It’s not a matter of if, but when.

India is now firmly on track to become the 4th largest economy in the world by the end of 2025, overtaking Japan in nominal GDP terms. According to the International Monetary Fund’s April 2024 World Economic Outlook, India’s GDP is projected to hit $4 trillion by the end of next year, surpassing Japan and trailing only the US, China, and Germany.

And it’s not just projections anymore. The recently released Q4 FY25 GDP numbers offer compelling evidence that this transformation is well underway.

Q4 FY25 GDP Results: India beats estimates again

India’s economy grew by a robust 7.4% year-on-year in the fourth quarter of FY 2024–25, significantly beating expectations and the Reserve Bank of India’s forecast of 7.2%. This was driven by strong public capital expenditure, manufacturing revival, and a resurgence in rural demand.

A look at the numbers:

- India’s economy grew by 7.4% year-on-year in Q4 FY 2024-25, reaching ₹51.35 lakh crore at constant prices, up from ₹47.82 lakh crore in the same quarter last year.

- At current prices, GDP rose 10.8% to ₹88.18 lakh crore in Q4, compared to ₹79.61 lakh crore a year ago.

- Real GVA grew by 6.8% in Q4, while nominal GVA rose by 9.6%.

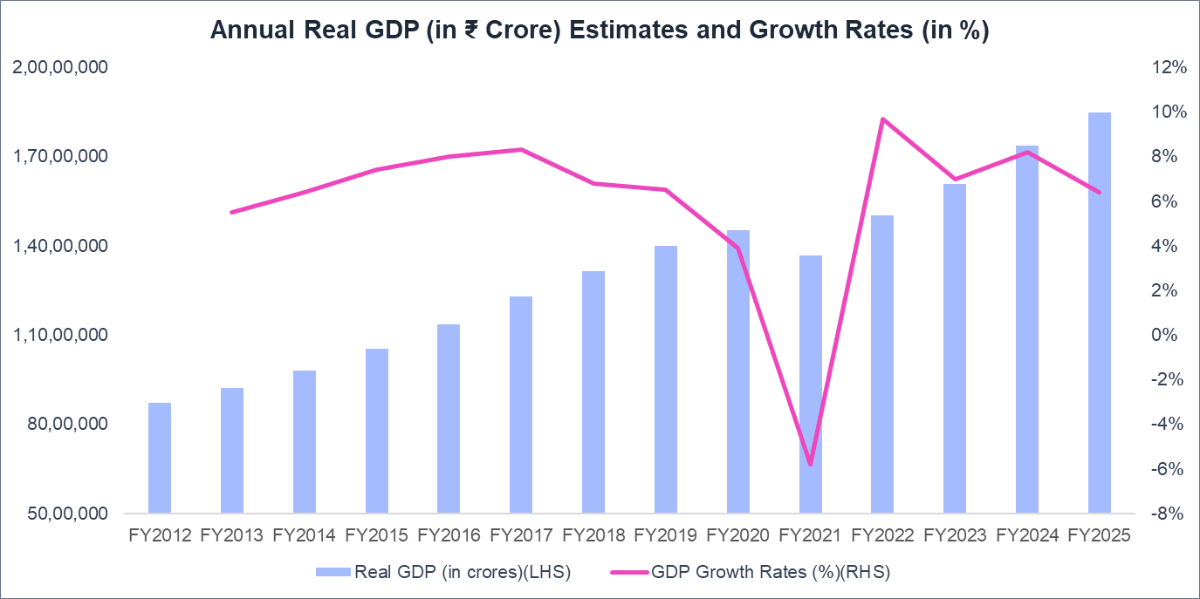

- For the entire fiscal year 2024-25, real GDP growth is provisionally estimated at 6.5%, with nominal GDP up by 9.8%.

Sectoral Performance: The Pillars of Growth

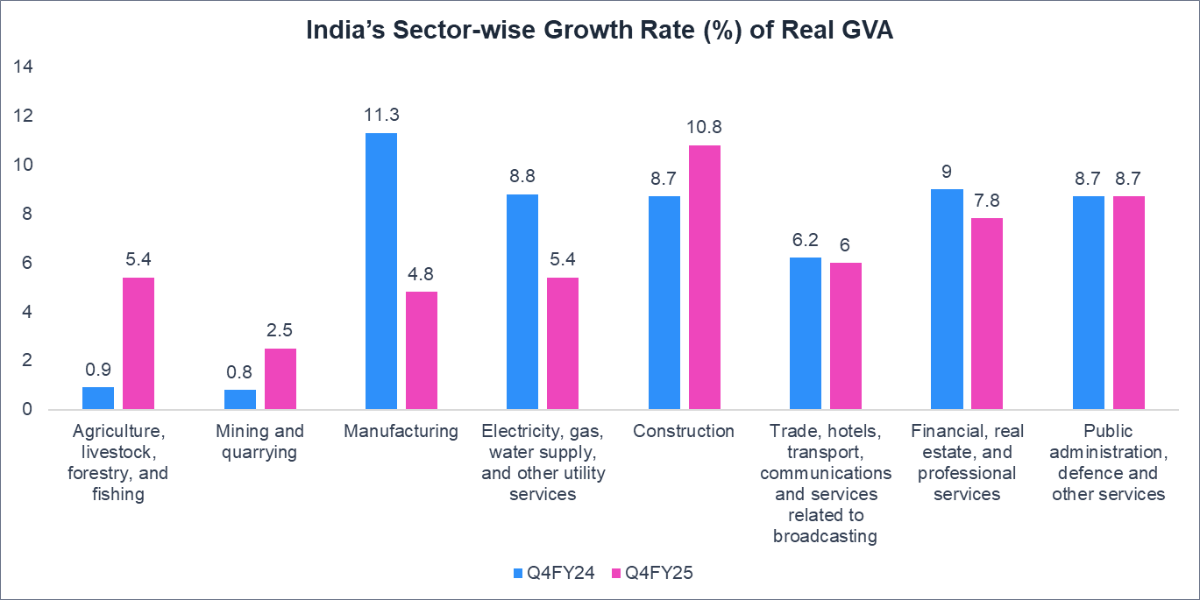

A granular look at the Gross Value Added (GVA) by different sectors reveals the underlying strengths:

- Construction: This sector has been a standout performer, registering an impressive 10.8% growth in Q4 FY25. This robust expansion is driven by a sharp rise in infrastructure activity and real estate development. The government’s emphasis on capital expenditure was central to this momentum. Over FY25, the sector grew by 9.4%, becoming a key driver of economic expansion.

- Public Administration, Defence & Other Services: This sector demonstrated strong growth of 8.7% in Q4 FY25, reflecting continued government expenditure and possibly increased activity in public services. Annually, this sector recorded an 8.9% growth, underscoring the government's role in driving economic activity.

- Financial, Real Estate & Professional Services: Growing by 7.8% in Q4 and 7.2% for the year, this sector remained stable. This performance highlights the strength and dynamism of India's financial ecosystem and the ongoing demand for professional services.

- Primary Sector (Agriculture, Mining, Forestry, and Fishing): This sector expanded by 5.0% in Q4 FY25, up from 0.8% in Q4 FY24. On an annual basis, it grew 4.4%, compared to 2.7% in FY24. A favourable monsoon and improved agricultural output have likely contributed to this resurgence, which is critical for rural income and overall consumption.

- Manufacturing: Though manufacturing grew only 4.5% in FY25 compared to 12.3% in FY24, it improved in Q4, registering 4.8% growth. This suggests some revival in industrial activity after a subdued first half of the year. The Finance Minister, Nirmala Sitharaman, specifically highlighted the "good" manufacturing activity during Q4, dispelling some concerns about private investment.

Recommended for you

Readers also explored

India’s GDP Growth: Challenges and Future Outlook 2025

India's IT Sector Outlook for FY2026

Demand-Side Story: Consumption and Investment

From the expenditure side, two key components stand out:

- Private Final Consumption Expenditure (PFCE): Often considered the backbone of India's demand-driven economy, PFCE reported a robust 7.2% growth rate during FY25, a notable improvement from 5.6% in the previous financial year. This indicates resilient consumer demand, which has been a consistent driver of India's economic growth. The Chief Economic Advisor (CEA) noted that private consumption's share in GDP has risen to its highest level since FY04, underscoring its importance.

- Gross Fixed Capital Formation (GFCF): This metric, representing investment in physical assets, recorded a strong 9.4% growth in Q4 FY25, marking the most significant increase in nearly two years. For the full fiscal year, GFCF grew by 7.1%. This surge in investment, particularly in the last quarter, is a positive sign for future productive capacity and long-term growth.

The Full-Year Perspective: A Four-Year Low, But Still Strong

While the Q4 performance was impressive, the overall GDP growth for FY25 at 6.5% marks the slowest pace in four years, following a 9.2% growth in FY24. This is still a strong growth rate, especially when compared to other major economies globally. India continues to hold its position as the fastest-growing large economy in the world.

| Components | FY25 | FY24 | FY25 (PE) | |||

|---|---|---|---|---|---|---|

| Q1 | Q2 | Q3 | Q4 | |||

| Private Final Consumption Expenditure (PFCE) | 8.3 | 6.4 | 8.1 | 6 | 5.6 | 7.2 |

| Government Final Consumption Expenditure (GFCE) | -0.3 | 4.3 | 9.3 | -1.8 | 8.1 | 2.3 |

| Gross Fixed Capital Formation (GFCF) | 6.7 | 6.7 | 5.2 | 9.4 | 8.8 | 7.1 |

| Exports | 8.3 | 3 | 10.8 | 3.9 | 2.2 | 6.3 |

| Imports | -1.6 | 1 | -2.1 | -12.7 | 13.8 | -3.7 |

| GVA at basic prices | 6.5 | 5.8 | 6.5 | 6.8 | 8.6 | 6.4 |

| Primary Sector | 2.2 | 3.5 | 6.1 | 5 | 2.7 | 4.4 |

| Agriculture, Livestock, Forestry & Fishing | 1.5 | 4.1 | 6.6 | 5.4 | 2.7 | 4.6 |

| Mining and Quarrying | 6.6 | -0.4 | 1.3 | 2.5 | 3.2 | 2.7 |

| Secondary Sector | 8.6 | 4 | 5.1 | 6.8 | 11.4 | 6.1 |

| Manufacturing | 7.6 | 2.2 | 3.6 | 4.8 | 12.3 | 4.5 |

| Electricity, Gas, Water Supply and other Utility Services | 10.2 | 3 | 5.1 | 5.4 | 8.6 | 5.9 |

| Construction | 10.1 | 8.4 | 7.9 | 10.8 | 10.4 | 9.4 |

| Tertiary Sector | 6.8 | 7.2 | 7.4 | 7.3 | 9 | 7.2 |

| Trade, Hotels, Transport, Communication & Services related to Broadcasting | 5.4 | 6.1 | 6.7 | 6 | 7.5 | 6.1 |

| Financial, Real Estate and Professional Services | 6.6 | 7.2 | 7.1 | 7.8 | 10.3 | 7.2 |

| Public Administration, Defence & Other Services | 9 | 8.9 | 8.9 | 8.7 | 8.8 | 8.9 |

Several factors contributed to this overall moderation compared to the previous year's higher base:

- Global Headwinds: Despite India's relatively low dependence on exports, global economic uncertainties, trade tensions, and fluctuating commodity prices have undoubtedly played a role. The fourth quarter, in particular, was impacted by global trade disruptions led by Trump's tariffs and the escalation of the Russia-Ukraine war.

- Subdued Private Investment (earlier in the year): While GFCF picked up significantly in Q4, there were earlier concerns about subdued private investment for a large part of the fiscal year, possibly due to global uncertainties.

- High Base Effect: The high growth rates observed in FY24, which benefited from a post-pandemic rebound, naturally created a higher base, making it more challenging to achieve similar percentage point increases in the subsequent year.

Underlying Strengths and Future Outlook

Despite the annual moderation, the Q4 results and the broader economic commentary from policymakers and institutions paint a picture of underlying strength and optimism for India's future.

- Domestic Demand: Both consumer spending (Private Final Consumption Expenditure) and business investment (Gross Fixed Capital Formation) picked up significantly, showing that demand from within India is powering its growth.

- Government Initiatives: Government spending on infrastructure and public services has been key. Programs like 'Atmanirbhar Bharat' and large-scale infrastructure projects are building a strong base for future economic expansion.

- Demographic Dividend: India's young and large workforce remains a significant asset, promising a sustained boost to consumption and productivity in the coming decades.

- Digital Transformation: The rapid pace of digital adoption and the development of the "India Stack" (digital public infrastructure) are fostering innovation, improving efficiency, and creating new economic opportunities.

- Inflation Management: Inflation, once a concern, is now significantly lower due to government actions and better food supply. India's consumer price inflation hit a low of 2.82% in May 2025, its lowest since February 2019. This is well within the RBI's target, leading to interest rate cuts totalling 100 basis points in 2025, bringing the repo rate to 5.5% as of June 6, 2025.

- Global Recognition: Top international bodies like the IMF and OECD continue to see India as the world's fastest-growing major economy for both 2025 and 2026. This confirms India's strong economic foundations and its ability to keep growing even with global challenges. For example, the IMF expects India's economy to grow by 6.2% in 2025 and 6.3% in 2026, while the OECD predicts 6.3% in 2025 and 6.4% in 2026.

Challenges and the Road Ahead

While the outlook is largely positive, India's economic journey is not without its challenges:

- Sustaining Investment Momentum: While Q4 saw a strong surge in GFCF, ensuring this trend is sustainable, particularly for private sector investment, will be crucial. Global uncertainties and interest rate movements could influence corporate investment intentions.

- Employment Generation: While economic growth is strong, the challenge of creating sufficient, high-quality jobs for the growing workforce remains paramount, especially in the manufacturing sector. Addressing skill gaps and promoting labour-intensive industries will be key.

- Global Trade Tensions: Escalating trade protectionism and geopolitical instability can impact India's export potential, even with its domestically led growth.

- Fiscal Consolidation: Maintaining fiscal prudence while continuing to invest in growth-enhancing infrastructure will be a balancing act for the government. The government's fiscal deficit target of 4.8% of GDP for FY25 and 4.4% for the current fiscal year will need careful management.

- Rural Demand: While rural consumption has shown signs of strength, its continued growth is susceptible to monsoon patterns and global food price fluctuations.

Conclusion

India closed FY25 on a strong footing. A solid Q4, led by construction, public services, and improved consumption, confirmed the economy’s upward trajectory. While annual growth moderated due to a high base and global factors, India remains among the best-performing major economies.

The outlook for FY26 is optimistic, with higher rural incomes, improving inflation dynamics, and policy support providing a stable environment for continued expansion. However, sustaining this momentum will require a push in private investment, steady job creation, and a focus on inclusive growth.

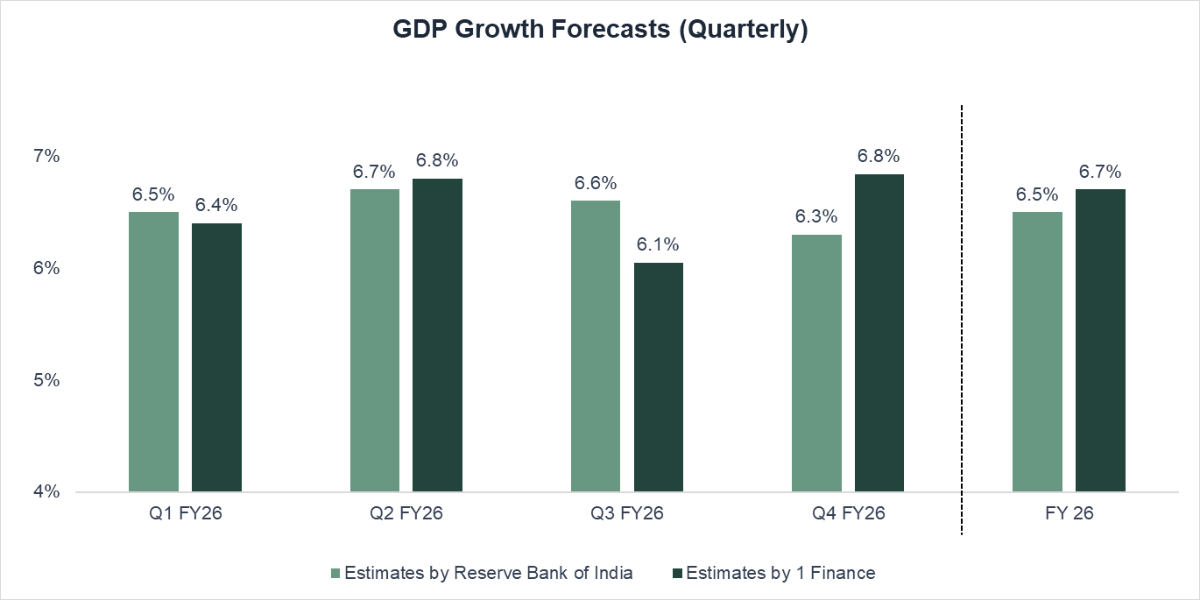

In light of these mixed signals, 1 Finance has marginally revised its FY26 GDP forecast to 6.7% from 6.8%. While this marks a modest downgrade, it still reflects confidence in India’s structural strength, making it one of the few major economies projected to grow above 6%.

India’s steady climb toward becoming the world’s fourth-largest economy by 2025 now looks well within reach—not just by size, but by strength of fundamentals and execution.