Introduction

In a developing economy like India, individuals have to bear the impact of inflation, particularly when economic growth is steady or rapid. Inflation, often described as a silent financial predator, gradually erodes the purchasing power of money by increasing the general price level of goods and services over time. This common economic force affects nearly every aspect of personal finance, from savings and investments to debt and retirement planning. For example, if the economy is growing moderately with stable inflation, the income growth of an individual may be sufficient to take care of the rising expenditure. However, sustaining this balance in the long run may not be easy. As prices rise, individuals find it increasingly challenging to maintain their standard of living without proportionately increasing their income. Hence, it is imperative to understand the nature of inflation and its impact on your current savings and investments. Effective personal finance management becomes crucial in such an environment to safeguard one's financial well-being. This blog aims to provide a comprehensive understanding of inflation and its impact on personal finance, offering practical strategies to protect and enhance purchasing power.

Understanding Inflation

Inflation refers to the rate at which the general level of prices for goods and services rises. Continued inflation generally occurs when too much money is chasing too few goods. Inflation is normally calculated by comparing the price of a basket of goods at different times and can be used as a measure of the cost of living.

Disinflation is a decrease in the inflation rate, indicating a slowdown in the increase in the price level. Here the prices increase at moderate levels slightly lower than their previous rate of increase. Disinflation is often seen as a result of economic policies aimed at controlling inflation, such as higher interest rates or reduced government spending.

Deflation is a sustained decrease in the price level of goods and services often occurring during economic downturns. Deflation occurs when there is a decrease in the demand for goods and services.

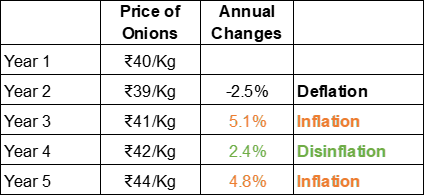

Example of yearly changes in onion prices

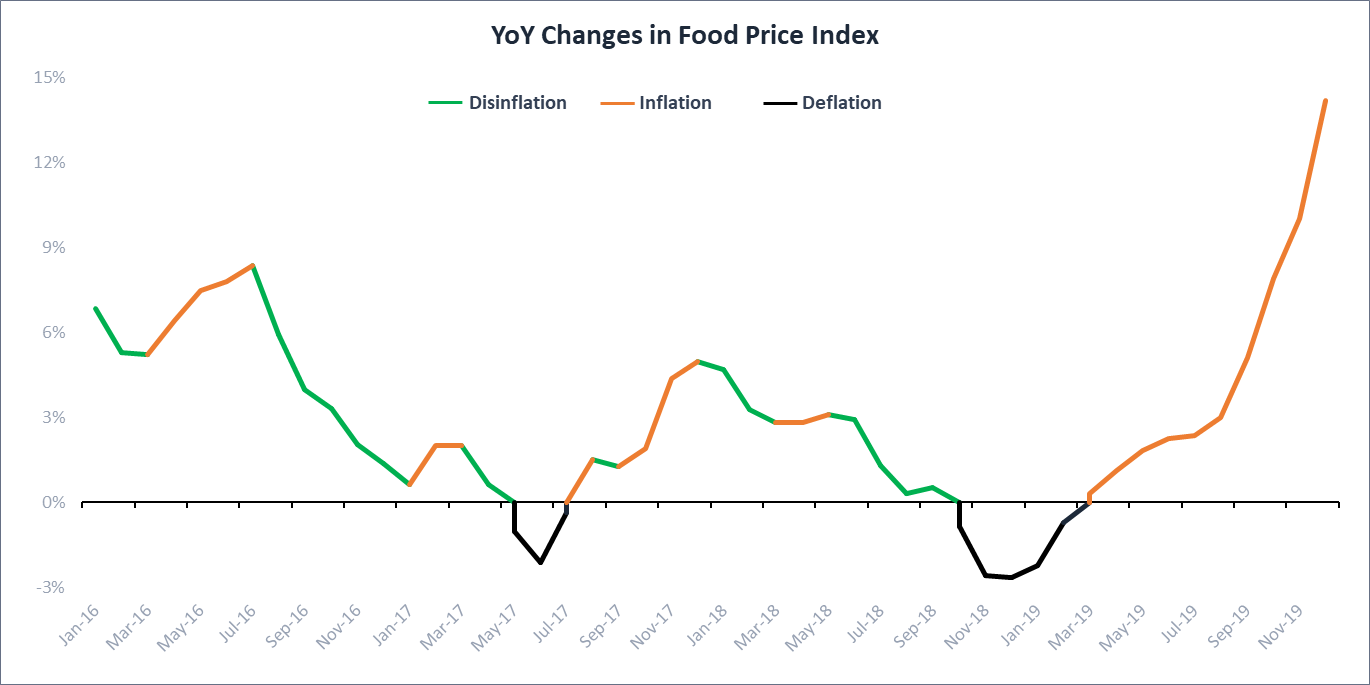

In Year 1, the price of onions was ₹40.0 per kg. By Year 2, the price dropped to ₹39.0 per kg, indicating a 2.5% decrease. This reduction in price is deflation, which means that consumers pay less for the same quantity of onions. In year 3, the price increased to ₹41.0 per kg, a 5.1% increase from the previous year, showing inflation. In year 4, the price increased, but at a declining rate of 2.4%. This phenomenon is termed as disinflation. The below chart captures the inflation trends in the food price index between January 2016 and November 2019, during which food prices remained volatile.

Disinflation is generally seen as positive; often indicating that the economy is stabilising and that runaway inflation is controlled. However, consistent disinflation may lead to deflation, which might sound favourable for consumers, but it can be harmful if continued for long, as it often leads to losses in business. Also, people may delay their spending, expecting the prices to fall further, which can worsen the economic slowdown leading to recession. Thus, managing inflation at moderate levels is crucial for sustained economic growth.

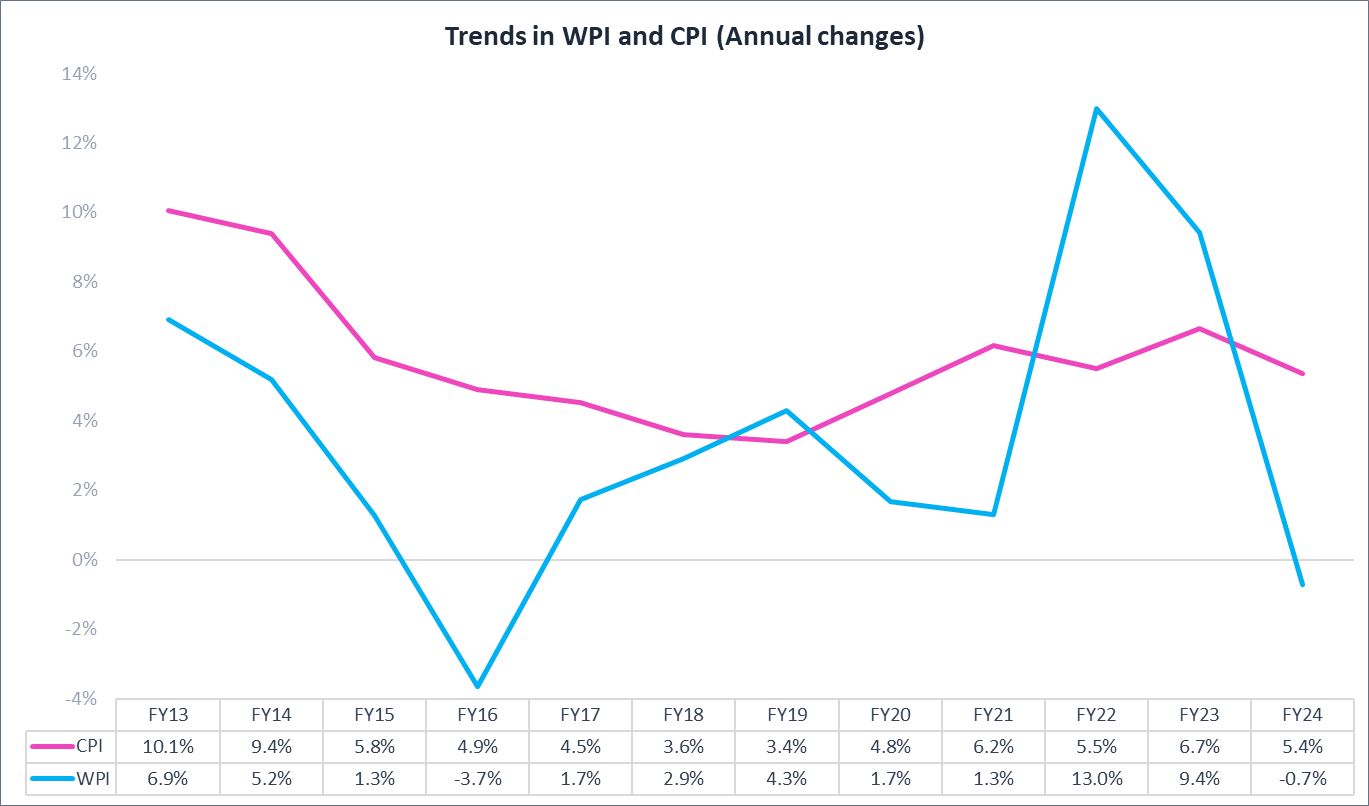

Central banks worldwide often have the mandate to control inflation within a specific range based on economic criteria, using various measures to understand underlying trends. In India, the Reserve Bank of India (RBI) used WPI inflation for its monetary policy decisions until 2014. Following the Urjit Patel Committee recommendations, the RBI established a framework for inflation targeting that uses the CPI. This framework includes a flexible inflation range of 2.0% to 6.0%, with a median target of 4.0%.

Recommended for you

Readers also explored

Will the Retirement Corpus Truly Last?

India’s Unemployment Rate in 2025

Measuring Inflation: CPI & WPI

In India, inflation is measured by the Consumer Price Index (CPI) and Wholesale Price Index (WPI).

- CPI measures the average change over time in the prices consumers pay for a basket of goods and services, such as food, medical care, transportation, housing, etc.

- WPI measures the changes in the cost of goods sold and traded in bulk by wholesale businesses to other businesses. It does not include the cost of services; it only contains goods like fuel, power, manufacturing, etc.

Generally, there is a positive correlation between WPI and CPI inflation rates, as changes in wholesale prices typically affect consumer prices, sometimes with a lag. The monthly data from 2015-2023 found a strong positive correlation (+0.7) in CPI and WPI indices. The divergence between WPI and CPI occurs due to their composition differences and weightage, consumer demand vs. input costs, changes in the prices of global commodities (which we import) and policy measures or government interventions.

Varying Trends in Inflation

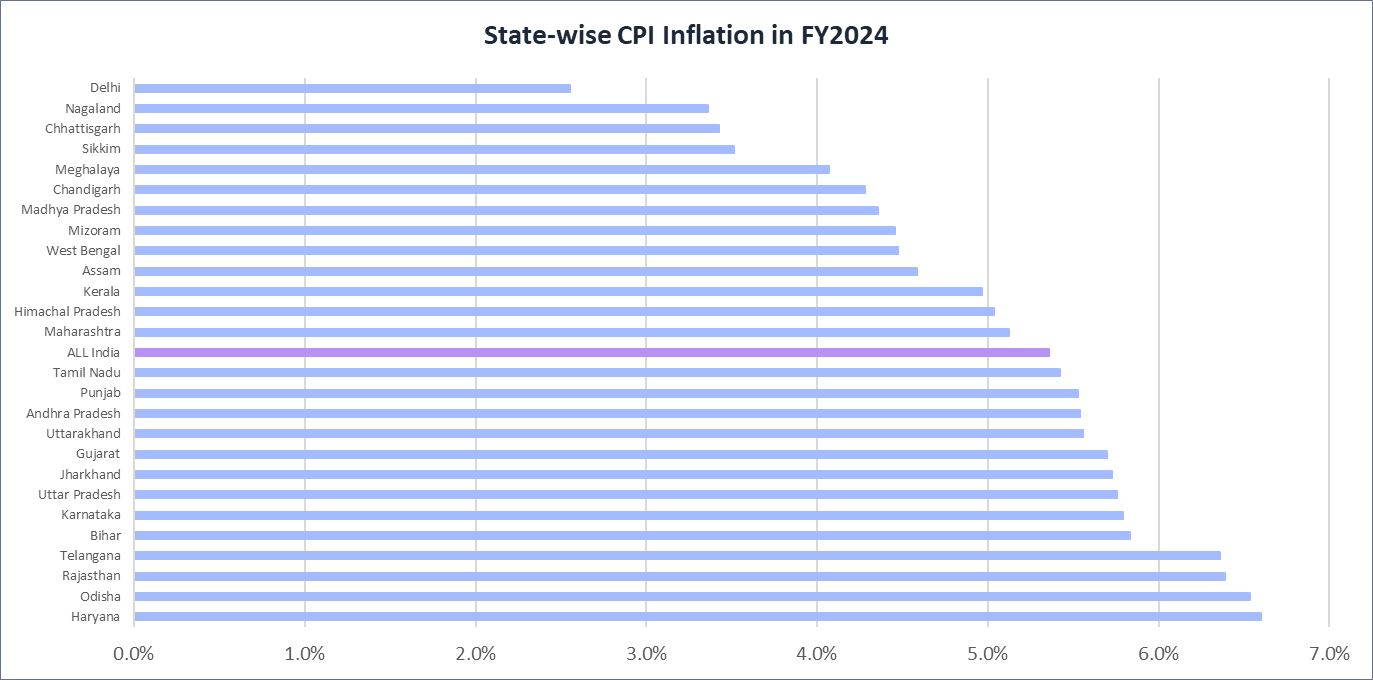

Recent trends show a surge in CPI inflation in India, driven primarily by rising food prices. Regional disparities also contribute to varying inflation rates including different states, urban and rural areas.

Changes in food inflation have a more pronounced impact on rural inflation, as rural households allocate a significant portion of their spending to food and beverages, comprising a much larger share of their expenditure basket than urban households. The food and beverage category accounts for 54.2% of the rural inflation basket, compared to 36.3% in urban areas. This disparity leads to a stronger correlation of 0.9 (Jan 2014 to July 2024) between food inflation and overall inflation in rural areas, indicating that higher food inflation in rural areas drives the overall rural inflation above the urban inflation level. When food prices rise, rural inflation typically outpaces urban inflation, highlighting the outsized impact of food costs on rural economies.

Regional disparities are captured in the state-wise inflation data for FY2024, signifying how states such as Haryana, Odisha, Bihar, Rajasthan, Telangana and Karnataka are experiencing much higher rates than the national average. Historical data suggests that during the pandemic, Rajasthan reported significantly higher inflation while Delhi reported the lowest. In recent years, Rajasthan's overall inflation has remained high, primarily due to rising food prices. Additionally, the state's high Value Added Taxes (VAT) on petrol and diesel contribute to higher transportation costs, which in turn raises the prices of other commodities, contributing to the overall rise in inflation.

Diverging inflation across states also has a varied impact on the economic sectors. States with higher inflation in FY2024, such as Haryana at 6.6% and Odisha at 6.5%, face greater strain on household budgets and reduced purchasing power. In contrast, regions with lower inflation rates such as Delhi (2.6%) and Nagaland (3.4%), experience less financial pressure. Similarly, with higher food inflation rates, rural areas could see a more significant effect on purchasing power than urban areas, potentially widening economic disparities.

Personal Inflation Rate

Personal inflation refers to the rate of inflation experienced by households or an individual, which can differ significantly from the general headline inflation rate reported by the government. This rate is determined by the household's specific consumption behaviours and spending patterns. It accounts for the unique mix of goods and services, that the household regularly purchases due to diverse economic factors or lifestyle. As a result, the personal inflation rate can be higher or lower than the overall inflation rate.

- Residents of Tier 1 cities (e.g., Mumbai, Bangalore) often experience higher personal inflation rates than those in Tier 2 cities (e.g., Jaipur, Lucknow) due to higher costs of housing, transportation, and services.

- High-income earners face different inflationary pressures than lower-income individuals due to varying spending patterns on luxury goods versus essential items.

- Demographic factors such as family size and age also impact personal inflation. Families with young children may experience higher inflation due to education and childcare costs, while retirees might be more affected by healthcare inflation.

- Consumption preferences, such as choosing between public and private healthcare or education, further diversify personal inflation rates.

Personal inflation is a microeconomic measure reflecting individuals' specific needs based on their unique expenditure profiles, geographic location, and lifestyle choices. This individualised inflation rate underscores the variability in how economic conditions affect different population segments.

Impact on Savings and Investments

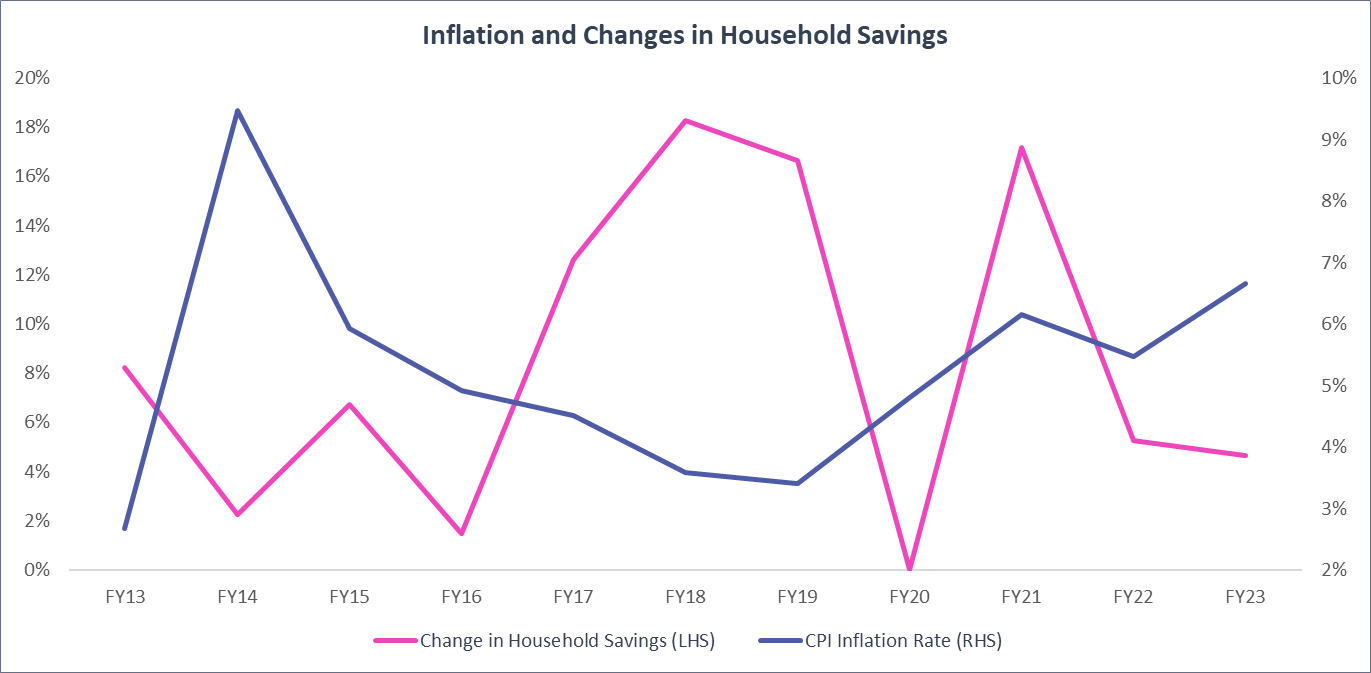

The financial health of households is a crucial indicator of economic stability. High inflation reduces purchasing power, forcing households to spend more on the same goods and services, which reduces savings. Recent data shows that rising inflation has significantly impacted household savings and net financial wealth in India in the last two years. During the pandemic, people cut back on spending due to the social distancing measures and saved more as a precaution. However, post-pandemic, with rising prices due to pent-up demand, savings have plummeted as households resumed spending. CPI inflation peaked at 7.4% in August 2023, and averaged 6.7% in FY2023, above the RBI’s target range of 2.0% to 6.0%. To control inflation, RBI increased the repo rate by 250 basis points in a year to 6.5% by February 2023, from a low of 4.0% in April 2022. Despite rising interest rates, households continue to borrow, particularly for mortgages and personal loans. Personal loans grew by 21.0% in FY23 exceeding the gross bank growth of 15.4% YoY, while the financial liabilities increased by 76.0% (YoY), outpacing asset growth, thus reducing the net financial savings as a percentage of GDP.

Household savings as a percentage of GDP reached a decadal low of 5.1% in FY23, a stark decline from a peak of 11.5% in FY21. This drop indicates that households are saving less and taking on more debt, primarily due to increased consumption driven by inflation. The decline in net financial assets and the surge in liabilities also highlight the financial pressures on households due to inflation. Such situations increase the potential financial vulnerability, if income growth does not keep pace with inflation and debt repayments.

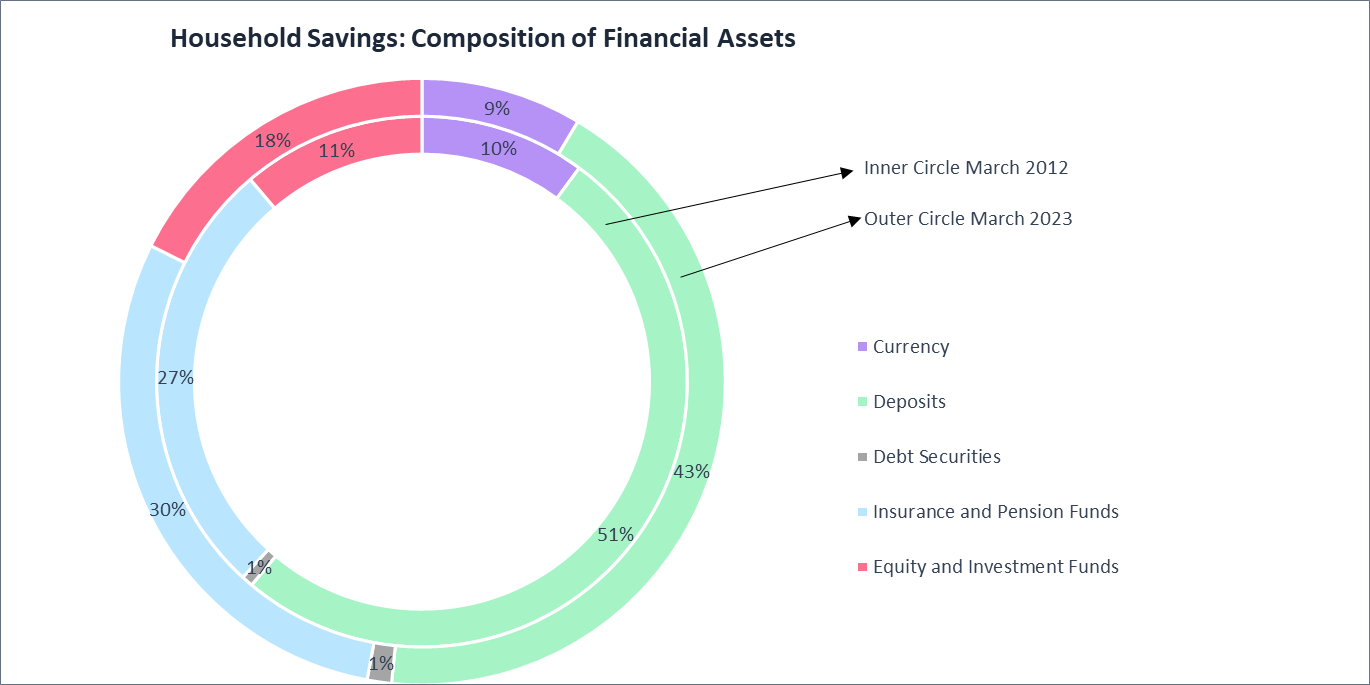

Long-term investment planning is essential for safeguarding against inflation and ensuring a balanced approach between consumption and savings. Although overall savings have declined, data indicates that investors are increasingly channelling their funds into equity-related investments, insurance, and pension funds. Over the past decade, savings in fixed deposits have decreased, while investments in equities and pension-related options have risen significantly.

Investment Strategies for Battling Inflation

Gold and Sovereign Gold Bonds (SGBs)

Gold has traditionally been viewed as a hedge against inflation. During periods of high inflation, the purchasing power of fiat currencies declines, whereas gold tends to retain its value. Historical data demonstrates that gold prices generally rose during elevated inflation, protecting investors' wealth. Between FY2013 and FY2024, gold prices have increased at a CAGR of 7.2%, compared to the average CPI inflation of 5.1%. However, investing in physical gold has its own set of risks such as theft, storage, additional costs like making charges for gold jewellery and purity concerns.

Sovereign Gold Bonds (SGBs) issued by the RBI, denominated in grams of gold, provide a secure alternative to holding physical gold. Investors pay in cash and redeem in cash upon maturity, receiving the market price of gold at that time. SGBs also offer periodic interest payments, which physical gold does not. Residents of India, including individuals, Hindu Undivided Families (HUFs), trusts, universities, and charitable institutions, can invest in SGBs. Joint holdings and investments by minors through guardians are also allowed. Application forms are available at banks, offices of Stock Holding Corporation Of India Ltd (SHCIL), post offices, agents, and the RBI website, with online options provided by some banks. Each application requires a PAN number.

SGBs are issued in denominations of one gram of gold, with a minimum investment of one gram and a maximum limit of 4 kg per individual and HUF, and 20 kg for trusts per financial year. The bonds offer a 2.50% annual interest rate, paid semi-annually. They can be redeemed early after the fifth year on coupon payment dates and are tradable on stock exchanges if held in demat form. SGBs can also be used as collateral for loans.

On maturity, SGBs are redeemed in Indian rupees based on the average closing price of gold over the previous three business days. SGBs provide a secure, convenient, and interest-earning way to invest in gold, making them an attractive alternative to physical gold.

Equities: SIPs & Step-Up SIPs

Historically, equities have provided returns that outpace inflation over the long term. Investing in sector-specific equities, particularly those less sensitive to high interest rates, can offer good protection against inflation.

Systematic Investment Plans (SIPs) are an excellent investment choice for all types of individuals. They allow investors to gradually build their portfolios, helping them achieve their investment goals without putting too much stress on their finances. Through SIPs, investors contribute a fixed amount regularly, usually monthly, into a mutual fund scheme, making it a disciplined approach to investing. This method also helps in averaging the purchase cost and capitalising on the power of compounding over time.

Step-Up SIPs: As individuals' incomes typically increase over time, step-up SIPs enable periodic increases in SIP amounts, helping to combat inflation and earn higher returns. You can access the 1 Finance calculator to understand how increasing your SIP contributions impacts your wealth accumulation over time. SIPs can help redirect this extra income into investments, ensuring that the investor benefits from higher returns and a systematic approach to wealth accumulation. Regular investment ensures that even small amounts can grow significantly over time, providing financial stability and growth.

Real Estate & Real Estate Investment Trusts (REITs)

Investments in real estate are widely regarded as a robust hedge against inflation, as its intrinsic value is not easily eroded by inflation. Property values and rental income typically increase over time, helping to maintain purchasing power. However, investing in property requires significant upfront capital, and is subject to various laws and regulations that can be complex and vary from time to time, such as the recent announcement regarding the changes in LTCG tax and removal of indexation benefit for properties bought after July 23, 2024.

Maintaining the property involves additional costs, moreover, liquidating the asset can be a cumbersome and lengthy process. Hence, investing in Real Estate Investment Trusts (REITs) is a better alternative to investing directly in physical real estate. REITs are more accessible and liquid and offer regular income making them an attractive option for many investors.

REITs allow investors to enter the real estate market with much smaller amounts of capital compared to direct property purchases. REITs invest in a diversified portfolio of properties, which helps mitigate risk compared to owning a single property. REITs are managed by professionals, and traded on stock exchanges, providing greater liquidity and the ability to buy or sell shares quickly. It provides regular and a consistent income stream, and enjoys special tax treatment, often exempt from corporate taxes if it meets distribution requirements, which can result in higher dividend yields. Due to diversification, professional management, and regulatory requirements that promote transparency and investor protection, REITS typically have lower risk.

Conclusion

India's inflationary trends over the past decade underscore the challenges individual investors face in protecting their portfolios. Inflation erodes purchasing power and can make it difficult to achieve real returns on investments. By understanding the impact of inflation and implementing proactive financial strategies, it is possible to protect and even enhance one's purchasing power despite inflationary pressures. While strategic financial planning is crucial, diversification is key to mitigating inflationary effects. Investing in a mix of equities, real estate, and commodities, along with inflation-protected securities, can provide a robust defence against rising prices. One can effectively manage inflation's challenges and achieve long-term financial stability by staying informed, regularly reviewing investments, and adapting the right strategy.