Rising Investment Opportunities

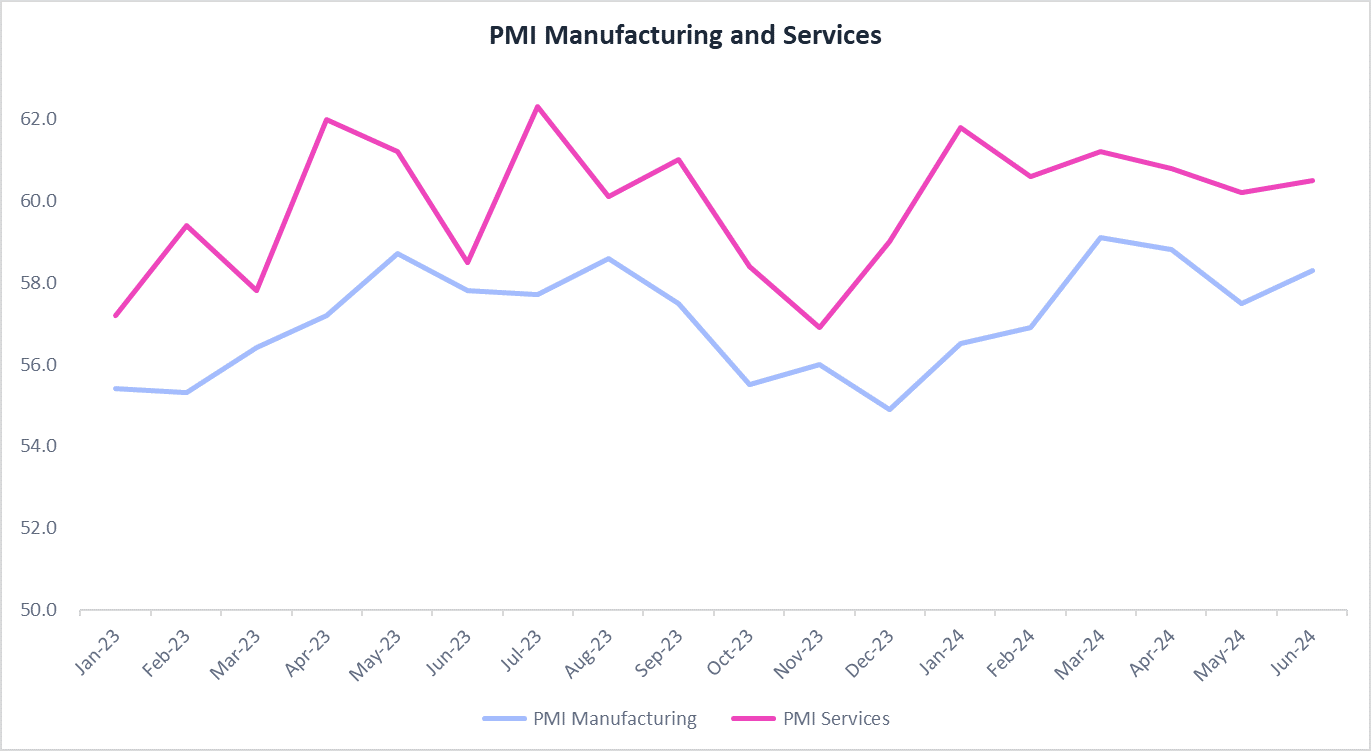

- Strong and steady expansion in manufacturing PMI (58.3) and services PMI (60.5) in June indicates rising demand for goods and services in the economy.

- A steady rise in PMI signals enhanced business confidence and the potential for increased capital investment, which leads to increased job creation in the private sector.

- The optimistic growth outlook presents opportunities for individuals to invest in these sectors for stable returns.

- Investing in long-term assets or high-growth stocks is advisable when the economic outlook remains positive.

Note: A PMI (Purchasing Managers’ Index) number greater than 50 indicates expansion and less than 50 shows contraction in business activity. Source: CMIE Economic Outlook, 1 Finance Research

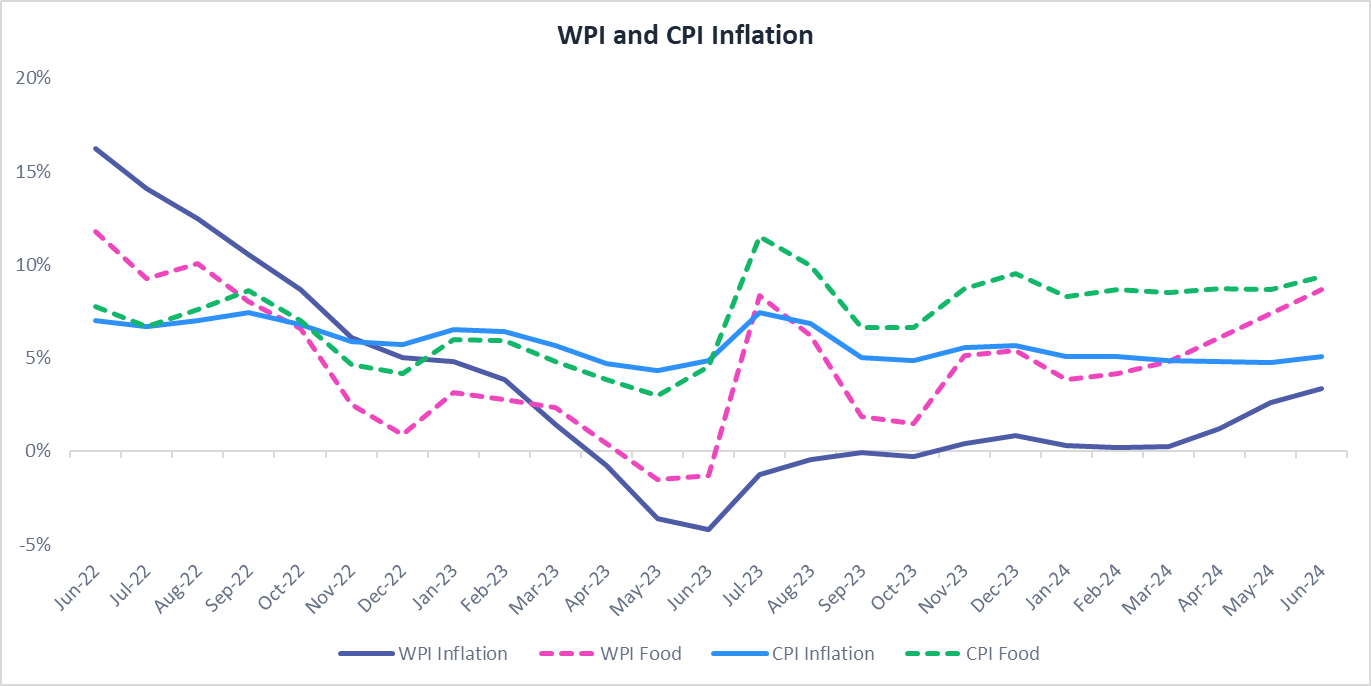

Food Inflationary Pressure to Continue

- CPI inflation increased to 5.08% in June YoY (4.83% in May 2024), while food inflation further increased to 9.36% (8.70% in May).

- An increase in wholesale prices (WPI food inflation at 8.68% in June) indicates rising input costs, which can squeeze the profit margins for food manufacturing businesses, and may keep food inflation high.

- Higher inflation reduces the purchasing power of an individual, and rising food prices can diminish household disposable income.

- To mitigate the impact of inflation, diversify your investments; equities and commodities (gold) often act as a hedge against inflation.

CPI: Consumer Price Index, WPI: Wholesale Price Index

Recommended for you

Readers also explored

Sustained Domestic Growth Momentum

World GDP Breakdown 2025: Who Powers the Global Economy?

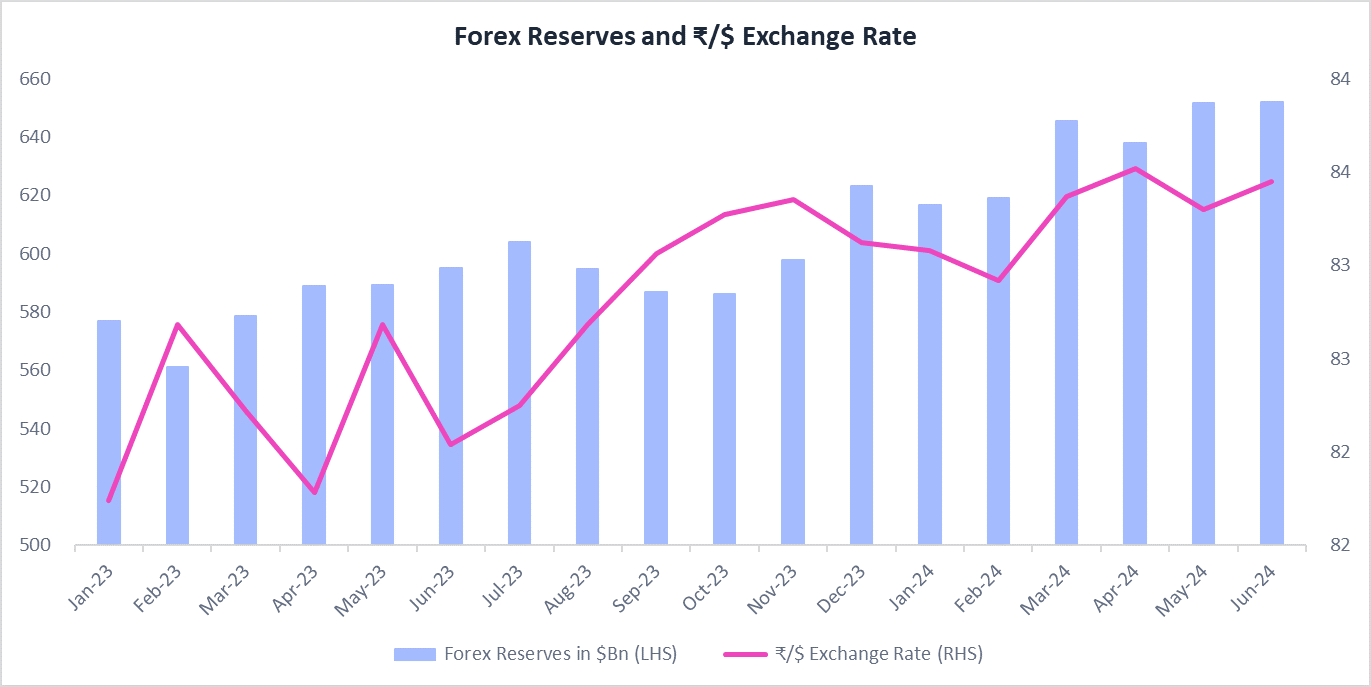

Abundant Forex Reserves Ensure Stability

- Foreign exchange reserves rose to a record $650 billion in June 2024, driven by a surge in foreign capital inflows and a decrease in Current Account Deficit (CAD).

- Increasing forex reserves reflect India’s strong external position, and help the government and RBI to effectively manage external debt obligations and maintain stability in the domestic currency.

- The exchange rate remained stable at ₹ 83.45/$ as of June 30, 2024, (₹ 83.30/$ on May 31), and appreciated by 7 paise from April 30, 2024.

- The stability in the rupee reduces the currency fluctuation risks for businesses and helps manage inflation in imported commodities.

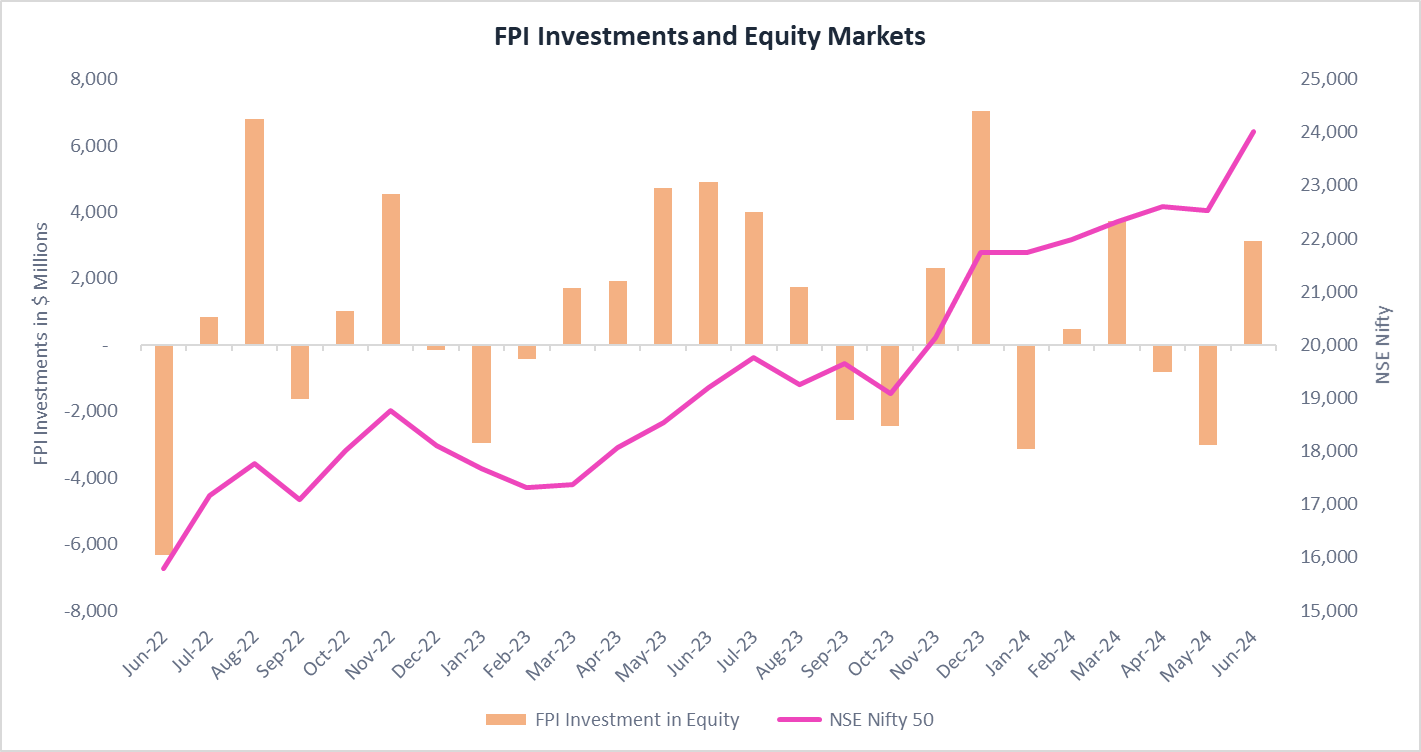

Equity Market Dynamism Sparks Investor Optimism

- The equity markets rebounded after the political uncertainty, and the NSE Nifty 50 index increased by 12% to 24,502.5 points as of 12 July 2024 from its low of 21884.5 on 4 June 2024.

- Foreign investors net invested ₹153.5 bn in Indian equities in June, while domestic investors invested ₹286.0 bn.

- Amid signs of RBI sticking with its high interest rates and the bonds being included in JPMorgan Chase indexes, foreign investors invested ₹84.8 bn in the Indian bond market.

- The positive market movements despite the volatility underscore the importance of maintaining a long-term investment horizon.