The Union Budget is one of the biggest events that shape India’s economy. It affects how businesses grow, how money flows in the markets, and how investors make decisions. This year, Budget 2025 focused on three key things:

- Structural Reforms – Long-term changes to improve different sectors of the economy.

- Fiscal Discipline – Managing government spending wisely to keep the economy stable.

- Growth-Oriented Policies – Steps taken to boost businesses, create jobs, and increase disposable income.

In this update, we analyse events happening post-budget to provide you with a comprehensive understanding and offer practical advice on how to use this information to plan your finances strategically.

How to Navigate Market Volatility After the Budget

What Happened?

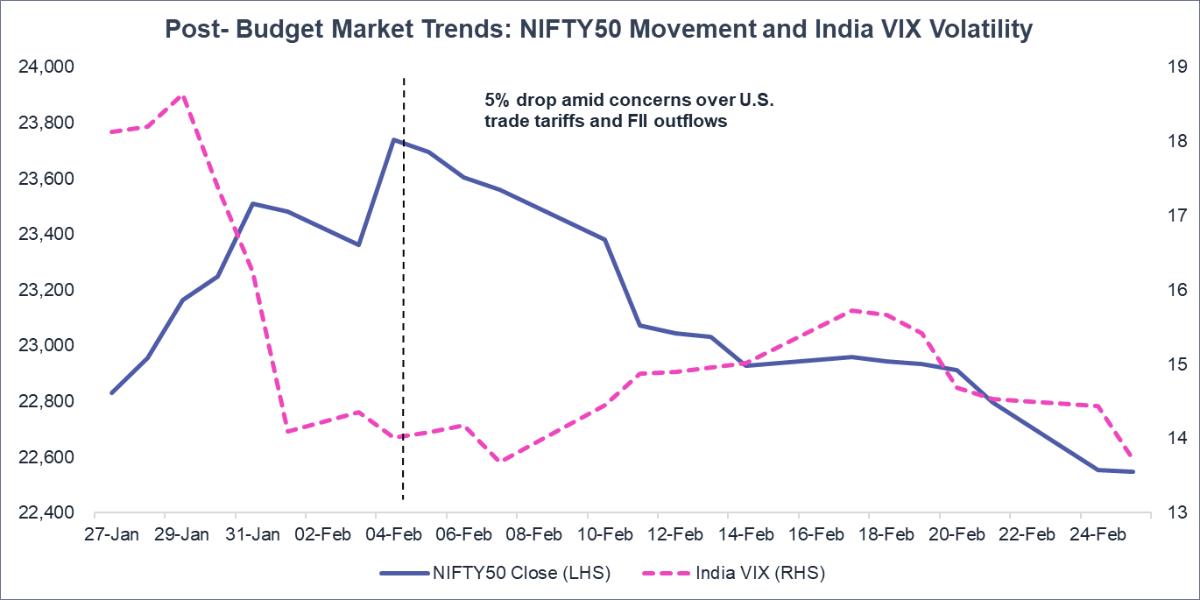

Nifty50 initially gained post-budget but later fell 5% to 22,547 amid U.S. tariff concerns. Between 1 Feb - 26 Feb, 2025, Foreign Investors (FIIs) sold ₹27,984 crore, weakening the rupee to ₹87/USD, while Domestic Investors (DIIs) invested ₹50,817 crore, providing market support. Volatility dipped on budget day but rose afterward, reflecting growing uncertainty.

Impact on You

1) Short-term market dips will affect portfolio returns but create good buying opportunities.

2) DII investments provide some market support amid US trade tariff concerns and FII outflows.

3) Weaker rupee will increase the cost of imported goods and travel.

Action Plan

1) Stay invested and avoid panic-selling.

2) Continue SIPs in mutual funds to average out market fluctuation.

3) Build a well-diversified portfolio by balancing equities with fixed-income instruments (bonds, debt mutual funds), real estate and alternative assets (gold). While equities offer high returns, diversification ensures stability[Use our Asset Allocator to find the right mix]

4) Maintain cash reserves for market opportunities.

Recommended for you

Readers also explored

Personal Finance Lessons from Past Economic Crises

India’s Unemployment Rate in 2025

Should You Reduce Your EMI After the Rate Cut?

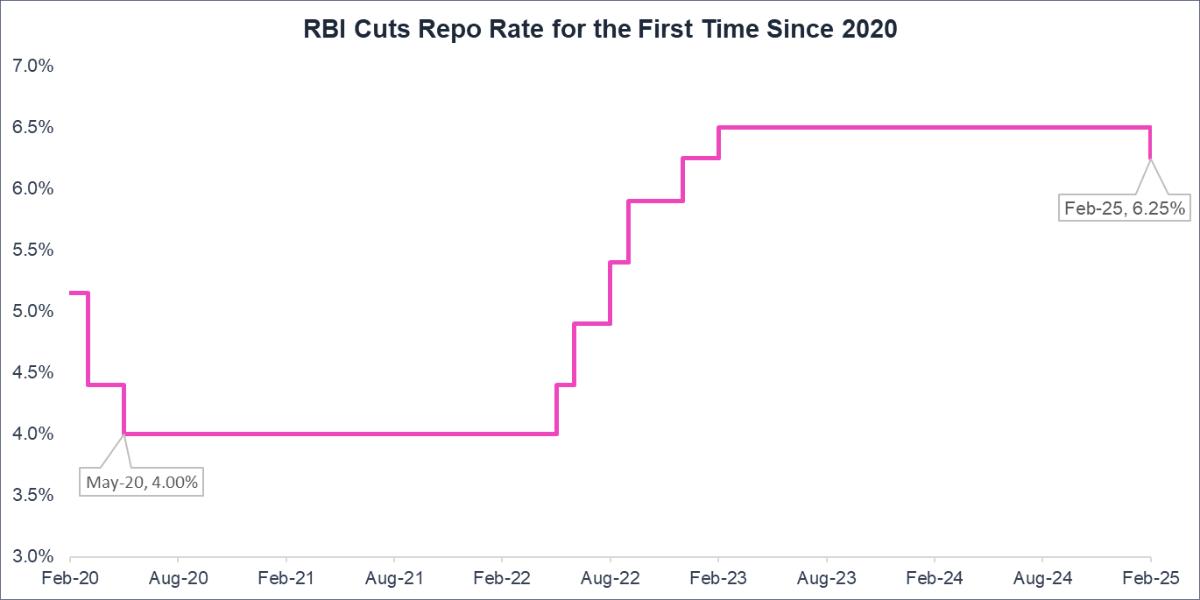

- What Happened?

On February 7, 2025, the Reserve Bank of India (RBI) cut the repo rate for the first time since 2020, reducing it from 6.50% to 6.25%.

Impact on You

1) Your new loans will get cheaper.

2) For existing home loans, you have the option to lower your EMI or reduce your loan tenure, which will help you save on interest.

Action Plan

1) If you're struggling with expenses, living paycheck to paycheck, or feeling stressed about monthly expenses, reduce your EMIs to free up monthly cash flow. This will provide immediate relief and help you manage your day-to-day finances.

2) If your finances are stable—meaning your monthly expenses are under control, and you’re already investing regularly in a diversified portfolio—consider reducing your loan tenure to save on interest costs over the long term. This allows you to repay your loan faster and minimise the total amount of interest paid.

3) If you decide to reduce your EMI, contact your bank to request a rate adjustment, as even small changes can lead to significant savings.

Explore the example below to see the impact on your EMI:

Amount Current Loan Details New Loan Details Loan Amount ₹50,00,000 ₹50,00,000 Interest Rate 9.00% 8.75% Loan Tenure (Months) 180 180 EMI ₹50,713 ₹49,972 Total Interest ₹41,28,399 ₹39,95,038 Interest Saved = ₹1,33,361

Use our Loan Refinance Calculator to see how much you can save! It's a quick and easy way to see the potential impact of refinancing.

4) With repo rates expected to fall, consider short- to medium-duration bonds because their yields may see a sharper decline than long-duration bonds, making them more attractive for debt investments.

Budget 2025 Tax Relief: What's Next for You?

What Happened?

Budget 2025 eliminated income tax for earnings up to ₹12 lakh (under the new tax regime), starting in FY2025-26, to boost consumer spending.

Impact on You

More Savings! This tax relief will significantly benefit you, allowing you to use the money to spend or invest.

Action Plan

1) Check out our Old vs New Income Tax Calculator to evaluate whether the new tax regime is beneficial for your income level and adjust accordingly.

2) Consider using a portion of this tax relief to increase your emergency savings.

3) Even though the new tax regime does not offer 80C and 80D deductions, it's essential to maintain your health and term insurance to ensure financial safety.

Key Takeaways

- The market is showing signs of recovery but is below pre-budget levels.

- Foreign investors remain cautious, but domestic investors are stepping in to support the market. This shows confidence in India’s growth.

- RBI’s rate cuts will make loans cheaper, offering opportunities for refinancing and loan management.

- Tax relief increases disposable income, boosting consumer spending and investment potential.

Risks to watch

- Global Uncertainty: High U.S. bond yields, a strong dollar and geopolitical risks could impact FII investment flows.

- Market Volatility: Concerns over the new U.S. tariffs may cause short-term fluctuations, requiring you to adjust strategies.

Outlook for 2025

India’s economic growth remains strong, supported by domestic investments and policy reforms. The Budget’s tax relief will boost spending, while RBI’s rate cut makes borrowing cheaper. However, global uncertainties like U.S. trade tariffs and FII outflows may cause short-term market fluctuations.

Stay invested with a long-term perspective, diversify across asset classes and turn market dips into opportunities to build wealth.

Read our Macro Outlook 2025 for our comprehensive analysis across asset classes, focusing on key themes shaping investment opportunities in 2025.