Introduction

As we progress through 2025, India is poised to become the world's fourth-largest economy, surpassing Japan's $4.1 trillion GDP, though significant per capita differences remain.

Below are a few factors that are working in India’s favour:

- Food inflation is moderating with strong agricultural output expected.

- Rural consumption is recovering, supported by good monsoons and falling agri input costs.

- The manufacturing sector shows readiness for capex with healthy balance sheets.

- Global growth, projected at 3.3% by the IMF, offers a marginal improvement over 2024's 3.2%, despite rising protectionist pressures.

This outlook weighs these factors to present our comprehensive analysis across asset classes, focusing on key themes that will shape investment opportunities in 2025.

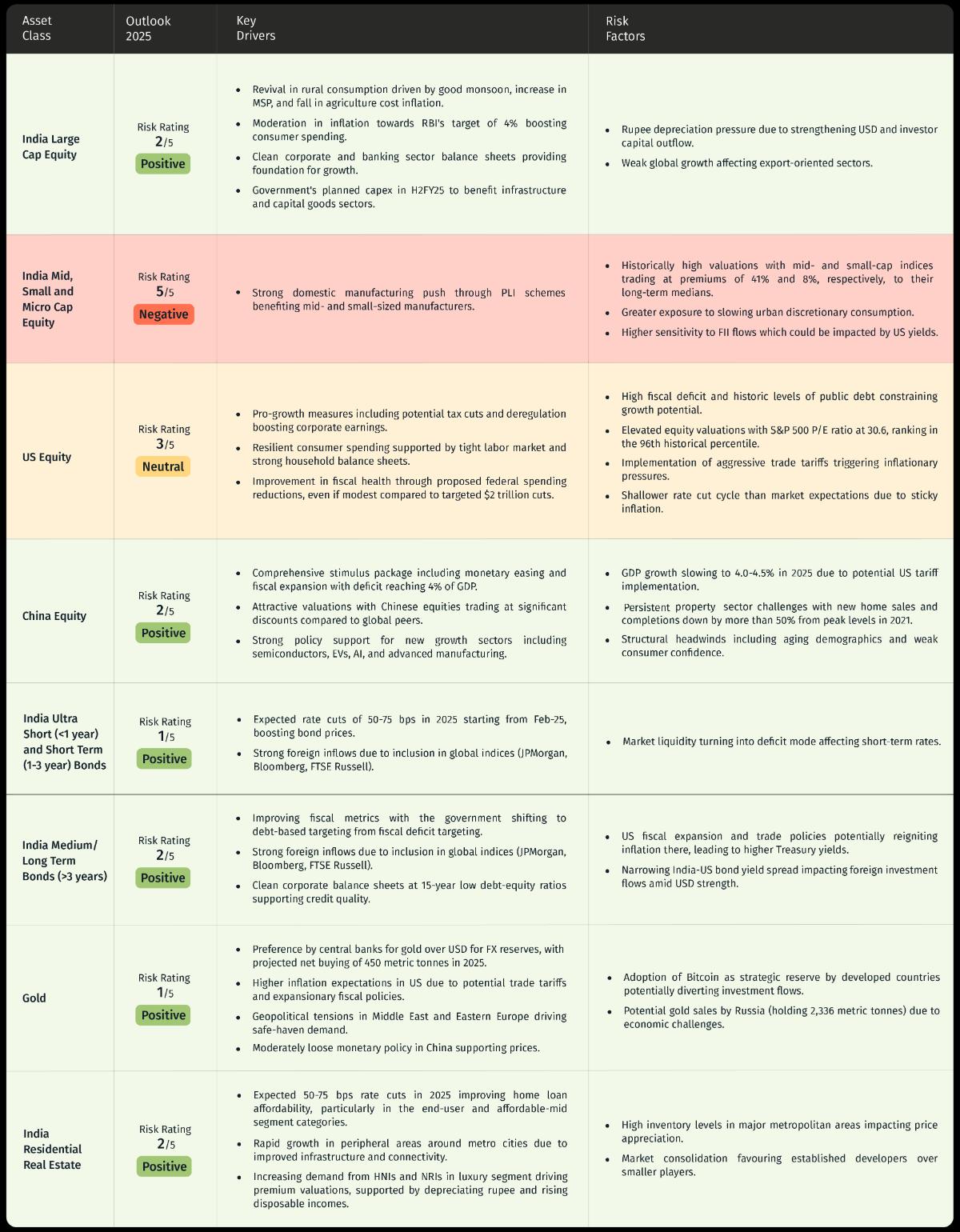

Key Drivers and Risks of Different Asset Classes

The risks of remaining concentrated in select asset classes will become apparent in 2025. The biggest focus will be on governments’ fiscal policies, central banks’ monetary decisions, household consumption and resolution of geopolitical issues.

Risk Rating reflects 1 Finance's proprietary framework combining quantitative and qualitative factors to assess downside risks across asset classes. Our methodology evaluates macroeconomic indicators, valuations, and market dynamics to assign ratings from 1 (lowest risk) to 5 (highest risk).

Recommended for you

Readers also explored

India’s GDP Growth: Challenges and Future Outlook 2025

Nifty 50 Companies List 2025 : Top 50 Stocks in India

Conclusion

Key themes shaping 2025:

- Rate cuts by major central banks amid growth-inflation balance

- Potential trade policy shifts under new U.S. administration impacting global markets

- Valuation normalisation across market segments in India

- Infrastructure push and rural consumption driving India's growth

- Gold's strategic importance in portfolio diversification