The Indian housing market has defied global slowdown trends and sustained a strong growth trajectory since the pandemic. This newsletter unpacks the key drivers, emerging risks, and macro trends shaping India’s housing cycle today — and offers a grounded outlook on where we go from here.

How has the India Housing Market been so far?

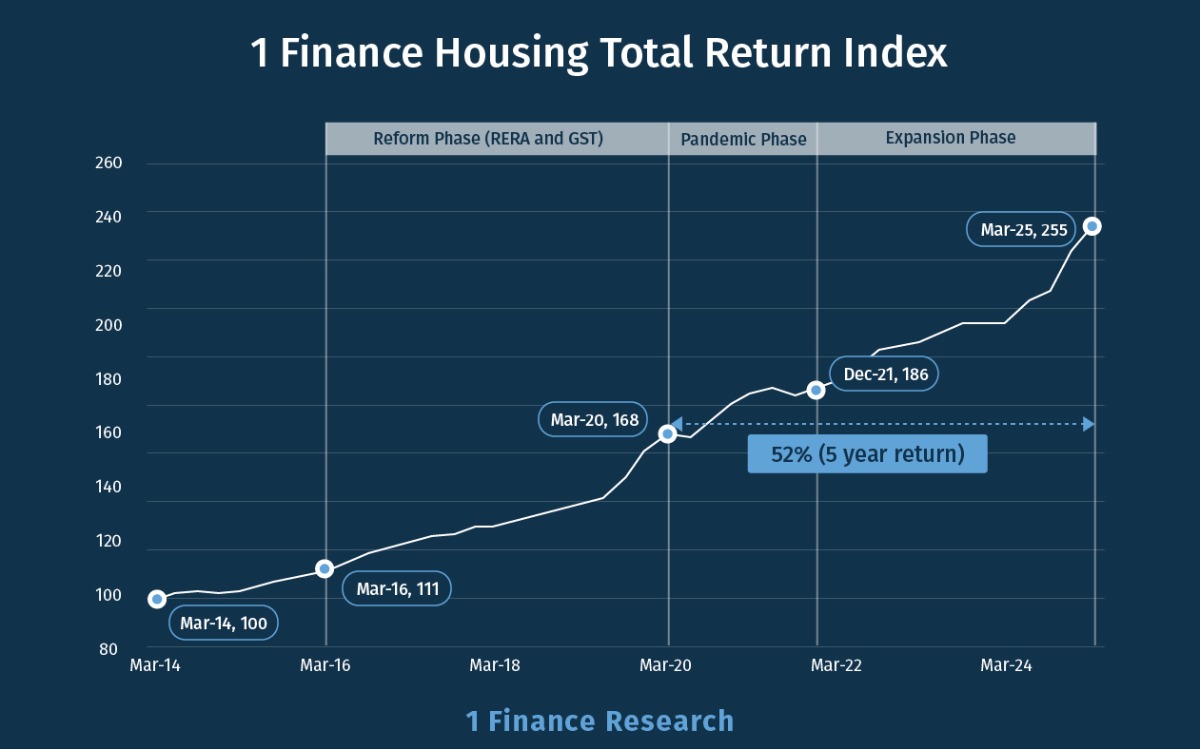

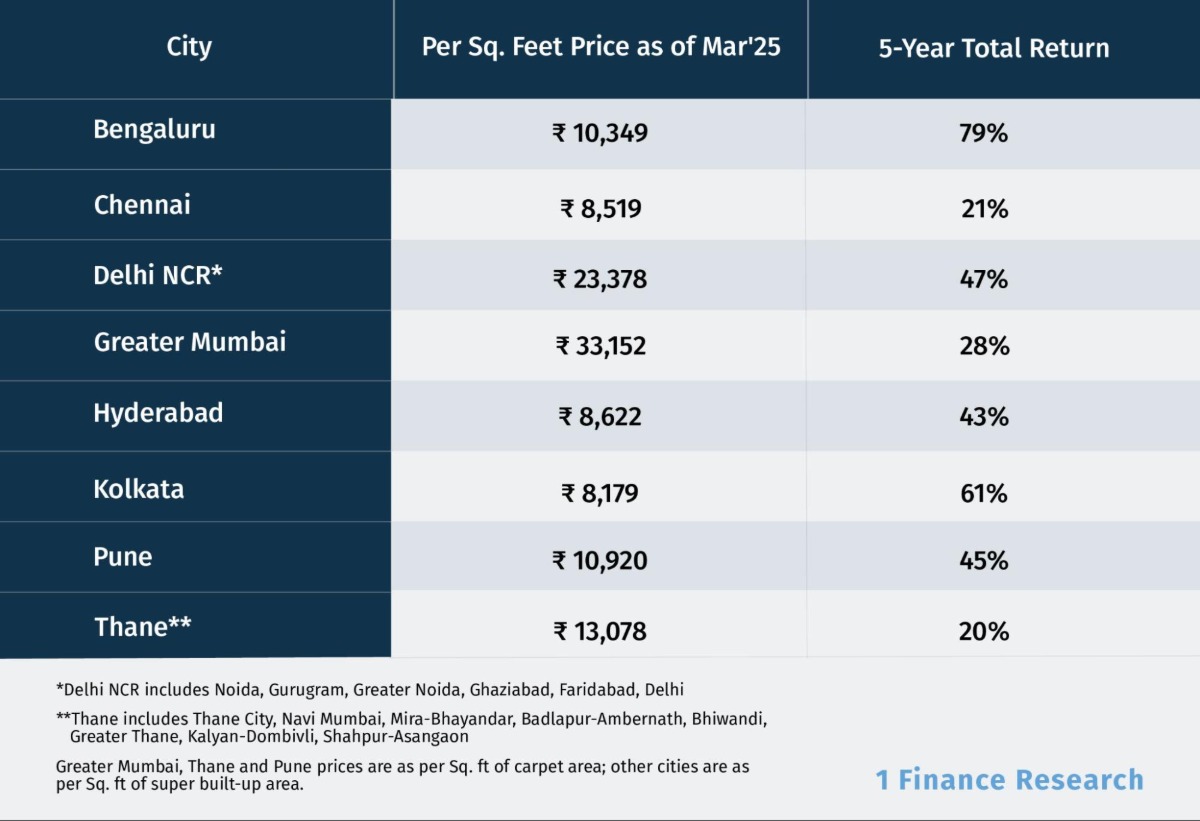

With over 15 Lakh units sold across India in the last five years, the country's housing market has been in a strong expansion phase. This robust demand has fueled stellar returns, with property prices rising 52% across major cities and the 1 Finance Housing Total Return Index climbing from 167 in 2020 to 255 in 2025. But with rising inventory levels and rapidly evolving macroeconomic conditions, investors and homebuyers alike are asking: Have prices peaked?

What’s fueling India’s Housing market?

1. Industrial Agglomeration and Its Impact on Housing Growth

India's major cities are witnessing a dynamic surge in their housing markets, and it's no coincidence. India’s housing market is closely intertwined with the country’s industrial geography. Different cities reflect different economic strengths, which in turn influence the nature and momentum of their real estate markets.

IT Hotspots: Bengaluru, Hyderabad and Pune

Bengaluru

Bengaluru has become an epicentre for India's high-value IT startups and research & development, boasting the nation's highest-paying technology jobs. The concentration of over 1 million tech professionals in the city fuels exceptional demand for housing and leads to aggressive price increases.

Hyderabad

With its dual strengths in IT- research & development, product development and pharmaceuticals, Hyderabad has also become a hub for high-income professionals. This concentration of talent has fueled exceptional demand for housing and led to aggressive price increases.

Pune

While Pune remains a significant IT hub, its focus on back-office and support services results in more moderate salary levels. Consequently, it has experienced a more tempered housing market compared to the high-end R&D roles found in Bengaluru.

Recommended for you

Readers also explored

Housing Cycle in India: Recovery, Expansion, Hypersupply, Recession

India’s Unemployment Rate in 2025

Premium Cities: Greater Mumbai and Delhi NCR

Greater Mumbai

As India's financial capital, Greater Mumbai hosts the highest concentration of BFSI professionals and corporate headquarters alongside thriving entertainment, textile, FMCG, pharmaceutical, etc industries. This diverse industrial mix attracts talent from across sectors, with senior executive salaries ranging from ₹50 lakh to ₹2+ crore, creating relentless demand for premium housing across Greater Mumbai, making it the country's most expensive residential market.

Delhi-NCR

The region's startup ecosystem has generated substantial wealth through successful IPOs like Zomato, Delhivery, and PolicyBazaar. ESOP holders and founders have created a new class of affluent buyers, driving exceptional demand in the premium and luxury housing segments with sudden wealth creation fueling aggressive price appreciation.

Textile and Automobile Manufacturing Hubs: Chennai and Kolkata

Chennai

Chennai's manufacturing sector combines labour and machinery-intensive operations in automotive and electronics, creating stable, well-paying industrial jobs. This employment base supports consistent demand for mid-segment housing with steady price growth.

Kolkata

Kolkata's economy relies heavily on labour-intensive textile manufacturing, resulting in lower average wages compared to other metropolitan markets. This income structure limits housing market expansion and keeps price appreciation modest.

2. RBI’s Monetary Policy to fuel Housing Market Growth

A supportive monetary policy has underpinned much of the recent housing momentum:

- The repo rate stands at 5.5% (as of June 2025) after a 50 bps rate cut, improving housing affordability.

- The implementation of the External Benchmark Linked Lending Rate (EBLR, 2019) has enhanced rate transparency and transmission.

- Outstanding home loan volumes have grown from ₹7.5 lakh crore in 2020 to ₹35 lakh crore in 2025, a 3.7x increase, reflecting increased liquidity in the banking sector.

Are we entering a phase of Hyper Supply?

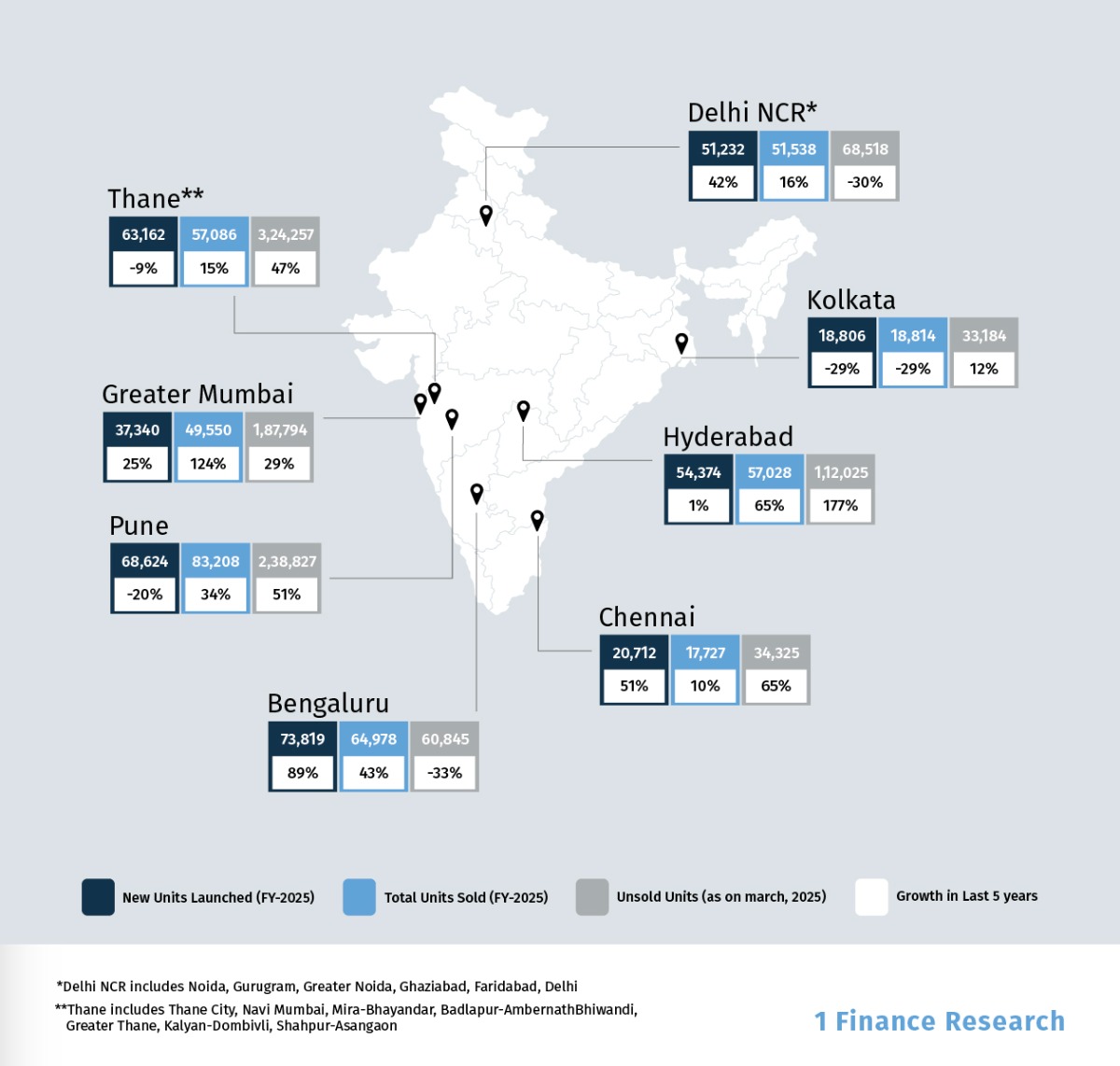

The Indian housing market exhibits a paradox. While the unsold inventory of India’s top cities has risen from 8 lakh units to 10.6 lakh units in 5 years, the inventory overhang (months to sell the unsold units entirely) has reduced from 31 to 24 months.

City-Level Trends:

1. Greater Mumbai and Thane combine for almost 50% of the unsold inventory

2. Hyderabad & Pune account for 35% of the unsold inventory. Developers are scaling back launches by 1% and -20% respectively.

3. Delhi NCR & Bengaluru: Witnessing strong demand — unsold inventory down 30% and 33% respectively.

4. Chennai faces a surge of 65% in the unsold inventory, but total units remain at 34,325.

5. Kolkata market contracts with both launches and sales declining 29% over 5 years

Macro Indicators that will Shape Real Estate Prices in FY26

| Macro Indicators | Current Trend | Outlook for FY26 | Impact on Real Estate Prices |

| Interest Rate | 5.5% (cut by 50 bps on June 6, 2025) | Further 25bps cuts expected in FY26 | Lower rates reduce borrowing costs, boosting demand and driving residential price increases, particularly in Tier 1 and Tier 2 cities. |

| Inflation | 2.82% (June 2025) | Expected to range within RBI’s target of 4% | Stable inflation enhances affordability, supporting moderate price growth |

| GDP Growth | 6.5% (FY 2024-25) | Expected to maintain 6.8% in FY26 | Strong GDP growth boosts incomes and demand for residential and commercial properties, driving price appreciation. |

Outlook

| Negative | Neutral | Positive |

| Chennai | Greater Mumbai | Bengaluru |

| Kolkata | Hyderabad | |

| Pune | Delhi NCR | |

| Thane |

The market is shifting towards sustainable growth after a period of rapid expansion. However, the sharp post-COVID surge is unlikely to continue. Instead, prices are expected to rise steadily, supported by strong buyer demand and ongoing infrastructure upgrades. The government’s investments in public transport and social infrastructure, especially in top cities and nearby districts, are improving connectivity. As a result, not only top cities but also surrounding and connecting areas are set to benefit from new growth opportunities.