Global Economy Still Exhibits Fragility

Despite significant improvement in global supply chains, economic growth is clouded by elevated debt levels, lingering geopolitical conflicts, and deceleration in global trade due to the growing trend of protectionism. Expectations for an early end to monetary tightening have risen with easing inflation in advanced economies, yet interest rates continue to remain relatively high.

Indian Economy Remained Resilient

India’s GDP grew by 7.6% YoY in Q2FY24, supported by higher government spending and strong performance in the manufacturing (13.9%) and construction sectors (13.3%). Investment (11%) and government consumption (12.4%) saw significant growth, while the agriculture sector (1.2%) underperformed.

Hawkish Pause by RBI for Fifth Consecutive Time

RBI kept the key policy rates unchanged in its December MPC meeting and continued with its stance of withdrawal of accommodation. RBI maintained its CPI inflation forecast for FY24 at 5.4% while revising the GDP growth forecast to 7% from its previous forecast of 6.5%.

CPI Inflation Rose to 5.5% in November

After moderating to a 4-month low of 4.89% in October, CPI inflation rose to 5.55% in November, driven by higher food inflation (8.7%) and a fading base effect. Core inflation maintained its downward trend (4.1%).

Recommended for you

Readers also explored

India's Economic Balancing Act Growth VS Global Woes

World GDP Breakdown 2025: Who Powers the Global Economy?

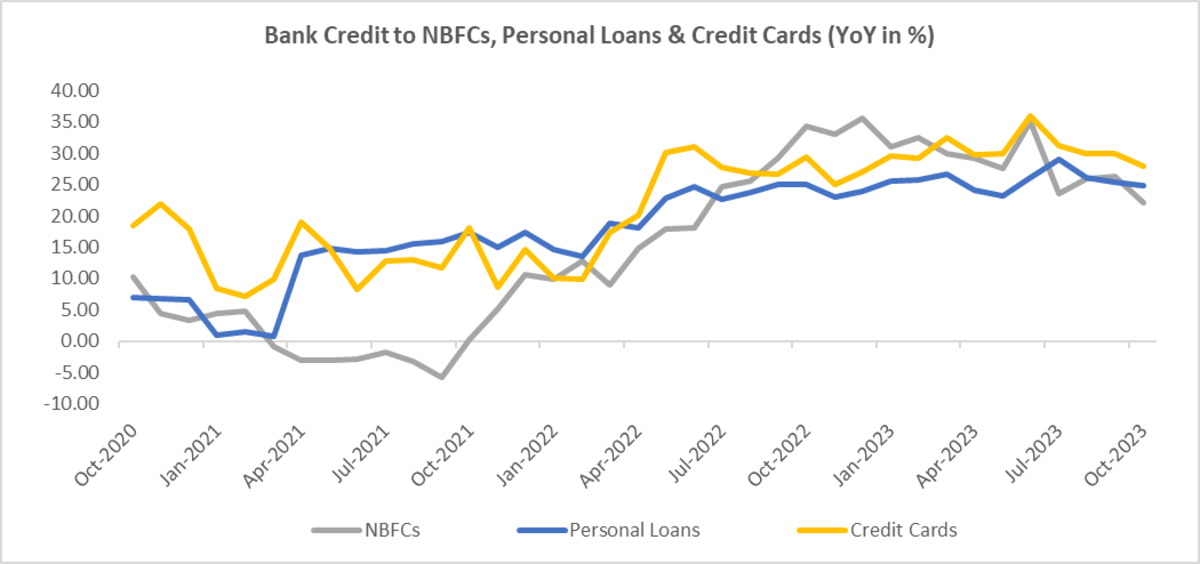

Higher Risk Weights to Unsecured Consumer Loans

As a part of regulatory measures towards consumer loans and bank credit to NBFCs, the RBI has assigned higher risk weights to unsecured consumer loans of commercial banks and NBFCs by 25% to 125%. The move is aimed at maintaining better asset quality in the banking system.

How Does This Impact You?

Optimistic GDP growth outlook despite formidable global challenges highlights India’s resilience and strong economic fundamentals. On the other hand, the continuation of a pause on interest rates by the RBI suggests lingering inflation concerns.

The borrowing rates on unsecured consumer loans (like personal loans and credit card loans) are expected to go up because of the revised risk weights assigned by the RBI on these loans.

Chart of the Month:

Rising Trend in Unsecured Consumer Loans and Bank Credit to NBFCs