Introduction

In our macro update for September 2024, we provide a comprehensive overview of the major events impacting India's economy and financial markets. This month, we highlight high equity valuations, rising bond yields, inflation pressures, and the role of gold in ensuring portfolio stability. These insights are aimed at helping you make informed decisions in a rapidly changing environment.

Let’s break down each of these events and explore what they mean for your finances.

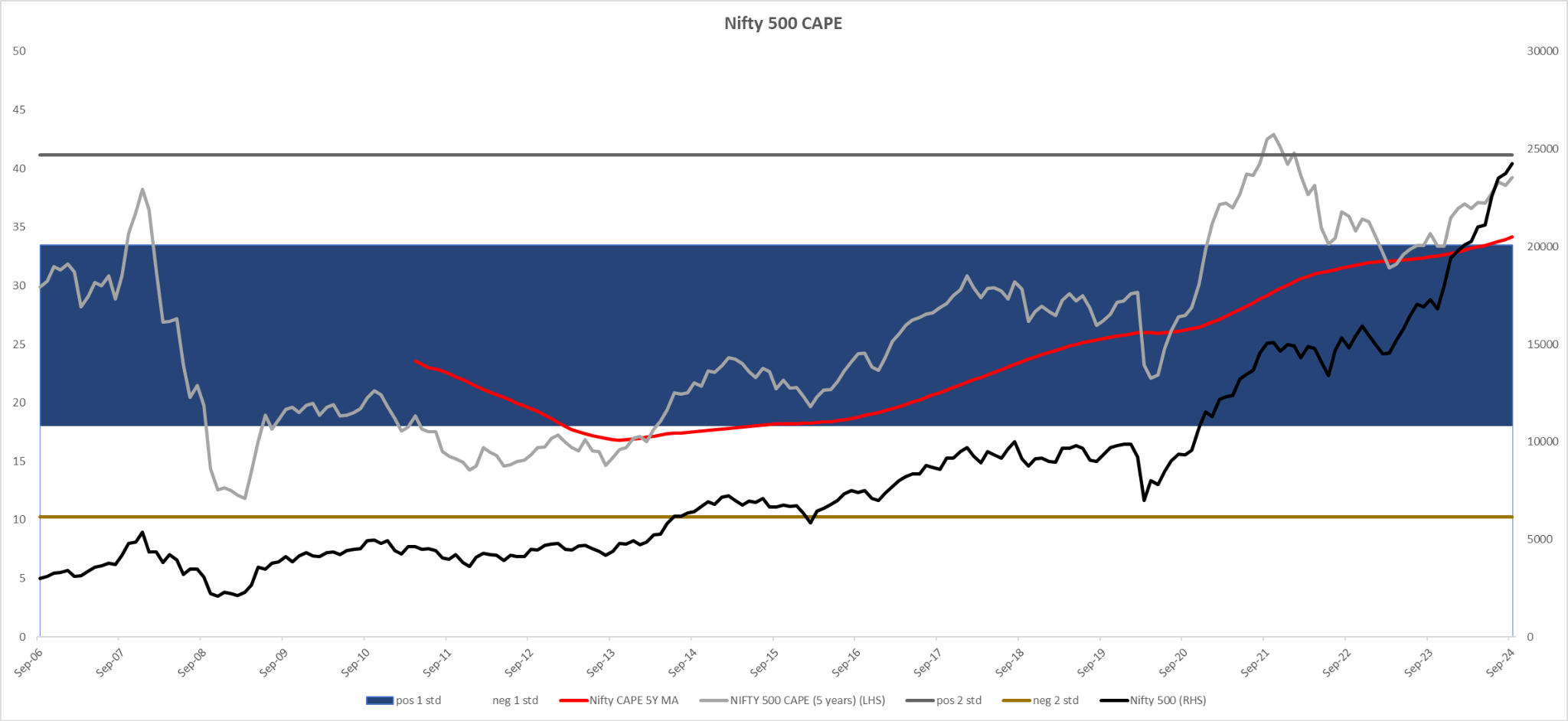

Equity Market Valuations

As we move into the latter half of FY 2024-25, the Indian stock market is showing signs of overheating. The 5-year Nifty 500 CAPE (Cyclically Adjusted Price Earnings) ratio, a key measure of market valuation, has climbed to 39.2, well above its long-term average, placing current market valuations in the upper range of historical values.

Valuations are looking stretched, especially in sectors like IT, FMCG, and Metals, while Banks and Auto sectors are still reasonably priced. In our August’24 report, we highlighted sectoral P/E trends, indicating a continued divergence in valuations amongst different sectors.

Smart Investing Strategies:

- If a large part of your portfolio is in equities, especially in overvalued sectors, it might be a good time to rebalance.

- Consider diversifying into fixed-income investments or alternative assets to reduce risk.

- Avoid lump sum investments and opt for SIPs to mitigate market timing risks.

CAPE: Cyclically Adjusted Price Earnings

𝜎 : Standard Deviation

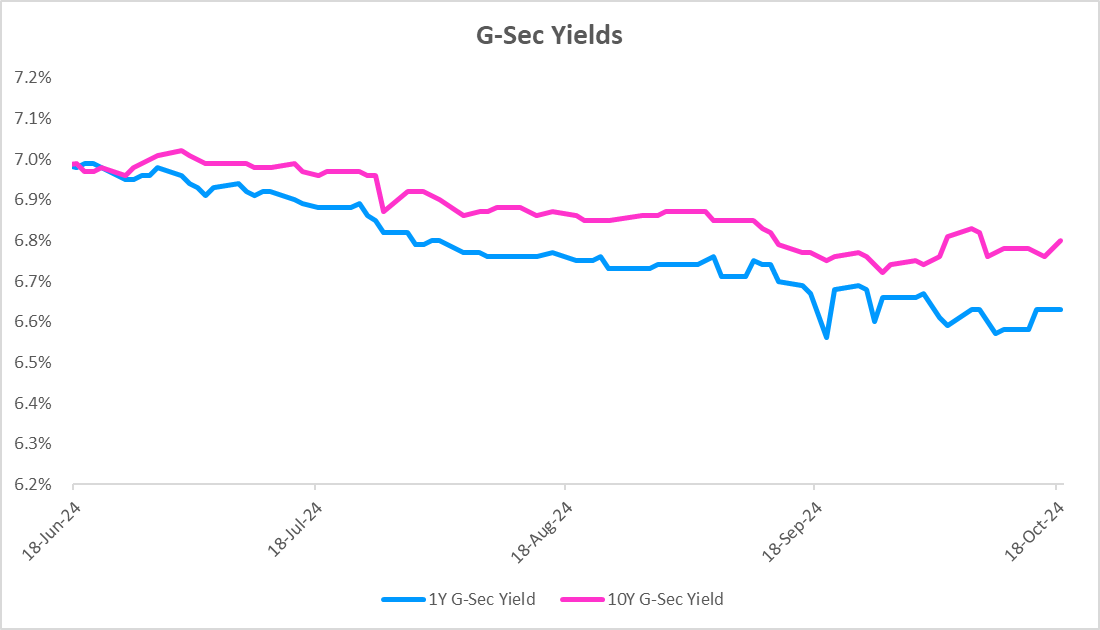

G-Sec Yields Stabilise

- Government securities (G-secs) yields have stabilised across most maturities, with 1Y G-Sec yield trading at 6.63%. This comes after a period of declining yields influenced by factors like domestic fiscal policies, changes in market liquidity, and global economic uncertainties.

- Investing in Debt funds and government securities (G-secs) is recommended for achieving stable returns and managing risk in uncertain markets.

Recommended for you

Readers also explored

A Mid-Year Check: Whether India is in Flux

India's IT Sector Outlook for FY2026

Consumer Price Index

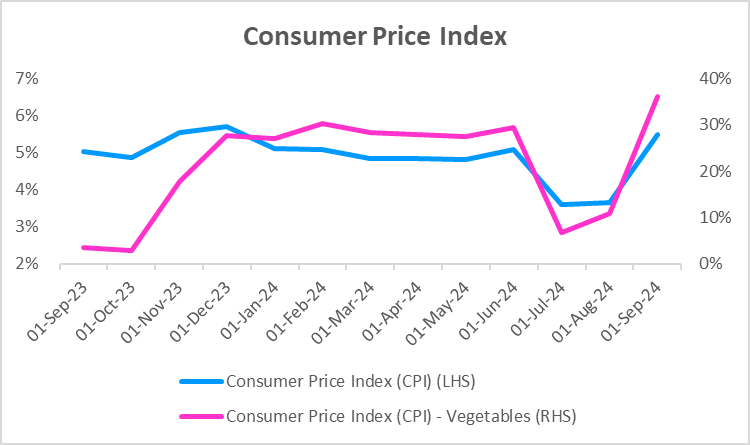

- Retail inflation surged to 5.5% YoY in September, reaching a 9-month high, mainly due to rising food prices such as onions, and tomatoes with vegetable inflation reaching 36% YoY and increased import duties on vegetable oils.

- Core inflation, excluding food and fuel, remained elevated at 5.8%, driven by higher costs in services and essential goods.

- This unexpected spike in inflation has been a key concern for policymakers, though the Reserve Bank of India (RBI) has opted to keep the repo rate at 6.5%, shifting its stance to "neutral" to maintain flexibility in future policy decisions.

- Foreign Portfolio Investors (FPI) continued to pull out investments from the Indian secondary market amounting to a total of $9.2 billion in the first 3 weeks of October, breaking a six-week trend of positive inflows.

What Lies Ahead

- Monsoon Outcomes: Uneven monsoon patterns are expected to limit growth in rabi crop area sown (0.4% in YoY FY 2024-25), impacting agricultural output and contributing to inflationary pressures in the near term.

- Food Price Stability: Food prices, accounting for 39% in overall inflation are expected to remain volatile, continuing to drive inflationary pressures

- Commodity Price Trends: Fluctuations in oil and other commodity prices will persist, influenced by ongoing geopolitical developments, impacting inflation levels.

- Current Account Deficit (CAD): The current account deficit is expected to face continued pressure due to the growing merchandise trade deficit. Although net earnings from services and higher FDI may provide some relief, subdued financial inflows will likely challenge the overall balance of payments in the near term.

Gold as an Alternative Asset

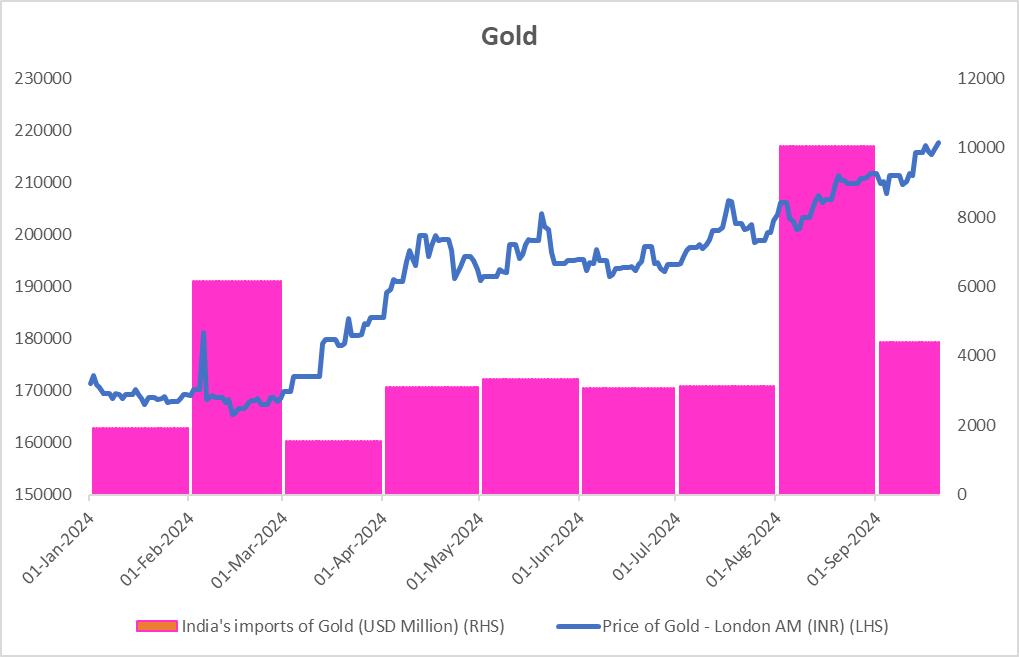

- Higher Import Bill: The average price of gold in the London Bullion Market increased by 20.7% during the first half of FY 2024-25. As a result, India's gold import bill is expected to rise by 11.3% to USD 50.7 billion for FY 2024-25. Despite this, gold continues to demonstrate its value as a safe haven amid economic uncertainty, offering a reliable hedge during inflationary periods.

- Lower Import Volume: Gold imports from the UAE have surged, reflecting changing trade dynamics, but the overall volume of gold imports has fallen by 24.4% during April-July 2024 compared to last year. This decline in volume highlights subdued consumer demand driven by high gold prices, which have made gold less affordable for many Indian households.

- Investing in Gold: Gold serves as an effective hedge against inflation, providing stability during uncertain times. You can consider adding gold to your portfolio through physical purchases, ETFs, or sovereign gold bonds

The Need for Diversification

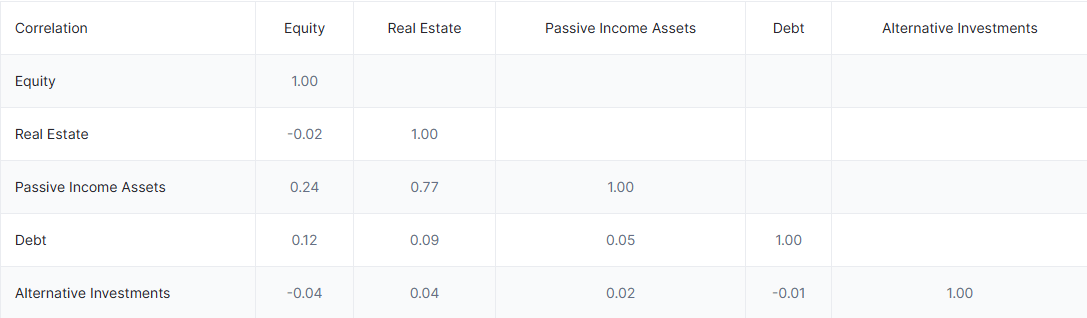

The correlation matrix shows low correlations between equity and debt (0.12), and equity and gold (-0.04), underscoring diversification benefits.

By investing across various asset classes, you can effectively manage risk, optimise returns, and ensure greater portfolio stability, particularly during times of market uncertainty.

For a more detailed understanding of asset allocation strategies, visit our Asset Allocator page at India Macro Indicators.