Renewed Resilience in the Global Economy

Presenting a cautiously optimistic view of the global economy, IMF's latest World Economic Outlook report predicts a global GDP growth rate of 3.2% in 2025, up from 3.1% in 2024. Stronger economic resilience in the US and key emerging markets, and China's fiscal measures are supporting this outlook, however geopolitical tensions, inflationary pressures, and tight monetary measures continue to pose downside risks to the growth trajectory.

Receding Global Challenges

With the improving global economy, the challenges faced by the Indian economy slightly eased in recent months. The rupee stabilised to 83.08 / $ in January from 83.12 / $ in December and FPIs continued to remain net buyers in the Indian markets ($1.3 billion in January). Forex reserves crossed $ 622 billion by February 2, 2024, adding $ 47 billion in a year. Merchandise exports improved slightly (0.81% YoY), while growth in services exports moderated (3.89% YoY) in December.

Recommended for you

Readers also explored

Tracing the Journey of India’s Foreign Exchange Reserves

India's IT Sector Outlook for FY2026

Stable Domestic Macro Conditions

The Indian economy continued with growth momentum; composite PMI reached 6-month high of 61.2 in January, and credit growth remained strong at 20% YoY in December. IIP grew by 3.9% in December, while capacity utilisation stood at 74.0% in Q2 FY2024. CPI inflation moderated to 5.1% in January 2024 from 5.7% in December 2023, driven by easing core inflation (3.6% from 3.9%) and food inflation (8.3% from 9.5%).

RBI’s Cautious Policy Tone

Sustaining its efforts towards disinflation, RBI maintained the key policy rates unchanged in its February MPC meeting. RBI kept a 4.5% inflation outlook for FY2025, while maintaining 5.4% for FY2024, and projected an optimistic GDP growth rate of 7% for FY2025. GDP estimate comes on the back of the government’s (MoSPI) first advance estimates of 7.3% for FY2024.

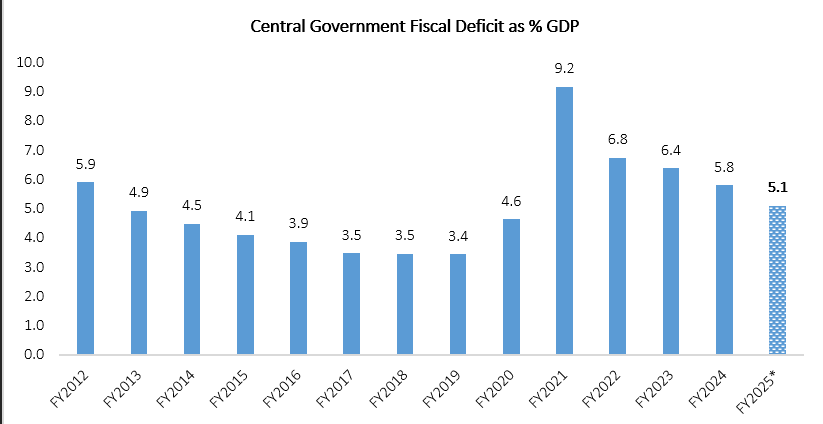

Interim Budget on Fiscal Consolidation Path

Continuing its stand on fiscal consolidation, the central government has set the fiscal deficit target for FY2025 at 5.1% of GDP, lower than 5.8% in FY2024. Budgeted capex is expected to moderate to 17.7% for FY2025 from 21.5% in FY2024, yet the share of capex allocations on core infrastructure sectors will remain high. Tax collections are projected to grow at a conservative 11.4%, compared with 12.5% for FY2024.

How Does this Impact You?

The interim budget underscores the government's thrust to a fiscal consolidation path. The stance of the government will likely be to keep the current tax rates unchanged in FY2025 while aiming to align retail inflation to the RBI’s target of 4%. This is expected to bring the government bond yields down from the current level of ~7%. Consequently, the likelihood of the RBI cutting the interest rates in the next fiscal increases, potentially reducing the borrowing costs.

Chart of the Month

* FY2025 deficit estimate is based on nominal GDP growth projections at 10.5% for BE2025.

Source: indiabudget.gov.in, CMIE, 1 Finance Research