As we cross the halfway mark of 2025, India’s macro landscape is shifting in unexpected ways. Cooling inflation has reignited interest in fixed income, yet credit growth remains sluggish despite ample liquidity. Equity markets are buoyant, driven by forward-looking investor optimism, rising primary issuances in the equity market, and direct government spending, even as parts of the real economy show signs of fatigue. Meanwhile, India’s global trade calculus is being reshaped by high-stakes negotiations with the US amid emerging geopolitical risks.

This mid-year wrap decodes the key signals shaping asset allocation, credit cycles, and policy priorities—and what you should keep an eye on in the months ahead.

Inflation Cools, Real Returns Rise: A New Era for Fixed Income?

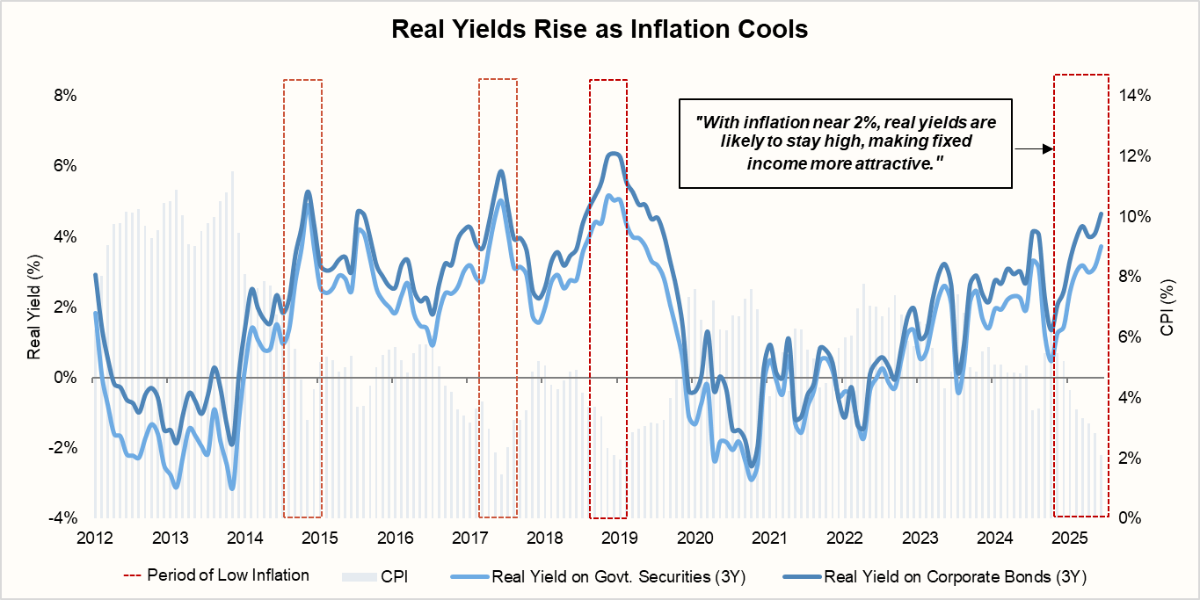

For years, inflation nibbled away at fixed income gains, leaving savers with negative or barely positive real returns. But now, the gap between stable bond yields and easing inflation has created a sizable "real yield zone”.

With headline CPI falling to a six-year low of 2.1%, real yields have jumped across the debt spectrum. India’s 3-year G-Sec real yield has surged to ~3.7%, while real yields on 3-year corporate bonds are even higher, crossing 4% levels.

The big question for the months ahead: Will this real yield revival endure, or is it just a fleeting advantage? With inflation cooling, debt is regaining its appeal. For now, fixed income is back in the spotlight, but sustainability depends on inflation's trajectory and central bank moves.

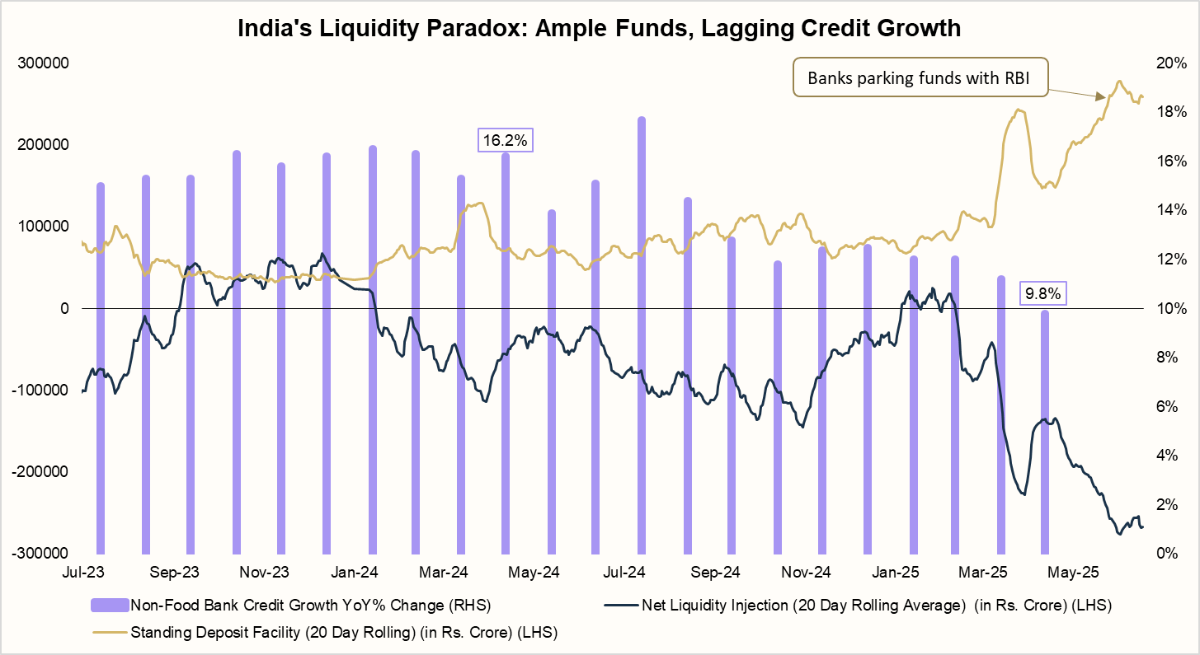

India's High-Liquidity Phase and the Credit Growth Challenge

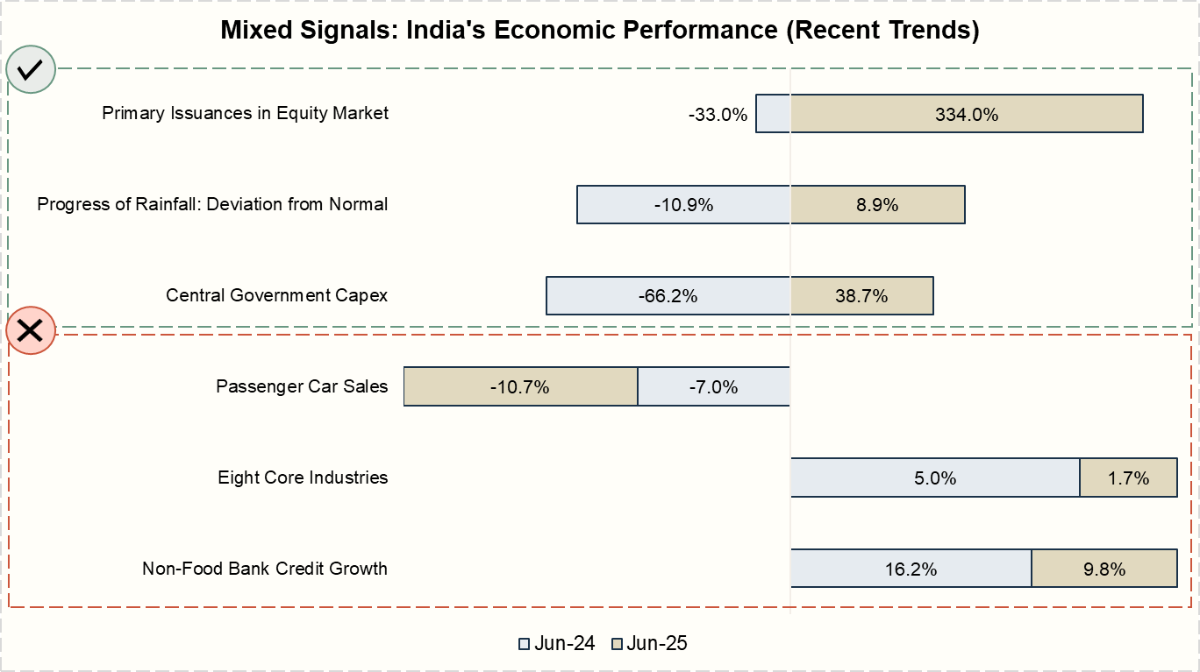

Despite the RBI's liquidity support, banks continue to park funds in the Standing Deposit Facility (SDF) rather than lending them out. This is worrying—non-food credit grew just 9.8% YoY in May 2025, down from 16.2% a year ago. Weak demand, particularly from large corporations, continues to stifle loan uptake.

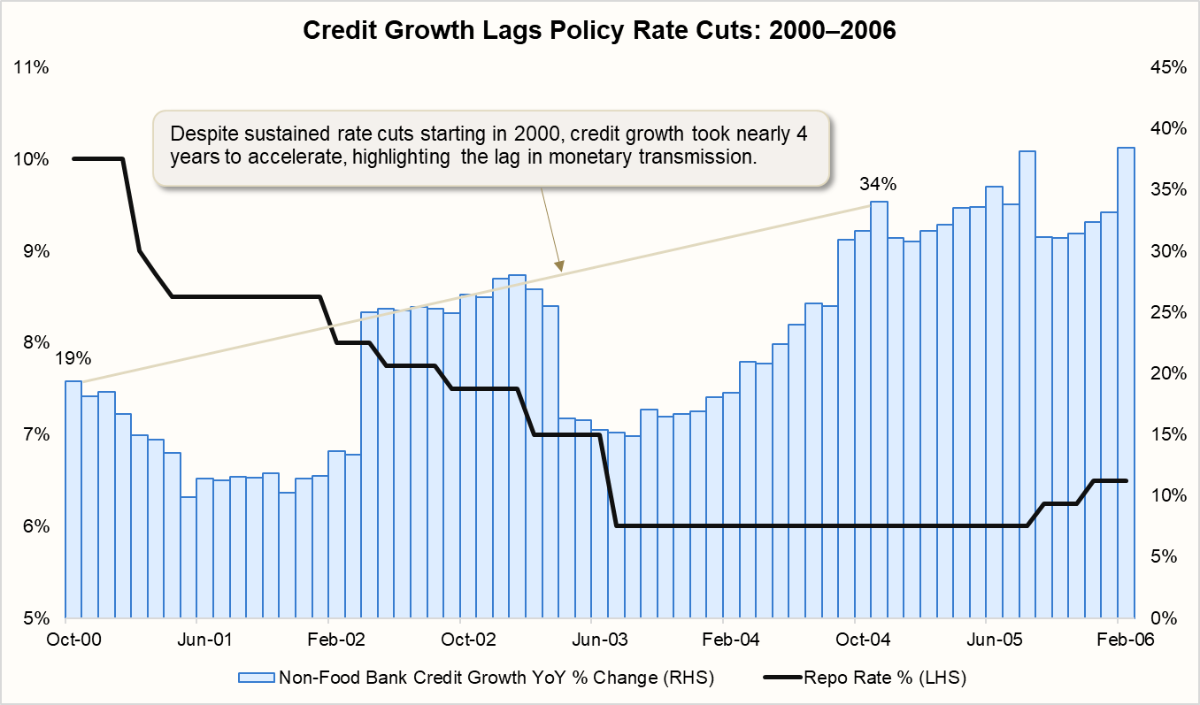

Examining past cycles provides context, as during 2000–2004, it took nearly four years post-rate cuts for credit growth to accelerate meaningfully (from 19% in November 2000 to 34% in December 2004). This suggests that monetary policy transmission isn't always immediate. Additionally, each cycle has its unique drivers—retail spending in the 2000s and infrastructure in 2012-14. For now, the next engine of credit revival remains unclear.

Recommended for you

Readers also explored

Balancing Slowdowns and Sectoral Strength

Nifty 50 Companies List 2025 : Top 50 Stocks in India

Optimism with a Side of Unease

India's economy presents a mixed picture. While primary issuances in the equity market surged 334% in Jun-25 and the monsoon also seems favourable, caution is warranted. Passenger car sales declined 10.7%, and core industrial growth slowed to 1.7% in June 2025, primarily due to declines in Coal, Crude Oil, Natural Gas, Fertilisers, and Electricity.

Note: Due to routine reporting lags affecting most macroeconomic indicators, data for the Non-Food Credit Growth are currently available only up to May 2025, with corresponding year-ago data available for May 2024. All other indicators reference data as of June 2025.

Trade Talks & Tariff Traps: India’s Balancing Act with the US

The global chessboard just got a dramatic shake-up. As India races to finalise a landmark trade pact with Washington, the US fired an economic warning shot on July 15: imposing 100% secondary tariffs on any country doing “significant” business with Russia, including energy deals. It’s a high-stakes moment, with both risk and opportunity for India.

How Does the Board Look for India?

| Key Factor | Tailwinds for India | Emerging Risks | Strategic Moves |

|---|---|---|---|

| Tariff Positioning | Lower US tariffs than China & Vietnam boost competitiveness | US may seek deeper access into Indian markets and stricter IP/regulatory alignment | Seek tariff parity with key ASEAN peers; negotiate exclusions for sensitive sectors |

| Energy Security | Discounted Russian oil helps manage input costs and inflation | US “secondary tariffs” could disrupt oil flows, raise costs, and add FX volatility | Secure diversified crude sources (Middle East, US); pursue diplomatic waivers for energy trade |

| Export Opportunity | Pharma, textiles, IT benefiting from China+1 shift; new demand in auto/furniture | Proof of non-Russian sourcing adds a compliance burden, especially for MSMEs | Offer support for supply chain audits; enable low-cost certification pathways |

| FDI Inflows | PLI schemes and geopolitical shifts like ‘China +1’, attracting FDI in EVs, defence, and semiconductors | Trade uncertainties may deter new inflows, especially in policy-sensitive sectors | Ensure stable rules; promote R&D-heavy investments through clear incentives |

| Geo-economic Strategy | Quad/Indo-Pacific status strengthens India's international voice | Trade deals could carry strategic conditions or be delayed by US election cycles | Build safeguards into agreements; maintain negotiating leverage across blocs |

This isn’t just diplomacy—it’s directional for markets. India’s position in global trade negotiations, especially with the US, could directly shape capital flows, export performance, and sectoral profitability.

What Should Advisors Watch?

In view of sustained low inflation, consider allocating to short- to medium-duration debt.

- Weak credit growth may delay private capex, pressuring earnings for capex-heavy firms.

- Equities are rising, but soft demand suggests sticking to quality over chasing the entire market

- Geopolitical trade shifts could create sector-specific winners (pharma, defence, EVs)

India's macro terrain in 2025 is defined by contrast: rising real returns versus slowing credit, external optimism versus internal caution, and strategic trade opportunity amid geopolitical friction. For financial advisors, it’s a moment to stay alert—not just to headline numbers, but to underlying shifts in momentum across sectors, policy, and global dynamics. The coming quarters will test the durability of the fixed income revival and the depth of India’s growth story. Staying agile and data-informed will be key.