Introduction

Money might make the world go round, but how much of it is out there and in what form? From crisp banknotes in your wallet to the invisible trillions moving through electronic payment systems every second, currency in circulation is both a tangible economic measure and a window into how modern finance operates.

This blog explores the scale, composition, and evolution of global currency in circulation, how it’s measured, and what the future might hold as digital payments rise and central bank digital currencies (CBDCs) loom on the horizon.

What Is “Currency in Circulation”?

Currency in circulation refers to the total value of physical banknotes and coins issued by a country’s monetary authority that are currently held by the public, outside of the vaults of banks and central banks.

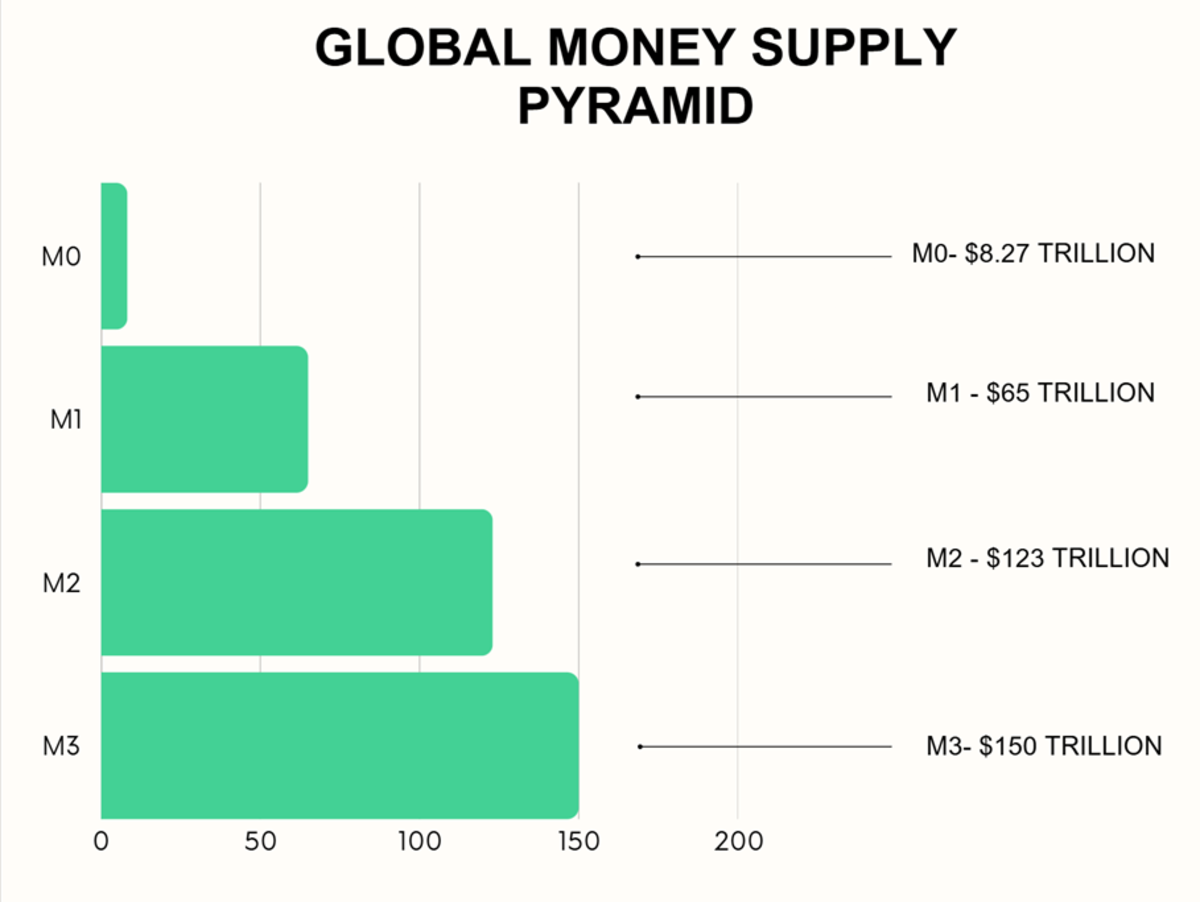

It’s a component of the broader money supply and is often called M0 (or the “monetary base”). However, globally, we often look beyond M0 to include broader aggregates, such as M1 and M2, which capture the true liquidity in an economy. The broader definitions include:

M0: Physical currency in circulation (banknotes + coins).

M1: M0 + demand deposits (checking/current accounts).

M2: M1 + savings deposits, small time deposits, and retail money market funds.

M3: M2 + large time deposits, institutional funds, and other broader liquidity.

When discussing global currency in circulation, it's crucial to include all layers: central bank money, commercial bank-created money, and increasingly, digital and crypto-assets.

The jump from M0 to M2 is a reminder that most “money” doesn’t exist in physical form; it’s stored digitally in accounts and moves through payment networks.

Recommended for you

Readers also explored

Annual Report 2026

India’s Unemployment Rate in 2025

Timeline: The Journey of Currency in the Last 100+ Years

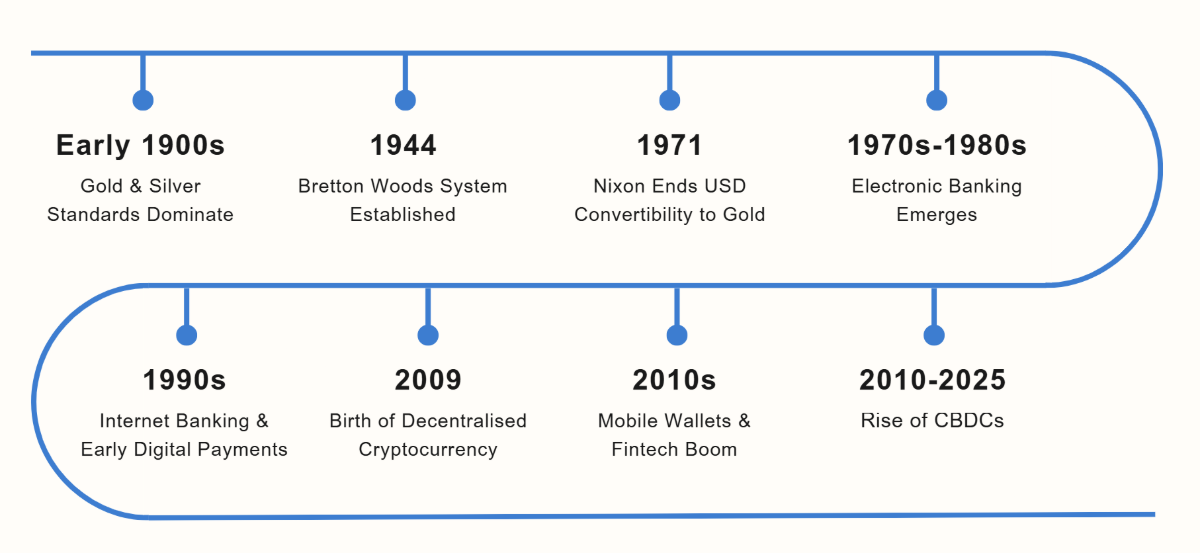

The past century has witnessed a remarkable evolution in currency—from predominantly physical cash to the dawn of digital finance. Early 20th-century economies relied almost exclusively on coins and banknotes, with currencies pegged to gold or silver standards.

Throughout the century, the global monetary system grew increasingly complex with the Bretton Woods system, international reserve currencies, and the rise of central banks’ roles in monetary policy.

The rapid adoption of the internet and mobile technology in the late 20th and early 21st centuries ushered in digital payments, e-wallets, and mobile money platforms, particularly in emerging economies where traditional infrastructure was lagging. The launch of cryptocurrencies in 2009 marked a groundbreaking innovation, offering decentralised digital money outside government control.

Thus, the journey of currency over the last century is a story of shifting from tangible physical money to intangible digital forms—transforming how individuals, businesses, and nations transact, save, and invest.

Global Currencies: A Snapshot of Circulation

As of 2025, the total value of physical currency in circulation worldwide stands at roughly $8.27 trillion. This figure represents all coins and banknotes actively used in transactions or held as a store of value, excluding the vast sums kept in digital form in bank accounts. In monetary terms, it corresponds to the M0 money supply — the most liquid and tangible form of money.

Breaking Down the Global Currency Landscape

The lion’s share of this $8.27 trillion is concentrated in a handful of major global currencies:

Data as of 2024.

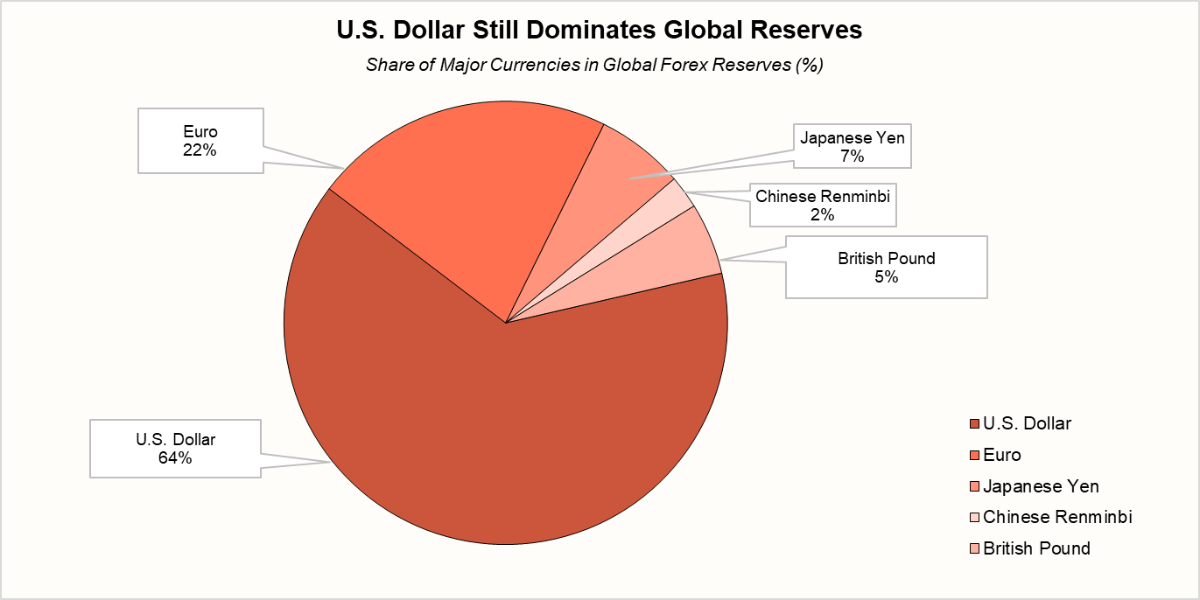

The undisputed champion, the US Dollar, continues its reign. Its physical currency in circulation has ballooned from $719.9 billion in 2004 to a staggering $2,322.9 billion in 2024, with the humble $100 bill accounting for the lion's share. Beyond physical cash, the broader M2 money supply in the U.S. saw an unprecedented 27% surge between 2020 and 2021, reaching over $22 trillion by March 2025 – a jump surpassing even wartime increases.

Across the Atlantic, the Euro stands as a pillar of European monetary unity. As of June 2025, over 30.4 billion euro banknotes, valued at around €1.6 trillion, were actively circulating. The Euro Area's M2 money supply also shows robust health, hitting €15.74 trillion in May 2025.

Meanwhile, the Japanese Yen maintains its steady presence. Japan's currency in circulation reached ¥110.97 trillion in June 2025, experiencing a slight dip from previous periods but remaining a significant global currency. The Bank of Japan (BOJ) diligently oversees its issuance. The nation's M2 money supply also reflects consistent, albeit slower, growth, recorded at ¥1.268 quadrillion in June 2025.

Then there's the Chinese Yuan, a rapidly ascending force. China's cash in circulation (M0) hit 10.47 trillion yuan by the end of 2022. But here's the game-changer: China has strategically integrated its digital yuan (e-CNY) into these M0 statistics. By late 2022, 13.61 billion digital yuan were circulating, a clear signal of China's forward-looking approach to a hybrid physical-digital monetary system. China's M2 money supply is truly colossal, reaching 330.29 trillion CNY in June 2025, equivalent to over $45 trillion.

Finally, the British Pound continues to navigate the global currents. The Bank of England issues four denominations (£5, £10, £20, £50). The UK's physical currency in circulation stood at £92.58 billion in June 2025, showing a healthy year-on-year increase. The broader UK M2 money supply also saw growth, reaching £3.123 trillion in June 2025.

Major Global Currencies: Physical Circulation vs. M2 Money Supply

| Currency Name | Issuing Central Bank | Latest Physical Currency in Circulation (Local Currency) | Latest M2 Money Supply (Local Currency) | Data as of |

|---|---|---|---|---|

| US Dollar | Federal Reserve | $23 trillion | $22 trillion | Jun 2025 (M2), 2024 (M0) |

| Euro | European Central Bank | €1.6 trillion | €15.74 trillion | May 2025 (M2), Jun 2025 (M0) |

| Japanese Yen | Bank of Japan | ¥111.26 trillion | ¥1.27 quadrillion | Jul 2025 |

| Chinese Yuan | People's Bank of China | ¥10.47 trillion* | ¥330.29 trillion | Jun 2025 (M2), Dec 2022 (M0) |

| British Pound | Bank of England | £92.58 billion | £3.123 trillion | Jun 2025 |

*China’s M0 statistics also include the circulation of its digital currency (e-CNY)

Despite the rapid rise of digital payments, physical cash continues to grow in value across these major economies. Cash offers anonymity, accessibility, and serves as a reliable store of value during crises. It also plays an essential role in the informal economy and in regions where digital banking still depends on cash-in/cash-out networks. The persistence of cash alongside emerging state-backed digital currencies like China’s e-CNY paints a complex, evolving picture of how money circulates in the modern world.

The Digital Revolution: Cryptocurrencies and Central Bank Digital Currencies (CBDCs)

The evolution of money is increasingly digital. While physical cash (M0) still underpins day-to-day transactions, the rapid rise of cryptocurrencies and central bank digital currencies (CBDCs) is reshaping the global currency landscape. These instruments extend the concept of money beyond physical and traditional bank deposits, offering programmable, borderless, and in some cases, state-controlled alternatives.

1. The Scale of Cryptocurrency Circulation

Over the last decade, the world has witnessed the rapid emergence of a new kind of money — one that exists entirely in the digital realm, operates without a central bank, and challenges the very foundations of traditional monetary systems.

What began in 2009 as an experimental asset with the launch of Bitcoin has, by August 2025, evolved into a $4.11 trillion global cryptocurrency market, fundamentally reshaping how we think about money, value transfer, and financial sovereignty. Bitcoin alone commands a market capitalisation of $2.39 trillion, representing nearly 59% of the total crypto market, while Ethereum follows with $566.7 billion.

More than speculative bubbles, cryptocurrencies—particularly stablecoins such as Tether (USDT) and USD Coin (USDC) are becoming digital cash. USDT alone stands at roughly $164 billion in circulation, with stablecoins frequently constituting over 50% of on-chain transaction volumes, cementing their status as the crypto ecosystem’s liquidity backbone.

Government Adoption and Integration of Cryptocurrency

Globally, governments are beginning to acknowledge cryptocurrency’s potential — not just as an alternative asset, but as a strategic tool for reserves, payments, and economic resilience.

- United States – In a landmark move, President Trump has signed an executive order to establish a strategic Bitcoin reserve, framing it as a hedge against economic uncertainty.

- Russia – Uses cryptocurrency for trade settlements to bypass sanctions and facilitate cross-border commerce.

- Brazil – Allows government employees to receive salaries in cryptocurrency, signalling mainstream adoption.

- El Salvador & Central African Republic – Have declared Bitcoin legal tender, aiming to improve financial inclusion and reduce reliance on traditional banking.

As more states experiment with crypto integration, the world is seeing a gradual policy shift — some nations adopting crypto-friendly stances, others developing tightly regulated frameworks for digital assets.

Top Countries Holding Bitcoin

| Country | BTC Holdings | Value (USD) |

|---|---|---|

| United States | 198,012 | $21.2B |

| China | 190,000 | $20.35B |

| United Kingdom | 61,245 | $6.56B |

| Ukraine | 46,351 | $4.96B |

| Bhutan | 12,062 | $1.29B |

| El Salvador | 6,209 | $664.74M |

Cryptocurrency in Cross-Border Payments

Perhaps crypto’s most immediate and transformative impact lies in reducing the cost and time of cross-border transactions. Traditional remittance corridors often charge 6–12% fees for small transfers and can take days to settle. In contrast, crypto-based remittances such as those handled between the U.S. and Mexico on platforms like Bitso - are completed in minutes with costs under 1%.

For millions in the developing world, this speed and affordability mean greater access to financial services without reliance on slow, expensive intermediaries.

2. Central Bank Digital Currencies: The Next Frontier

In response to the rise of private digital currencies and the broader digitalisation of finance, central banks worldwide are actively exploring and developing their own Central Bank Digital Currencies (CBDCs). Currently, 130 countries are actively exploring CBDC implementation, with 87 countries representing over 90% of global GDP engaged in development efforts. Three countries—the Bahamas, Jamaica, and Nigeria—have already launched fully functional CBDCs, while numerous others are conducting advanced pilot programs.

In India, the digital rupee circulation has grown dramatically to ₹10.16 billion ($122 million) by March 2025, representing over 300% annual growth. China continues to expand its digital yuan trials, while the European Central Bank advances development of the digital euro, and other major economies prepare their own digital currency initiatives.

CBDCs in Circulation

| CBDC Name & Country | Status | Technology Type | Year Launched / Pilot Start | Reserve Adoption Potential |

|---|---|---|---|---|

| Sand Dollar (Bahamas) | Fully launched | Account-based | 2020 | Low- small economy |

| JAM-DEX (Jamaica) | Fully launched | Token-based | 2022 | Low- domestic focus |

| eNaira (Nigeria) | Fully launched; undergoing upgrades | Account-based | 2021 | Low- domestic focus, but potential regional role in West Africa |

| e-CNY (China) | Pilot in 25+ cities | Account-based | 2020 | High - strong domestic use, potential cross-border use via Belt & Road |

| Digital Rupee (India) | Pilot phase (retail & wholesale) | Token-based | 2022 | Medium- focus on domestic settlement |

| Digital Euro (ECB) | Pilot phase | Hybrid | Expected 2028 | High- tied to euro’s reserve currency status |

The Future of Currency in Circulation

Looking ahead, currency circulation is set to embrace a hybrid future blending physical, digital, and programmable money. Physical cash will continue to serve vital roles in economies valuing privacy, informal trade, and financial inclusion. However, its share of total money supply will likely decline in advanced economies as digital payment adoption deepens.

Central Bank Digital Currencies (CBDCs) are poised to redefine currency circulation by offering government-backed digital money with instantaneous settlement, enhanced traceability, and reduced transaction costs. Their integration will reshape monetary policy frameworks and financial stability paradigms.

Cryptocurrencies and stablecoins are expected to coexist and interact with fiat systems, introducing programmable money features and supporting decentralised finance applications, potentially broadening access to financial services.

Global currency will thus evolve into a diverse ecosystem, balancing innovation with security, privacy, and inclusion considerations, marking new frontiers for monetary systems into the late 21st century.

Conclusion

The global currency system has transformed dramatically over the past century—from the dominance of physical money to an increasingly complex weave of digital, decentralised, and programmable forms. As of 2025, trillions of dollars in physical cash circulate worldwide alongside rapidly growing digital currencies, CBDCs, and cryptocurrencies, reflecting diverse needs for accessibility, security, and control.

Major fiat currencies like the US dollar, euro, yen, and yuan continue to anchor the system, supported by expanding digital payment infrastructures and emerging CBDC initiatives. Cryptocurrencies add a new decentralised layer, broadening the concept of money itself.

Looking forward, currency will not be confined to one form but will flourish as a multifaceted ecosystem balancing innovation with trust, privacy with transparency, and tradition with technology.