Introduction

In our November 2024 Macro Update, we analyse equity market valuations, explore implications of Rupee depreciation and CRR cuts on investments, loans, and expenses, and provide actionable strategies.

Additionally, we present forecasts for India’s Real GDP Growth over the next five quarters to guide financial planning in an evolving economic landscape.

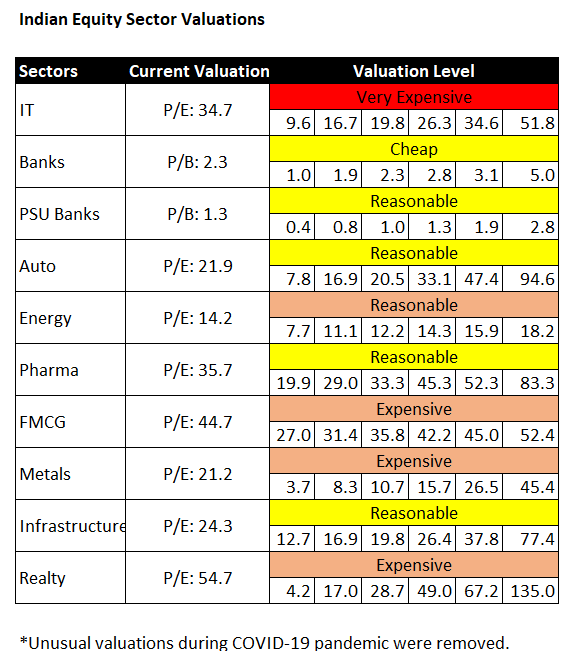

Your Equity Investments

- What’s Happening: Markets show mixed trends. P/E of IT is resilient but overvalued (34.7), while Pharma (35.7) and Infrastructure (24.3) are reasonably valued. FPIs stay cautious.

- Impact on You: IT and FMCG are pricey; focus on value in Banks and Pharma for better opportunities.

- Action Plan: Prioritise Banks and Pharma sectors for value. Avoid overvalued IT, FMCG, and Metals. Diversify with gold and use SIPs for consistent growth.

Recommended for you

Readers also explored

Rate Cuts, Gold’s Shine, and Global Jitters - How Should You Respond?

Currency in Circulation: How Much Money Exists in the World?

Your Debt Investments

- What’s Happening: RBI’s CRR cuts and potential rate reductions support bond markets, favouring long-duration instruments and government securities.

- Impact on You: Falling yields may boost long-duration debt; stable liquidity supports steady returns on high-quality instruments.

- Action Plan: Allocate towards long-duration bonds and high-rated corporate debt.

Your Loans

- What’s Happening: The RBI’s CRR cuts aim to infuse liquidity, with potential rate cuts enhancing affordability for loans.

- Impact on You: Falling rates might make borrowing cheaper, benefiting planned loans for cars, homes, or refinancing existing debts.

- Action Plan: Monitor RBI signals. Leverage potential rate cuts for favourable borrowing conditions; opt for floating-rate loans to benefit.

Your Daily Expenses

- What’s Happening: Depreciating rupee raises prices of fuel and imported goods, increasing everyday expenses.

- Impact on You: Household costs, including utilities and groceries, may rise.

- Action Plan: Tighten budgets and focus on essential expenses to sustain savings.

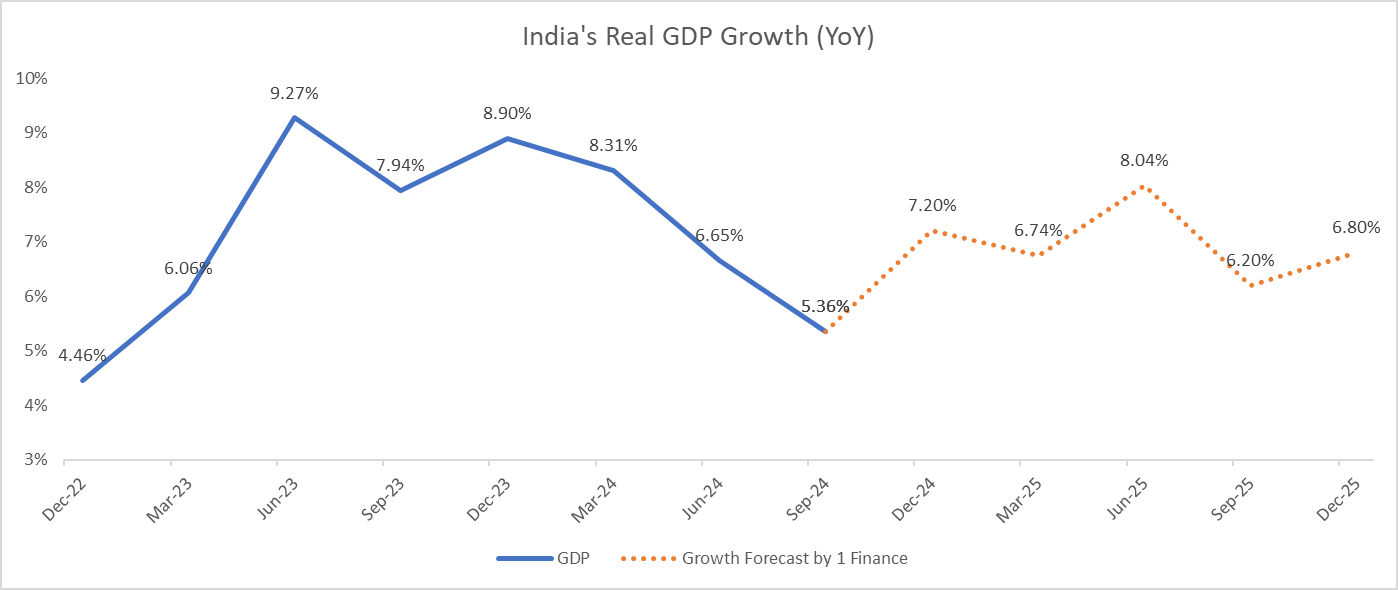

India’s Real GDP Growth Forecast

Source: CMIE Economic Outlook, 1 Finance Research

Positives

- Increase in Private Capital Expenditure and Trade Balance will support India’s growth

- Improved agriculture output will ease food inflation in the near term

Potential Hurdles

- High valuations and weak earnings-per-share growth could keep markets rangebound in the near term.

- Interest rate cuts, central bank gold purchases and further escalation in geopolitical tensions could impact markets.

Outlook

- Recovery - Anticipated rebound to 7.2% YoY Growth in December 2024

- Stabilisation - Growth likely to stabilise throughout 2025 with a steady momentum