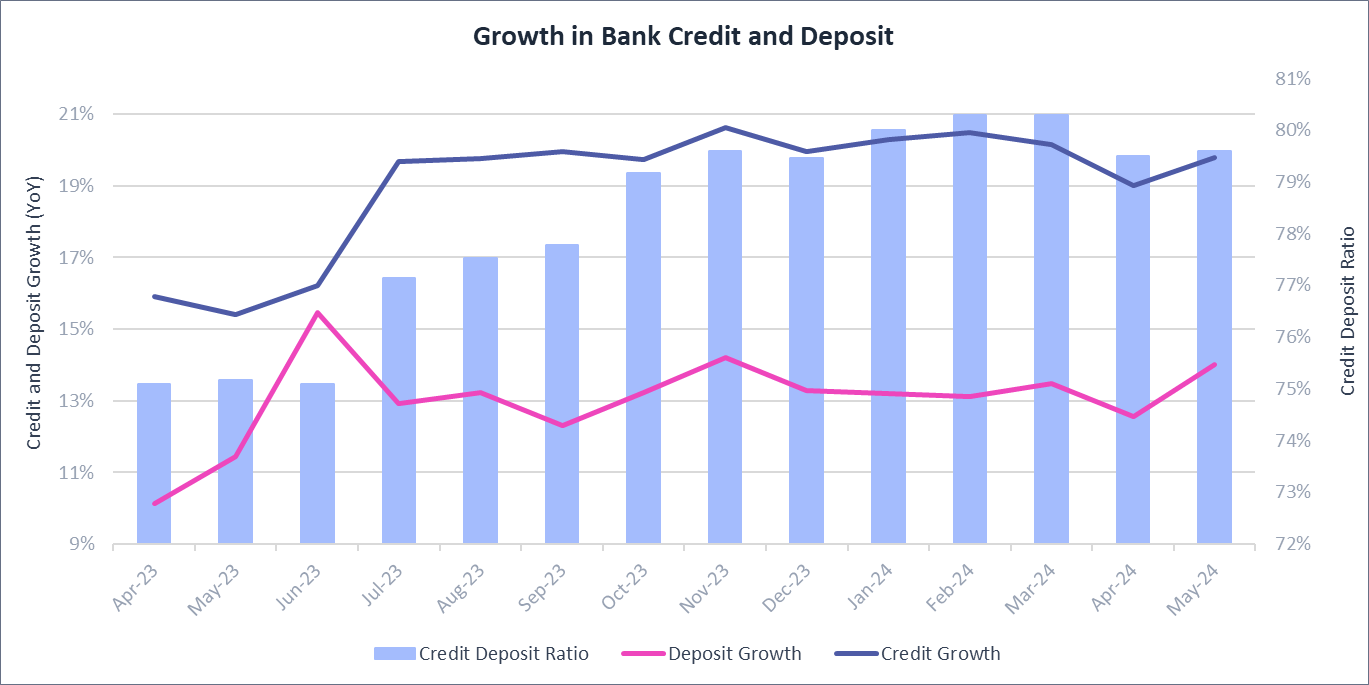

Credit-Deposit Divergence

Bank deposit rates may increase further

The bank credit-deposit ratio has remained close to 80% for the past seven months, indicating faster credit growth compared to deposit growth. Slower deposit growth is due to a shift in investment preferences by individuals towards the stock market. This situation presents some opportunities:

- Banks may increase Fixed Deposit (FD) rates to attract more deposits.

- If you're looking to diversify your investment portfolio with fixed-return products, you can lock in higher FD rates before potential future repo rate cuts by the RBI.

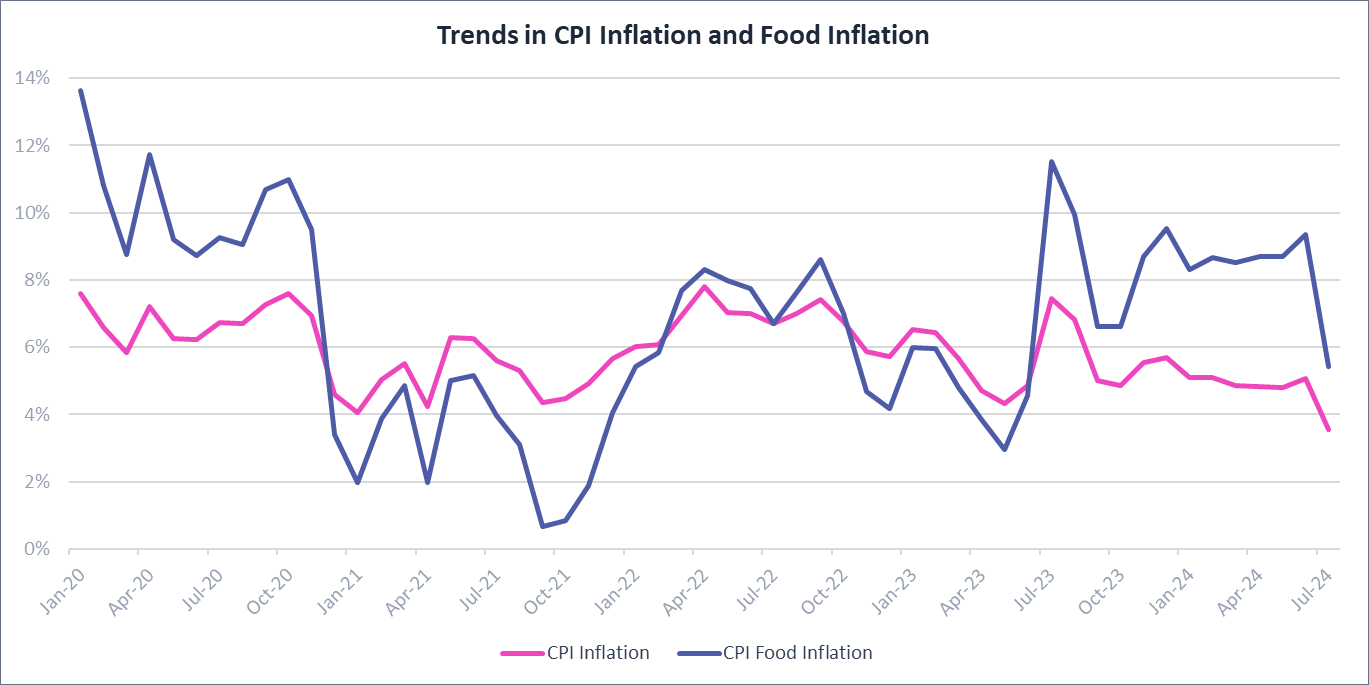

CPI Inflation Below 4%

Positive outlook for monetary easing

CPI inflation declined significantly to 3.54% in July, the lowest in five years, as food inflation eased to 5.42%. Cumulative rainfall this monsoon, which was at a 10.9% deficit until June, touched a surplus of 9.0% by July-end. This development could have the following impacts:

- Improved monsoon conditions and increased sowing are expected to boost agricultural output and reduce food prices in the coming months.

- Moderating inflation increases the likelihood of a repo rate cut by the RBI.

- When interest rates fall, your fixed-income investments (like debt funds) may increase in value as existing bonds with higher coupon rates become more attractive.

Source: CMIE Economic Outlook, 1 Finance Research

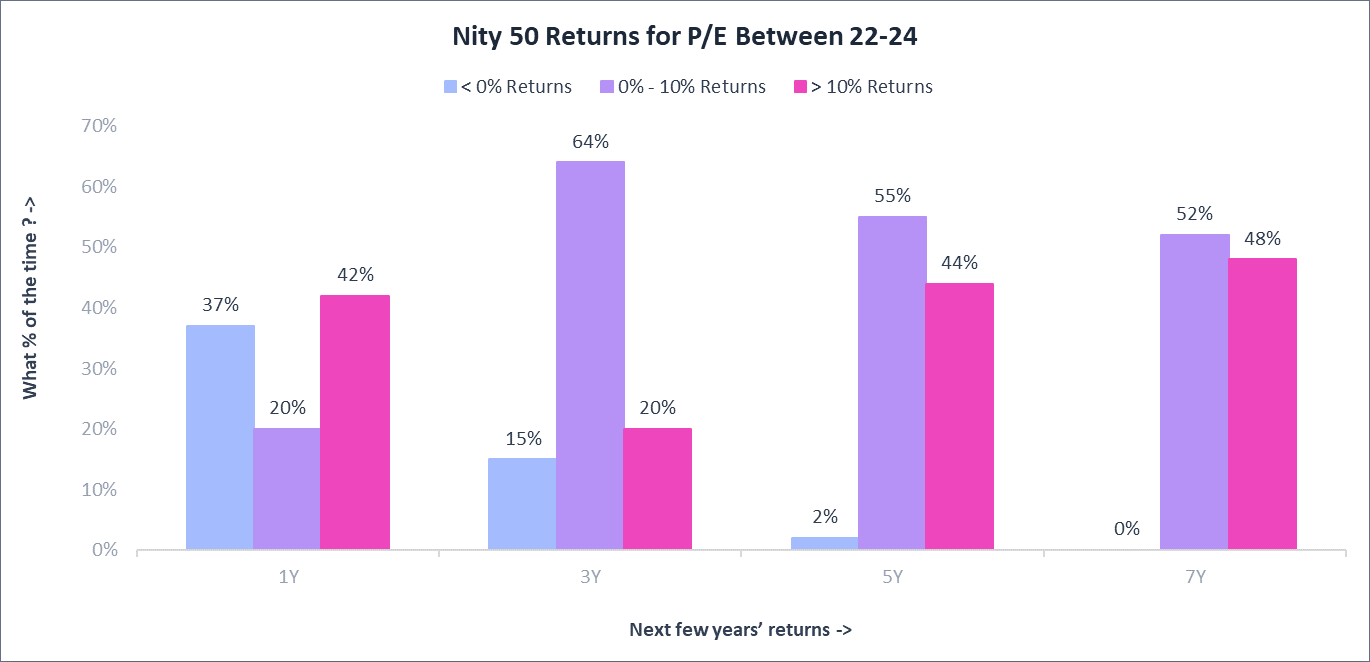

High Market Valuations

Focus on long-term investments

The Nifty 50 P/E ratio reached 23.4 in July and stood at 22.5 as of 13 August. The index fell by 3.5% by 13 August, from its record high of 25,011 on August 1, 2024, mainly due to the unwinding of the Japanese yen carry trade.

Historical data (since 1999) suggests that when the Nifty 50 P/E is in the 22-24 range:

- Short-term returns (1 year) are unpredictable, with negative returns 37% of the time but also notable >10% returns 42% of the time.

- Long-term investments (5-7 years) almost always yielded positive returns.

Given these trends, consider the following strategies:

- Reduce exposure to sectors or companies with weak, unsustainable earnings growth.

- Maintain a long-term investment horizon to mitigate short-term market volatility.

- Invest systematically through SIPs rather than making large lump-sum investments.

Source: CMIE Economic Outlook, 1 Finance Research