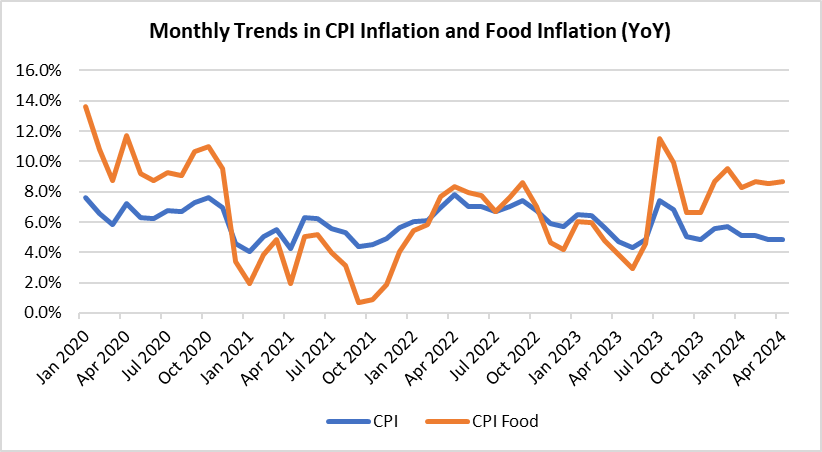

CPI Inflation Falls; Food Inflation Rises

- CPI inflation fell to 4.83% in April 2023 YoY, however, food inflation remained high at 8.70%.

- Rising food prices can diminish household disposable income and reduce your savings.

- Diversifying your investments across different asset classes such as stocks, bonds, and real estate can mitigate the impact of inflation.

- Investments in equities and commodities (gold) often act as a hedge against inflation.

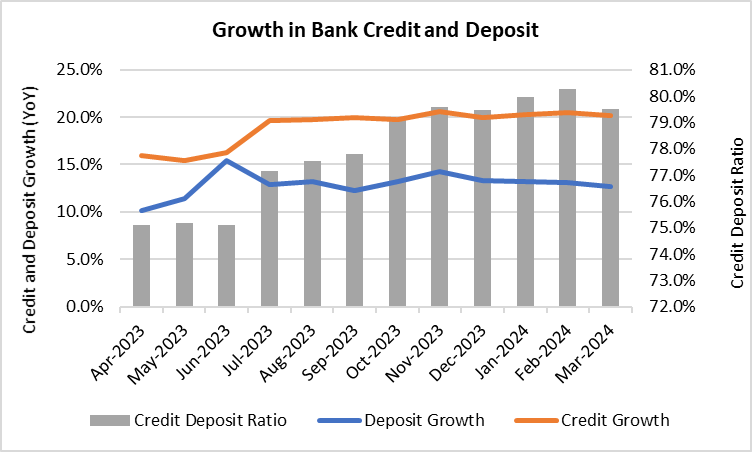

Borrowing Costs to Remain High

- The credit deposit ratio of banks reached a high of 79%, indicating that banks have disbursed 79% of their deposits as loans, surpassing the normal range 65% to 75%.

- To attract more deposits, banks might offer higher interest rates. Consequently, the borrowing rates may also remain high.

- You can increase your savings by opting for fixed deposits in banks. And if you are a borrower, consider paying down high-interest debts, such as personal loans.

- If you’re planning to take a new loan, opt for a floating interest rate or wait until the reduction in interest rates.

Recommended for you

Readers also explored

Gold Outlook in India for FY2026

India's IT Sector Outlook for FY2026

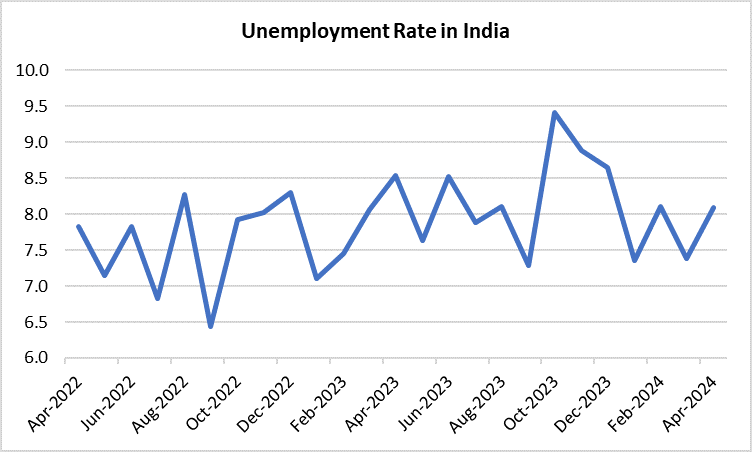

Unemployment Trends & Importance of Emergency Funds

- The unemployment rate in India rose to 8.1% in April 2024 from 7.4% in March 2024, according to the CMIE survey.

- Given the uncertainty in the job market, having a robust emergency fund is crucial.

- You should have enough funds to cover at least 6 to 9 months of living expenses.

- Increasing your allocation towards bank FDs or other liquid instruments and avoiding unnecessary expenses is advisable.

Note: A person is categorised as unemployed “because of a lack of job and where such a person is actively looking for a job”.

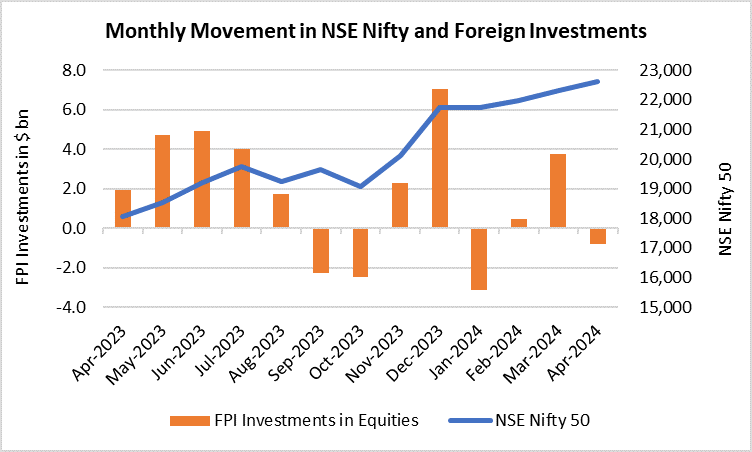

Strategic Investing during Volatile Markets

- Since 1st April 2024, the NSE Nifty 50 index increased by 0.6% (as of 17 May 2024), while in FY2024 it registered a growth of 28.6%.

- Foreign investors withdrew ₹86.7 bn from Indian equities in April, while domestic investors invested ₹441.0 bn.

- Given the volatile market sentiments due to high global inflation and ongoing Lok Sabha elections, opting for SIPs and diversifying your investments across sectors is advisable.

- You should maintain a long-term investment horizon to avoid short-term market fluctuations.