Domestic Institutional Investors (DIIs) are entities operating within India's financial system that invest substantial amounts of capital in various financial instruments, including stocks, bonds, and other securities. These investors typically have a long-term investment horizon and are managed by experienced fund managers and investment professionals. DIIs include mutual funds, insurance companies, pension funds, banks, and financial institutions, which pool funds from various sources and invest in the domestic financial market.

DIIs are defined by their domestic presence and investment focus. Unlike FIIs, which are foreign entities investing in the Indian market, DIIs are based in India and invest in the domestic financial market. This local presence makes them integral to the stability and growth of the domestic financial market.

Types of Domestic Institutional Investors (DIIs)

Domestic Institutional Investors (DIIs) are crucial players in the Indian stock market, contributing significantly to its stability and growth. There are several types of DIIs, each with unique characteristics and investment strategies.

1. Mutual Funds:

These are investment vehicles that pool money from multiple investors to invest in various financial instruments. Mutual funds are managed by professional fund managers and offer a diversified portfolio to investors. As of 31st March2024, there are 44 Asset Management Companies (AMCs) or Mutual Fund companies operating in India. These companies manage the investments of investors to fetch them returns, providing a wide range of investment options across various asset classes.

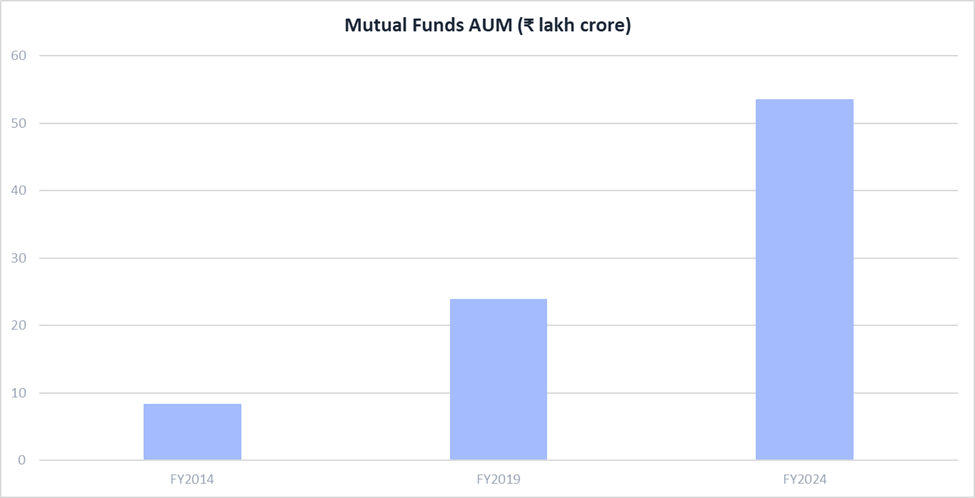

The total AUM of the Indian Mutual Fund industry has grown significantly:

₹8.25 lakh crore as on FY 2014

₹23.8 lakh crore as on FY 2019

₹53.40 lakh crore as of FY 2024

The mutual fund industry AUM has shown a growth of more than 6 times in the past 10 years and the growth is expected to continue, with projections suggesting that the AUM may surpass ₹100 lakh crore in the next 2 to 3 years.

Mutual funds with highest AUM (as of 31st March 2024):

- SBI Mutual Fund: ₹ 9.2 lakh crore

- ICICI Prudential Mutual Fund: ₹ 7.16 lakh crore

- HDFC Mutual Fund: ₹ 6.15 lakh crore

- Nippon Mutual Fund: ₹ 4.38 lakh crore

Recommended for you

Readers also explored

A Mid-Year Check: Whether India is in Flux

World GDP Breakdown 2025: Who Powers the Global Economy?

2. Indian Insurance Companies

Indian insurance companies are another significant type of DII, offering a wide range of insurance products and financial services beyond traditional insurance coverage.

Assets Managed: Insurance companies in India manage assets exceeding ₹60 lakh crore. Apart from insurance solutions, these companies provide financial options such as loans and Unit Linked Insurance Plans (ULIPs), which combine insurance coverage with investment opportunities in the stock market.

Insurance Companies with Highest AUM (as of 31st March 2024)

- LIC: ₹ 52.2 lakh crore

- HDFC Life Insurance Company: ₹ 3 lakh crore

- ICICI Prudential Life Insurance: ₹ 3.14 lakh crore

3. Pension Funds

Pension funds are built from contributions made to pension plans by both employees and employers, aiming to provide a comfortable retirement. The National Pension System (NPS) assets under management grew by 30.5% (YoY) to touch ₹11.73 lakh crore in FY 2024, largely due to increased contributions from non-government sectors. While, total corpus of various funds managed by Employees’ Provident Fund Organisation (EPFO) as on March 31,2022 amounted to ₹18.30 lakh crore, who invests funds as per the Investment Pattern notified by the Government. EPFO does not invest directly in individual stocks, but invests in Equity markets through ETFs, which increased to ₹ 53,081 crore by FY2023, from ₹ 14,983 crore by FY2017

4. Banking & Financial Institutions

Banks and financial institutions are influential DIIs, investing in the stock market beyond their traditional roles in savings and loans. In the quarter ending June 2024, banking assets across various sectors totaled ₹191.6 lakh crore, reflecting a notable rise in bank investments. The top banks with highest AUM are State Bank of India, HDFC Bank, and ICICI Bank.

The diverse types of DIIs, with their specific focuses and objectives, collectively shape the trajectory of the Indian stock market. Each category of DII charges a fee for managing investments, either collecting asset management fees or taking a portion of the profits from successful investments.

Role of DIIs

Domestic Institutional Investors (DIIs) are crucial players in the Indian stock market, contributing significantly to its stability and growth. DIIs have competent research personnel who have received certification from the Securities and Exchange Board of India (SEBI). These professionals conduct thorough research and analysis to make informed investment decisions, focusing on long-term wealth preservation and capital appreciation. Unlike FIIs, which often have short-term to intermediate investment goals, DIIs invest for the long term. DIIs and FIIs are sometimes referred to as market movers due to their significant purchase and sale volumes, which can change the direction of the market. However, DIIs are not subject to the same restrictions as FIIs, such as limits on the percentage of equity shares and the total amount of assets they can buy of a company.

Retail investors can benefit from tracking DII movements in several ways

1. Market Sentiment: DIIs influence overall market sentiment through their investment decisions. Positive inflows from DIIs often signal confidence in the economy and corporate earnings outlook, leading to bullish market sentiments. Conversely, large-scale selling by DIIs may dampen investor confidence and trigger market corrections.

2. Investment Insights: By tracking DII movements, retail investors can gain insights into market trends and potential investment opportunities. DIIs often invest in companies with strong fundamentals and growth prospects, which can provide valuable information to retail investors. Anyone can visit the NSE website for daily net buy/sell figures in the equity segment while if you are keen to know about the trades they make in bulk, you can visit the BSE website. Please consult a qualified financial advisor before making investment decisions.

3. Stability and Liquidity: DIIs provide stability and liquidity to the market, which is essential for retail investors. Their consistent participation helps absorb market shocks and maintain stability, making it easier for retail investors to enter and exit the market.

4. Counterbalance to FII Activities: DIIs act as a counterbalance to FII activities, which can be volatile and unpredictable. By tracking DII movements, retail investors can better understand the market dynamics and make informed investment decisions.

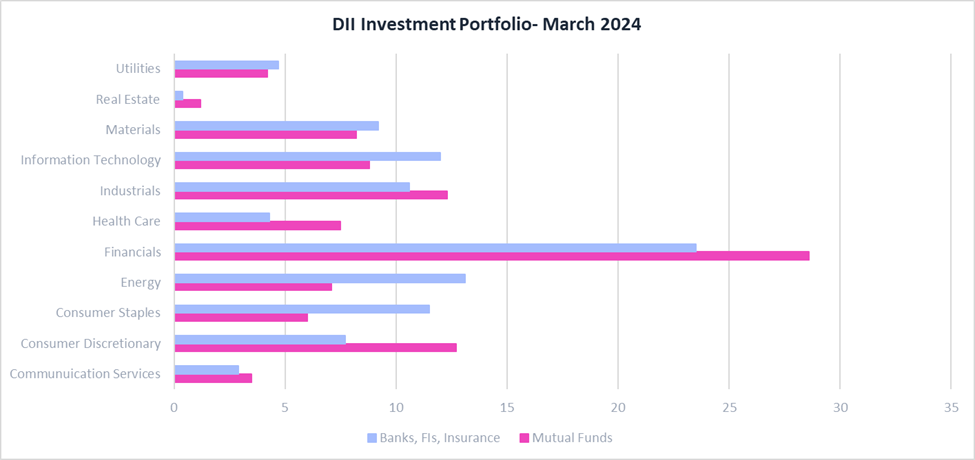

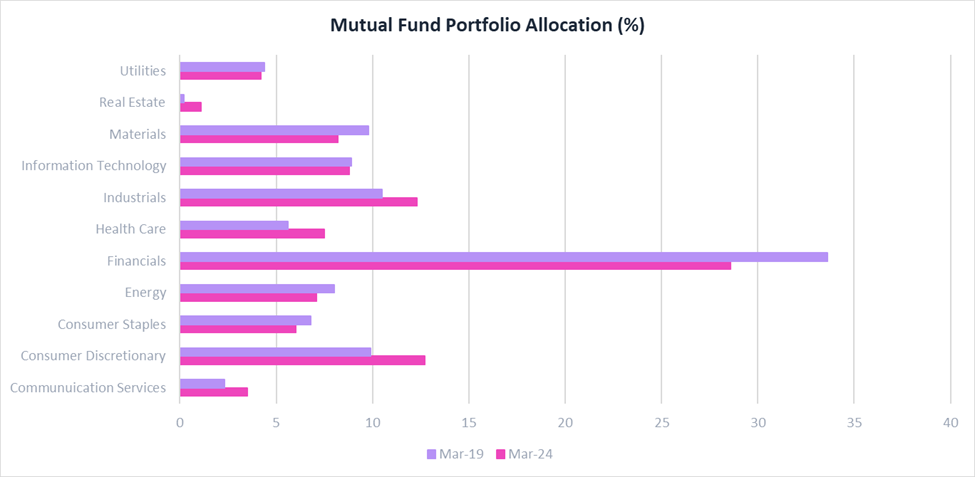

DIIs diversify their investment portfolios across different sectors

The mutual fund portfolio allocation from March 2019 to March 2024 reveals strategic shifts that align with future growth prospects. Financials remain the largest sector, though slightly reduced, reflecting a cautious approach amid evolving market conditions. Notably, there is increased investment in Information Technology and Health Care, sectors poised for significant growth due to technological advancements and rising healthcare demands. The rise in allocations to Real Estate and Utilities indicates confidence in their long-term stability and potential. Conversely, Consumer Staples and Energy have seen reduced focus, possibly due to changing consumer preferences and a shift towards renewable energy. These adjustments underscore a forward-looking strategy, positioning portfolios where future opportunities are expected to thrive.

Historical Effectiveness

Historically, DIIs have been effective in maintaining market stability during periods of volatility.

1. 2008 Global Financial Crisis: During the 2008 global financial crisis, FIIs withdrew significant amounts of capital from the Indian market, leading to a sharp decline in stock prices. However, DIIs stepped in to stabilise the market by investing ₹1,09,000 crore, which helped mitigate the impact of FII outflows.

2. 2013 Taper Tantrum: In 2013, the US Federal Reserve's decision to taper its quantitative easing program led to a sudden outflow of foreign capital from emerging markets, including India. DIIs played a crucial role in stabilising the market by investing ₹1,13,134 crore, which helped absorb the selling pressure created by FIIs.

3. 2016 Demonetisation: In 2016, the Indian government's decision to demonetize high-denomination currency notes led to a sudden outflow of foreign capital from the Indian market. However, DIIs played a crucial role in stabilising the market by investing ₹27,426 crore, which helped absorb the selling pressure created by FIIs.

4. 2018 Market Volatility: In 2018, the Indian stock market experienced significant volatility due to global economic uncertainty and FII outflows. However, DIIs continued to invest in the market, with net investments of ₹1,09,000 crore, which helped stabilise the market and prevent a sharp decline in stock prices.

5. 2020 COVID-19 Pandemic: During the COVID-19 pandemic, FIIs withdrew significant amounts of capital from the Indian market, leading to a sharp decline in stock prices. However, DIIs stepped in to stabilise the market by investing ₹1,28,208 crore, which helped mitigate the impact of FII outflows and prevent a complete market collapse.

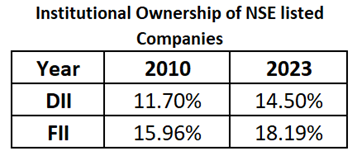

DII Ownership Trends Over Time

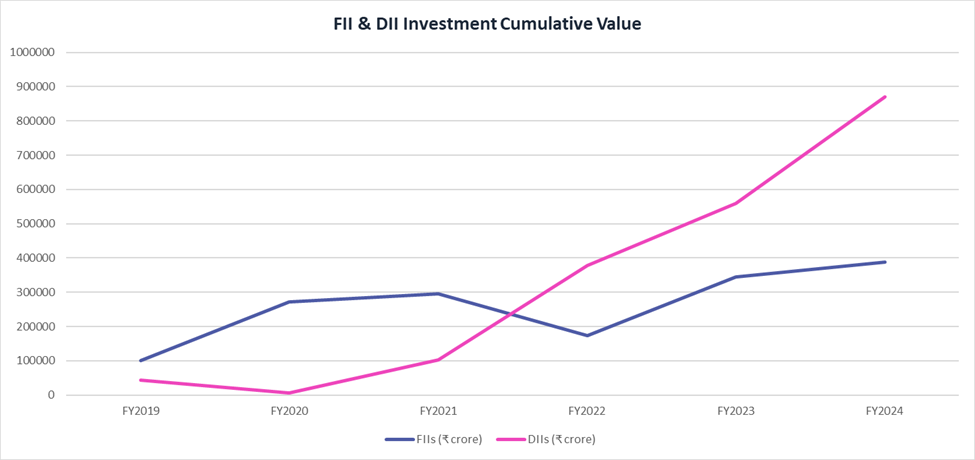

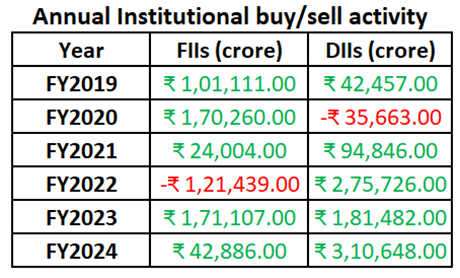

Domestic Institutional Investors (DIIs) have increasingly become influential players in the Indian stock market. Their growing presence is reflected in the ownership trends of companies listed on the National Stock Exchange (NSE). DIIs have steadily increased their ownership in NSE-listed companies.The consistent inflows from DIIs, totaling ₹8.7 lakh crore, alongside FII investments of ₹3.9 lakh crore over past 5 years have propelled the Nifty50 and BSE Sensex to new all-time highs.

Investment Inflows

From 2019, Domestic Institutional Investors have consistently injected capital into the market, counterbalancing the often volatile movements of Foreign Institutional Investors (FIIs). The consistent inflows from DIIs, totaling ₹8.7 lakh crore, alongside FII investments of ₹3.9 lakh crore over past 5 years have propelled the Nifty 50 and BSE Sensex to new all-time highs.

As of December 2023, DIIs held 15.96% ownership, up from 11.70% in March 2010. This growth highlights their expanding role in the market.

Growing Confidence of Retail Investors due to DIIs

The Indian stock market is witnessing a transformative shift. A decade ago, movements by Foreign Institutional Investors (FIIs) significantly impacted domestic markets. Today, the narrative is changing as the DIIs have significantly made their investments consistently and also absorbed the hard blows due to changing economic and geopolitical scenarios across the globe. This has built immense confidence particularly in the retail investors, as the Domestic Institutional Investors (DIIs), gain prominence.

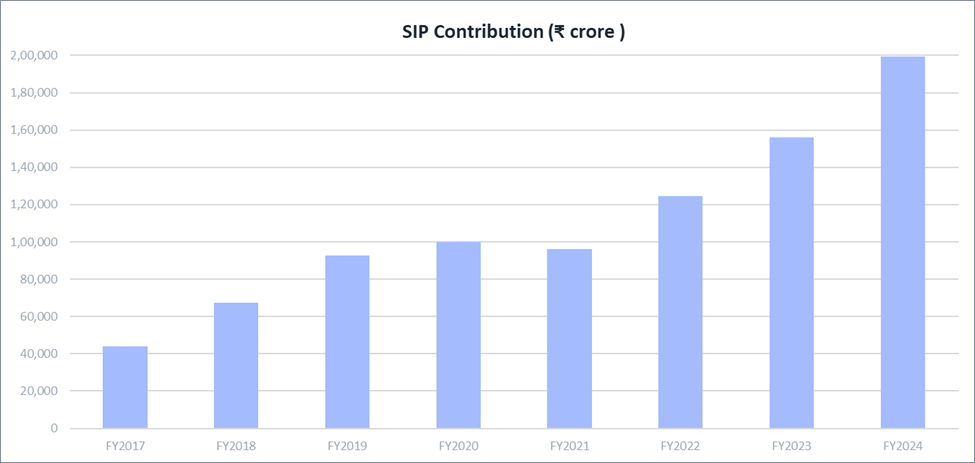

Retail investors have shown remarkable resilience and confidence. SEBI data highlights a sevenfold increase in demat accounts from 2 crore in FY13 to 14.8 crore by February 2024. This growth continued even through challenges like COVID-19. SIPs have emerged as a preferred route for individual investors to engage in the equity markets. Despite a dip in 2020, when many investors shifted to direct market participation, SIP inflows have been on a steady rise. In FY24, average monthly inflows through SIPs reached ₹16,602 crore, marking a 27.7% increase from ₹12,998 crore in FY23. This growth underscores the increasing confidence of investors in mutual funds as a viable investment vehicle.

While FIIs remain influential, the increasing share of DIIs and retail investors helps shield the market from external events. In April 2022, the Finance minister Nirmala Sitharaman brushed aside concerns over outflow of ₹1.14 lakh crore from the Indian equity market and said that retail investors can absorb any shock induced on account of exit of foreign institutional investors and foreign portfolio investors, as she says, “FIIs and FPIs would come and go. But today Indian retail investors have proven that even if they come and go, any shock that may come in is now taken care of because of the shock-absorbing capacity that the Indian retailers have brought into the market”. This exemplifies the profound trust DIIs have cultivated among retail investors in the capital market.

Looking Ahead

The continued growth and diversification of DIIs - including mutual funds, insurance companies, pension funds, and banks - promises to further strengthen India's financial markets. Their long-term investment approach, coupled with professional management and macroeconomic outlook, positions DIIs as key drivers of sustainable market growth and stability in the years to come.

As India's economy continues to expand and mature, the role of DIIs is likely to become even more crucial in shaping the country's future capital market.