Introduction

In our macro update for October 2024, we provide a comprehensive overview of the major events impacting India's economy and financial markets. This month, we highlight INR depreciation, profitability of Sensex companies, inflation pressures, and the importance of diversification in ensuring portfolio stability.

These insights are aimed at helping you make informed decisions in a rapidly changing economic environment.

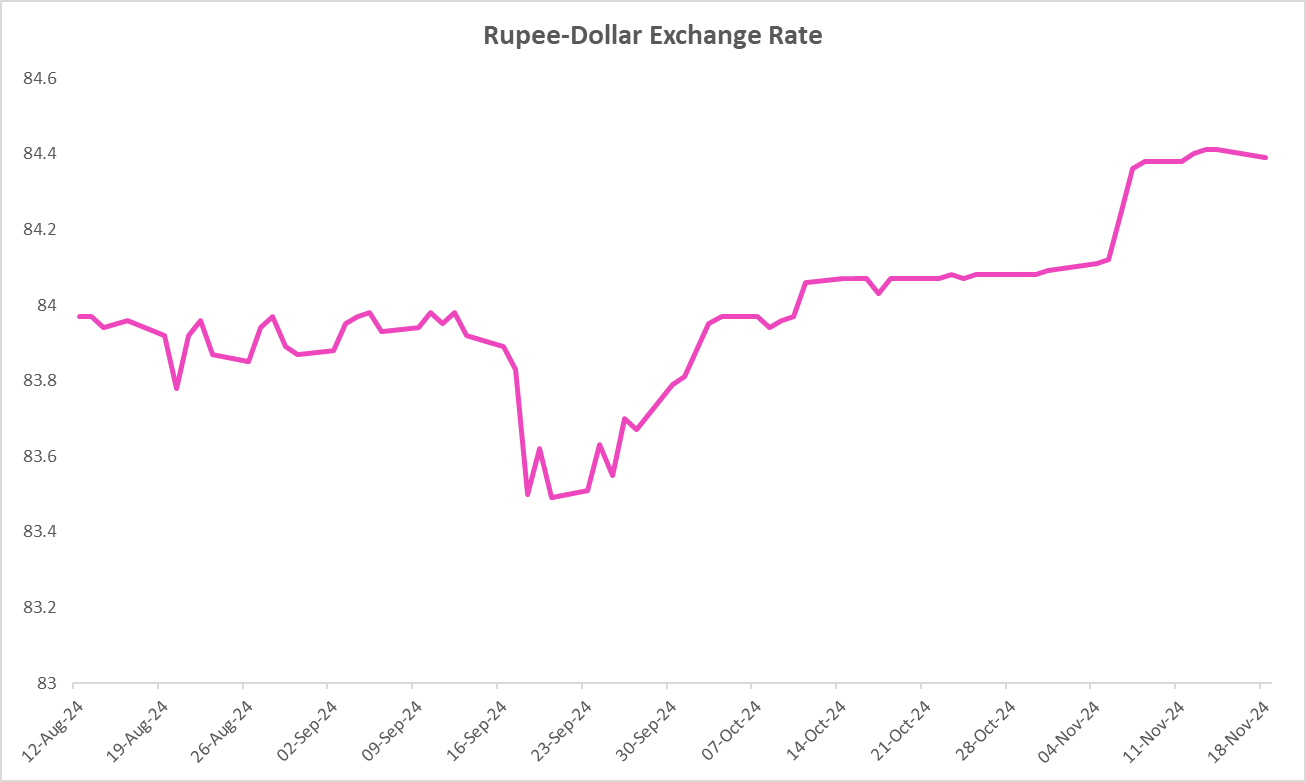

Indian Rupee Depreciation

The Indian Rupee (INR) has weakened significantly against the US Dollar, averaging ₹84.24 per USD in early November 2024, down from the lows of ₹83.5 in September 2024.

This depreciation is largely attributed to foreign portfolio investor (FPI) outflows, which totaled $11 billion in October—the highest since March 2020.

The strong US Dollar, combined with geopolitical factors and FPI outflows, also resulted in a decline in India's foreign exchange reserves to $682.1 billion as of November 1, 2024.

Moreover, the widening trade deficit of $74.1 billion in the September quarter suggests increased pressure on India's current account balance.

In its October 2024 MPC review, the Reserve Bank of India (RBI) revised its Q2 GDP growth estimate from 7.2% to 7%, while maintaining the fiscal year forecast at 7.2%.

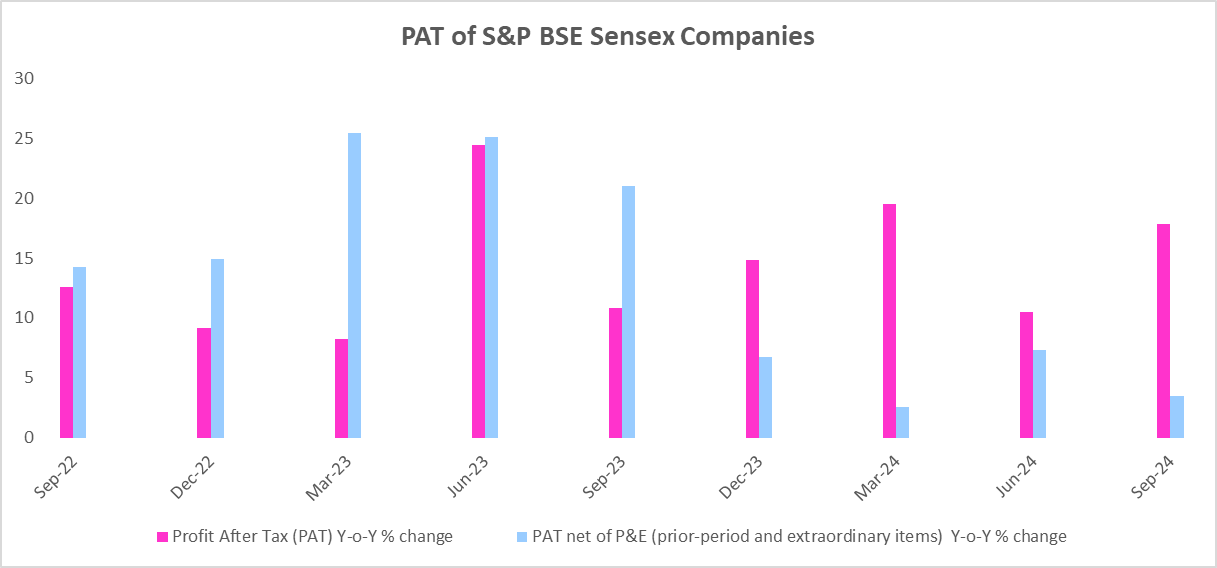

Domestic Companies’ Earnings Growth

In the September 2024 quarter, Sensex companies reported a 17.9% YoY rise in Profit After Tax (PAT), primarily due to non-recurring gains.

However, PAT adjusted for prior-period and extraordinary (P&E) items grew by just 3.5%, highlighting weaker core profitability and reliance on one-off gains.

Banking and Infrastructure sectors demonstrated strength, driven by robust credit growth and public infrastructure spending, which helped sustain growth.

Sectors like FMCG and Metals faced significant headwinds due to rising raw material costs, which impacted their margins and overall profit stability.

This divergence in performance across sectors underscores the importance of assessing individual sector dynamics and focusing on areas demonstrating sustainable growth potential.

Recommended for you

Readers also explored

Inflation and Personal Finance: Protect Your Purchasing Power

India’s Unemployment Rate in 2025

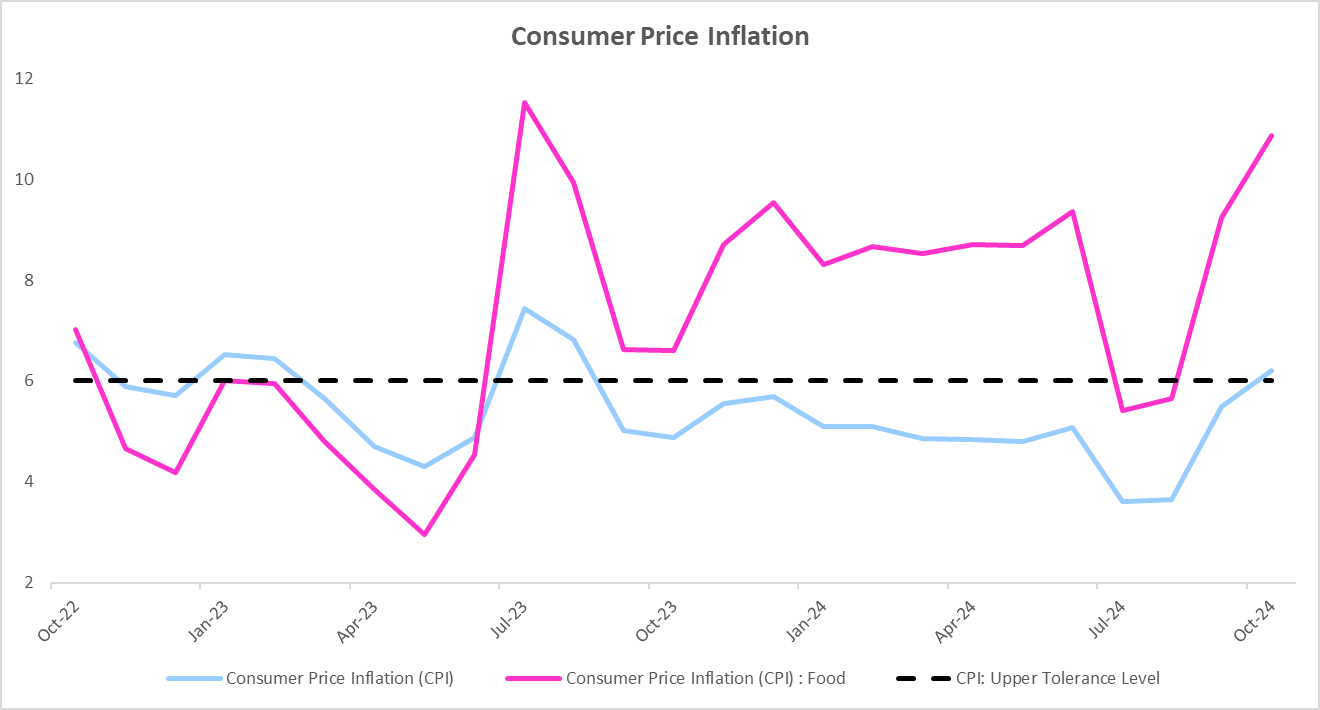

Inflation Outlook: Rising Pressures

Headline inflation surged to 6.2% in October, breaching the Reserve Bank of India's upper tolerance level of 6% for the first time in 14 months.

This rise, up from 5.5% in September, is driven largely by food inflation, which climbed to 10.9%. Vegetable prices are a major contributor, with inflation in tomatoes, onions, and potatoes reaching 161.3%, 51.8%, and 64.9% respectively.

Core inflation, which excludes food and fuel, rose slightly to 3.7%, driven by increase in the prices of gold and silver.

These trends indicate persistent inflationary pressures, particularly in the food and core components, which may limit the scope for interest rate cuts by the RBI in the near term.

Strategic Portfolio Diversification

In times of uncertainty, an actionable diversification strategy should consider both the current state of the economy and the individual's age group.

For younger investors with a longer time horizon, equities—which have delivered an average return of 15% over the past decade—are suitable for maximising growth potential.

Gold, with consistent returns of 12%, serves as a hedge against inflation and market volatility, making it a suitable addition for all age groups, especially during economic uncertainty.

Real estate, including rental yield, has provided returns of around 12%. For mid-career investors, with dreams of becoming homeowners, this asset class offers a balanced mix of price appreciation and rental cost savings.

For those interested in real estate, we recently published an insightful report that assesses the current dynamics of top cities of India. Click here to access it.

Portfolio Reward - Risk Ratio (R:R)

Source: CMIE Economic Outlook, Bank for International Settlements (BIS), National Housing Bank (NHB), Reserve Bank of India (RBI), ACE MF, Yahoo Finance, 1 Finance Research

The above portfolio allocation reflects the current economic phase of 'Transitory Slowdown' and is tailored for investors under the age of 35.

Visit India Macro Indicators' Asset Allocator for more personalised insights.