Progress in Global Growth

Global economy is witnessing a noticeable improvement, supported by easing financial conditions and recovery in external demand. This has raised the probability of achieving higher growth in 2024 than projected earlier, with evenly balanced risks. The IMF and the OECD have raised their 2024 global growth projections by 0.20 percentage points each to 3.10% and 2.90%, respectively.

Upward Trend in India’s GDP

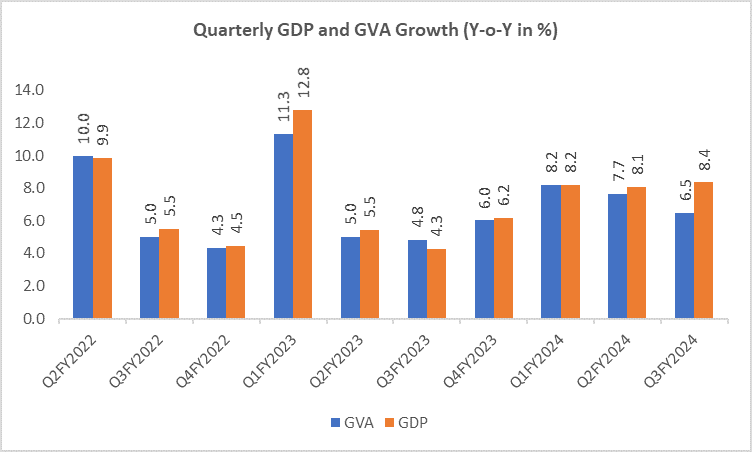

Exceeding market expectations, India's GDP grew by 8.4% YoY in Q3FY2024, as per MoSPI. With the upward revision in Q1 and Q2 GDP growth data, the FY2024 GDP growth is estimated at 7.58%, up from 6.99% in FY2023. The annual growth is largely driven by fixed investments (10.2%), while on the supply side, industry (9%) and services (7.5%) grew notably, but the agriculture sector (0.7%) lagged.

Key Indicators Reflect Stability

Composite PMI stood at 60.60 in February and IIP grew by 3.80% in January. CPI inflation remained almost unchanged at 5.09% in February 2024 compared to 5.10% in January. Core CPI inflation eased (3.37% from 3.63%), but food inflation accelerated (8.66% from 8.30%). Growth in merchandise exports improved (3.06%) and imports turned positive (1.00%) in January.

Demand Conditions Remain Strong

Demand for credit in the economy sustained, registering a 20.50% rise YoY as of February 23, 2024 while deposit growth lagged at 13.12%. The credit deposit ratio rose to 78.00%, the highest since March 2019, consequently, the deficit liquidity conditions continued in February. The spread between 1-year and 10-year yield narrowed to 4 bps compared to 12 bps in January.

Recommended for you

Readers also explored

India's Economic Balancing Act Growth VS Global Woes

India’s Unemployment Rate in 2025

Resilient Investor Sentiments

Better domestic growth prospects kept the investor sentiments positive in February. NSE Nifty increased by 1.00% (MoM), and FPIs invested a net $2.05 billion in the Indian markets. However, concerns over elevated valuations in small and mid-cap segments prompted SEBI to direct AMFI to address potential overvaluation risks in mutual fund schemes.

How Does this Impact You?

Stability in the domestic economic conditions is likely to boost investor confidence and improve the equity market outlook. Strong economic growth promises better returns on savings and investments and also increases demand. However, juxtaposed with this positive scenario is the risk of persistent inflationary pressures, which could lead to higher household expenses.

Chart of the Month

A significant reduction in subsidy outgo and a sharp increase in indirect tax collections have led to a record ~ 2 percentage point gap between GDP and GVA growth in Q3FY2024.

Note: Data is provisional

IMF: International Monetary Fund

OECD: Organization for Economic Cooperation and Development

MoSPI: Ministry of Statistics and Programme Implementation

IIP: Index of Industrial Production

GDP: Gross Domestic Product

GVA: Gross Value Added

FPIs: Foreign Portfolio Investors

CPI: Consumer Price Index

PMI: Purchasing Managers' Index

AMFI: Association of Mutual Funds in India

SEBI: Securities and Exchange Board of India