Moderating Global Growth Outlook

Global economic growth is expected to decelerate from 2.6% in 2023 to 2.4% in 2024 due to tightened monetary conditions. Major central banks have kept policy rates steady, emphasising the need to bring back inflation within their targets. A diverse pattern of disinflation across economies has increased the prospects of interest rate reductions in the later half of the year.

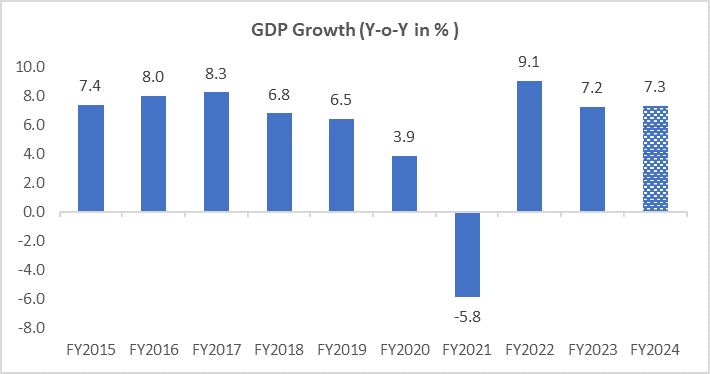

India’s Promising GDP Growth Projections

Higher government spending (10.3% YoY) is expected to drive India’s GDP, projected to grow by 7.3% YoY in FY24, compared to 7.2% in FY23. As per MoSPI, GVA growth is expected to be at 6.9% (7.0% in FY23), with the construction sector anticipated to record the highest growth (10.7%), and lowest by the agriculture sector (1.8%).

Recommended for you

Readers also explored

Growth Momentum Moderates Amid Economic Shifts

World GDP Breakdown 2025: Who Powers the Global Economy?

Easing External Conditions

The challenges from global economic factors slightly declined in recent months. The rupee appreciated from 83.35 / $ in November to 83.12 / $ in December and crude oil prices dropped from $83.5 / barrel to $77.4 / barrel. FPI net inflows amounted to $10.2 billion in December, and forex reserves crossed $623 billion by December 2023.

Tightness in Banking Liquidity

The liquidity in the banking system remained in deficit mode in December (₹ 2.68 trillion deficit as on December 28) which led to tightness in the money market conditions. Interbank call money rates were ~31 bps higher than repo rates by December end. To ease the liquidity conditions, RBI conducted four variable repo auctions (total ₹ 4.50 trillion) in December.

Increasing CPI Inflation

CPI inflation rose to 5.69% in December 2023 from 5.55% in November, driven by higher food inflation which increased to 9.53% from 8.70% during the same review period. Core inflation maintained its downward trend and eased to 3.90% from 4.10%.

How Does This Impact You?

India's strong economic fundamentals are evident in optimistic GDP growth estimates, yet recurring inflation concerns pose risks to growth and interest rate outlook. In addition, tighter liquidity in the banking system may cause a rise in borrowing costs in the near term.

Chart of the Month

Source: Ministry of Statistics and Programme Implementation (MoSPI), 1 Finance Research