Global Economic Recovery Continues

Global trade improved in January 2024 (0.9%), and the composite PMI reached a nine-month high of 52.3 in March, supported by continued expansion in both services and manufacturing, reflecting sustained economic recovery. Meanwhile, US inflation increased to a six-month high of 3.5% in March, raising the probability of further delay in rate cuts by the US Fed.

MPC Holds Rates Steady

Maintaining a cautious stance on policy actions to focus on restoring price stability, the RBI opted for a status quo on rate cuts along with the withdrawal of accommodation stance for the seventh straight time, in its April MPC meeting. RBI retained the GDP outlook for FY2025 unchanged at 7.0% and CPI inflation at 4.5%.

Conducive Domestic Conditions

CPI inflation softened to a ten-month low of 4.85% in March (5.09% in February), food inflation stood at 8.52% (8.66%), and core inflation eased to 3.27% (3.41%). Both the services PMI (61.2 in March from 60.6 in February) and manufacturing PMI (59.1 from 56.9) expanded, and IIP growth rose to a four-month high of 5.7% in February (4.1% in January).

Global Headwinds & External Sector

Despite global challenges, external sector conditions remained resilient in FY2024. Exports (merchandise and services $778.7 bn in FY2024), forex reserves ($645.6 bn), and net FPI inflows ($41.6 bn), contributed to a significant easing in CAD (1.2% of GDP in Q3 FY2024 and 1.3% in Q2). Crude oil prices moved above $91 /barrel in April from an average of $84 /barrel in March due to ongoing geopolitical tensions.

Recommended for you

Readers also explored

Major Macro Risks Shaping 2026

India’s Unemployment Rate in 2025

Positive Market Sentiments

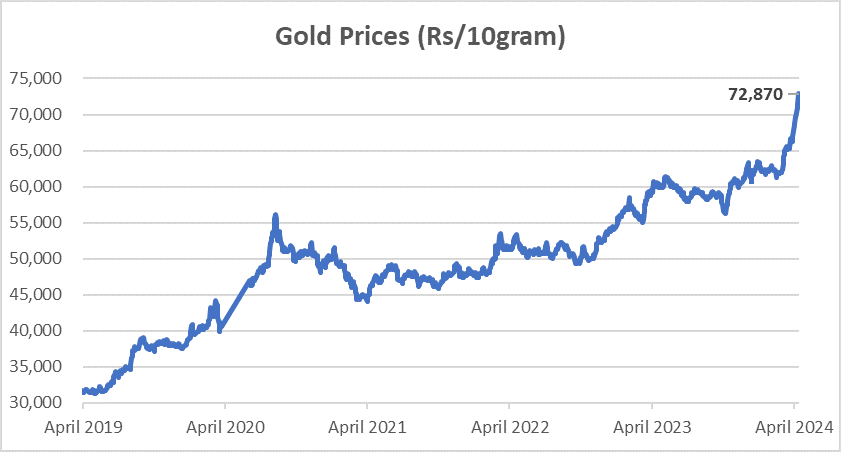

The banking system liquidity improved in April compared to March, and 1-year G-Sec yields eased while 10-year hardened. FPIs remained net buyers in equities ($3.7 bn) and DIIs too invested Rs 563 Bn in equities in March. NSE Nifty posted 1.6% returns over February, and the PE ratio increased to 22.9 from 22.7. Gold prices crossed Rs 72,000 per 10 gm in April surging by 16% in 2024.

How Does this Impact You?

Lingering geopolitical instability may impact domestic market sentiments, while India’s strong growth prospects and easing inflation are supportive of the market confidence. Expectations of monetary easing by global central banks and repeated geopolitical unrest could drive investors towards safer alternative investments such as gold, which might further increase gold prices.

Chart of the Month

Gold has emerged as one of the best performing asset classes in 2024, with 16% returns so far, reaching a record high in April.

CAD: Current Account Deficit

MPC: Monetary Policy Committee

PMI: Purchasing Managers' Index

CPI: Consumer Price Index

IIP: Index of Industrial Production

FPIs: Foreign Portfolio Investors

DIIs: Domestic Institutional Investors

PE: Price-to-Earnings

AMFI: Association of Mutual Funds in India

SEBI: Securities and Exchange Board of India

GDP: Gross Domestic Product

GVA: Gross Value Added

IMF: International Monetary Fund

OECD: Organization for Economic Cooperation and Development

MoSPI: Ministry of Statistics and Programme Implementation