Summary

Indian equities were positive in April 2025 after earlier losses. The country's foreign exchange reserves then rose to USD 688.1 billion. Additionally, its services PMI slightly increased to 58.7 that month. The April 22 Pahalgam attack caused the India-Pakistan conflict, leading to India's suspension of the Indus Waters Treaty. The India-UK free trade agreement on May 6th, presents new opportunities in the global trade uncertainty. We will analyse these developments to help you strategise your finances effectively.

Analysing the Impact of Recent Events on India

| US/China Trade Agreement | |

| India has an opportunity to boost exports in sectors less affected by the US-China trade deal, such as pharmaceuticals (APIs), gems & jewellery. | Narrow tariff gap between US & China will lure companies back to China from India, Vietnam, etc. |

| The agreement with China could mean an end to their dumping of cheap goods in markets such as India. | Limited to 90 days, the deal's trade impact is constrained by political sensitivities. |

| India/UK Trade Deal | |

| Boost exports in textiles, leather, gems & jewellery, engineering goods, marine products etc. | Increased competition from UK alcoholic beverages, cosmetics, medical devices, etc. |

| Opportunities for Indian professionals and service exports. | India might face costs and challenges when adapting its standards to those of the UK. |

| India/Pakistan Conflict | |

| India imports very limited goods from Pakistan, so the trade impact will be minimal. | Inability to store billions of cubic meters of western river water during high flows due to lack of infrastructure. |

| India/US Trade Deal (Ongoing) | |

| US gives India 90 days (until July 9, 2025) for trade talks. | India faces US pressure for tariff cuts in vulnerable industries like automobiles, wines, etc. |

| India is seeking tariff reductions on textiles, gems & jewellery, leather goods, garments, etc., which could boost Indian exports to the US. | US has a comparative advantage due to recent China and UK agreements. |

Equity: Strategic Investing for Long-Term Growth

What Happened:

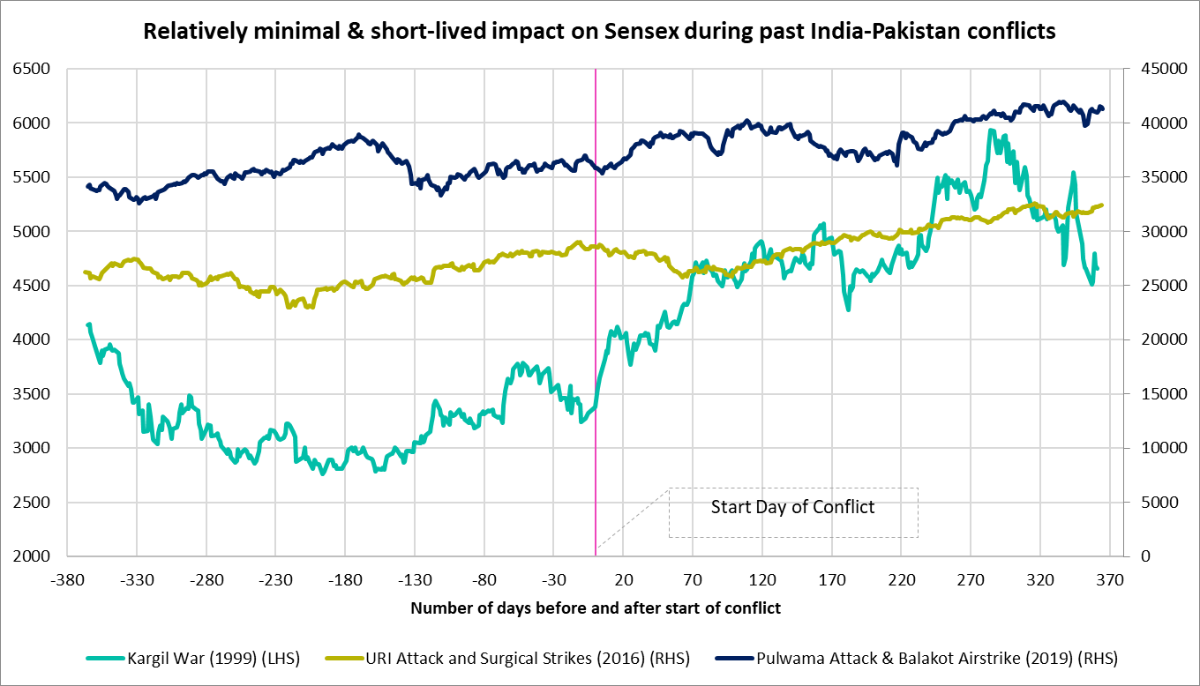

Historical military conflicts between India and Pakistan have had a temporary and limited negative effect on Equities. Geopolitical tensions can cause short-term market volatility, but their long-term impact on Indian equities has historically been minimal.

Recommended for you

Readers also explored

Gold Outlook in India for FY2026

World GDP Breakdown 2025: Who Powers the Global Economy?

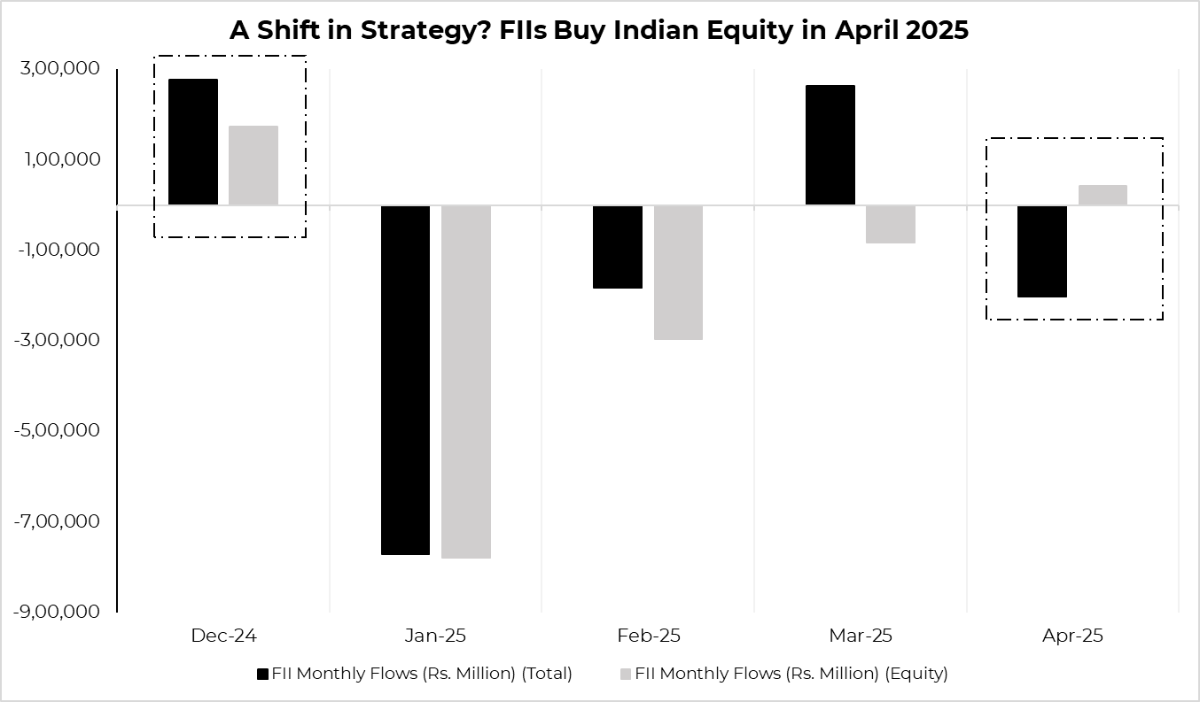

In April 2025, Foreign Institutional Investors (FIIs) recorded a net withdrawal from the Indian capital market. However, surprisingly, they were net buyers in the equity segment for the first time in 3 months due to boost in investor confidence by favourable economic indicators and rupee appreciation.

Action Plan:

- Diversification: Historically, India-Pakistan Conflict has led to very short term impact on Equities. Thus, don’t panic & continue consistent SIPs with step-ups.

- Limited Number of Funds (4-5): Avoid over-diversification, which can dilute returns. Focus on a few well-chosen funds that provide diversification at the market cap and AMC (Asset Management Company).

Debt in Focus: India's Easing Inflation and Falling Yields

What Happened:

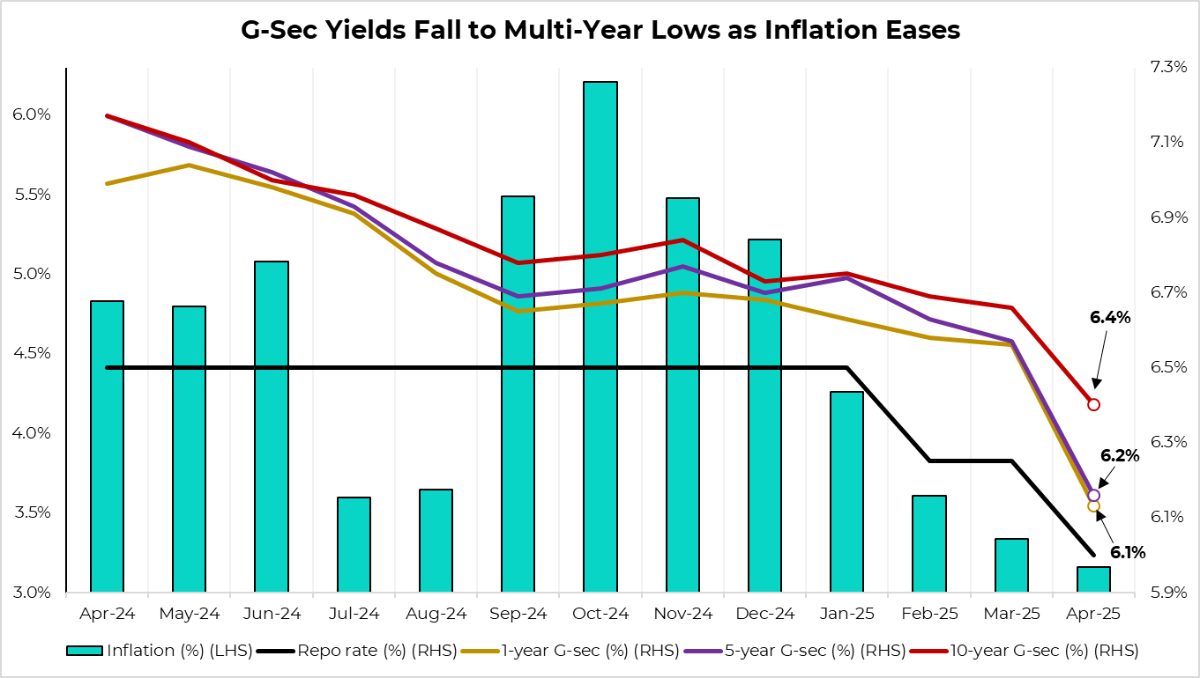

Indian G-sec yields had seen a significant drop, supported by easing inflation (below RBI's 4% target). This suggests that prospects for debt have improved, especially if more rate cuts materialise in late 2025 or early 2026.

India's consumer price inflation (CPI) moderated to 3.16% in April, down from 3.34% in March, creating room for further rate cuts.

We expect RBI rate cuts of 50-75 bps in FY26, which suggests a favourable outlook for fixed income securities.

Action Plan:

- Fixed Income: Focus on high-quality short-to-medium duration debt mutual funds (1–5y segments) to benefit from potential capital appreciation while mitigating reinvestment risk. The 1 Finance Scoring & Ranking Model allows you to compare and evaluate the best funds.

- Lock in high FD rates now: If you want a safe investment with a fixed return, before the rates potentially go down.

- Expense Planning: Lower rates, inflation, and taxes mean more money in your pocket. Plan your finances and investments with this additional disposable income strategically for your financial future.

Conclusion

The interplay of global events, from trade agreements to geopolitical tensions, presents both opportunities and challenges for the Indian economy. Our analysis suggests that a disciplined, long-term investment approach, emphasising diversification in various asset classes like debt, equity, real estate and gold, remains key to harnessing India's brightening horizon.