“The balance of trade, a key component of the balance of payments, reflects the difference between a nation's imports and exports.”

What is Balance of Trade?

The flow of goods and services out of a country constitutes its exports, while the inflow of goods and services from other nations is referred to as imports. To put it more simply, exports are things or services we sell to other countries. Imports are things or services we buy from them. The Balance of Trade is simply the difference between our sales and our purchases.

How is Balance of Trade Calculated?

BOT = Exports - Imports

For instance, if a country exports $100 million worth of goods and services and imports $80 million, its BOT is a surplus of $20 million.

Importance of Considering both Goods and Services in Calculations

To accurately assess a nation's economic interaction with the global market, it's essential to consider the exchange of tangible goods that are produced and consumed across borders. Also, in today's interconnected world, services like tourism, finance, and technology play a crucial role in international trade. Ignoring these services would lead to an incomplete and misleading picture of a country's trade balance.

Three Types of Balance of Trade

- Trade surplus: When a country's exports are greater than its imports.

- Trade deficit: When a country's imports are greater than its exports.

- Balanced trade: When a country's exports and imports are roughly equal.

Recommended for you

Readers also explored

India’s Services Exports

Currency in Circulation: How Much Money Exists in the World?

Countries with Trade Surplus and Trade Deficits

In November 2024, India's trade deficit hit a record high, widening significantly compared to the previous year. Exports dropped while imports surged. China, on the other hand, saw its trade surplus soar to a 26-month high, driven by strong exports despite weaker domestic demand. The US trade deficit narrowed slightly, with both imports and exports declining. Japan's trade deficit shrank, but not as much as expected, due to stronger export growth. Finally, the UK's trade deficit widened in October, with imports increasing faster than exports.

Trade Surplus vs Trade Deficit

1) Advantages of Trade Surplus.

When a country sells more goods and services to other countries than it buys from them, it is called trade surplus. Why is trade surplus important?

- It can boost the economy by creating jobs and stimulating production.

- It can also help stabilize the currency and build up foreign exchange reserves, which can be a safety net during tough times.

- Additionally, a trade surplus can improve a country's creditworthiness and attract foreign investment, further fueling economic growth.

Germany is often cited as a country that has benefited from a trade surplus. Their strong manufacturing sector, known for high-quality goods like cars and machinery, has driven exports. This has fueled economic growth and created a strong reserve of foreign currency.

2) Risks and Consequences of Long-Term Trade Deficits.

- Loss of jobs as companies move production overseas to cheaper places.

- The country's currency can become weaker, making imports pricier and hurting the economy.

- To pay for all those imports, the country might have to borrow a lot of money from other countries, which can become a big problem later on.

- Economic growth can slow down because there's less money for businesses to invest and innovate at home. And in some cases, relying too much on imports for important things like energy or weapons can create security risks.

The US in the late 20th and early 21st centuries experienced significant trade deficits. While this fueled consumer spending and economic growth in the short term, it also contributed to job losses in manufacturing, a decline in US manufacturing competitiveness, and a growing national debt.

Key Factors Influencing Balance of Trade

- Currency Exchange Rates: If a country imports more than it exports, its currency might lose value compared to other currencies. This can make imports more expensive, but it can also make exports cheaper, which can help boost exports and reduce the deficit.

- Domestic Production Capacity: When a country produces enough goods locally, it can reduce imports and boost exports, improving the trade balance. But if production is low, reliance on imports increases, which can hurt the balance.

- Global Demand: High global demand for a country's products can drive exports up, improving the trade balance. On the flip side, if demand drops, exports fall, and the trade balance might take a hit.

- Government Policies: Policies like export subsidies, trade agreements, or infrastructure improvements can boost exports and help the trade balance. However, high tariffs, protectionist measures, or inefficient regulations can backfire, limiting trade opportunities.

India’s Balance of Trade: Historical Context

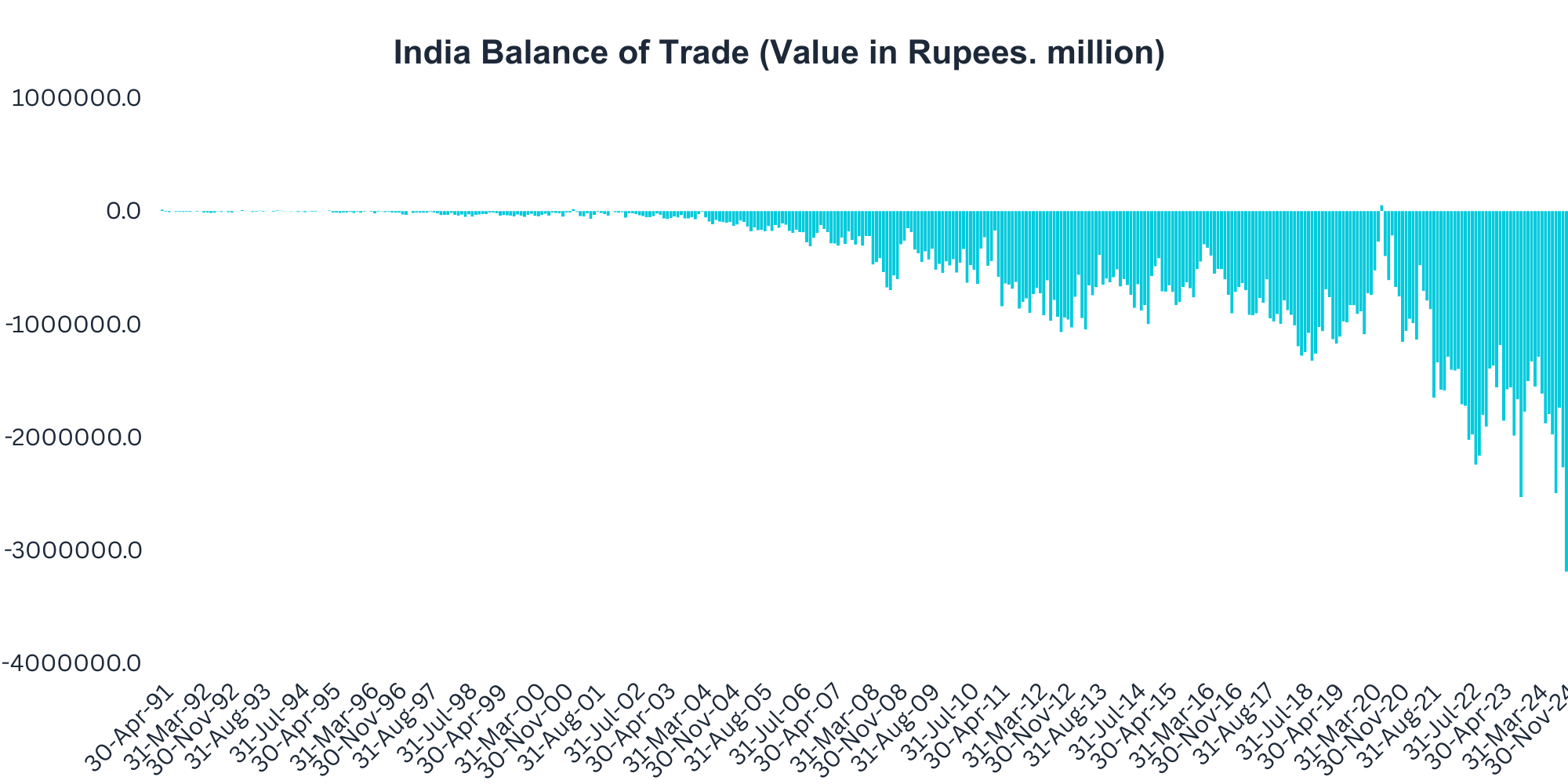

The chart displays the India Balance of Trade in Rupees (million) from approximately 1990 to 2024. The chart shows a predominantly negative balance of trade throughout the period, with significant fluctuations. There are periods of improvement, but overall, the trend is towards a larger and larger trade deficit. While a trade deficit can offer short-term benefits, a trade surplus is generally more favorable for long-term economic health.

In June 2020, something pretty interesting happened: India saw a trade surplus for the first time in 18 years! Here's why: Imports took a big hit due to the pandemic, while exports held up better. The Indian government also took some steps to boost exports, like making it easier for certain companies to do business here and offering more incentives to exporters. These moves, along with policies aimed at promoting exports in areas like agriculture and services, likely played a role in this positive trade balance.

Policies that have contributed to India’s Trade Dynamics:

- Foreign Direct Investment (FDI) policy

- Merchandise Exports from India Scheme (MEIS)

- Service Exports from India Scheme (SEIS)

- Duty Credit Scrips

- PLI schemes

- Agri-Cells

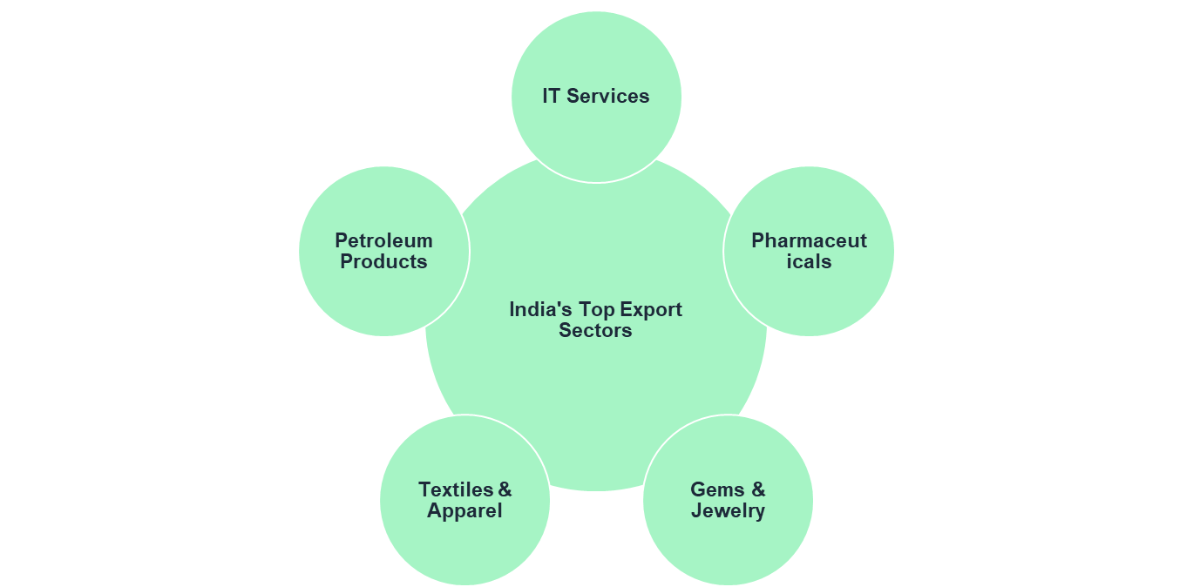

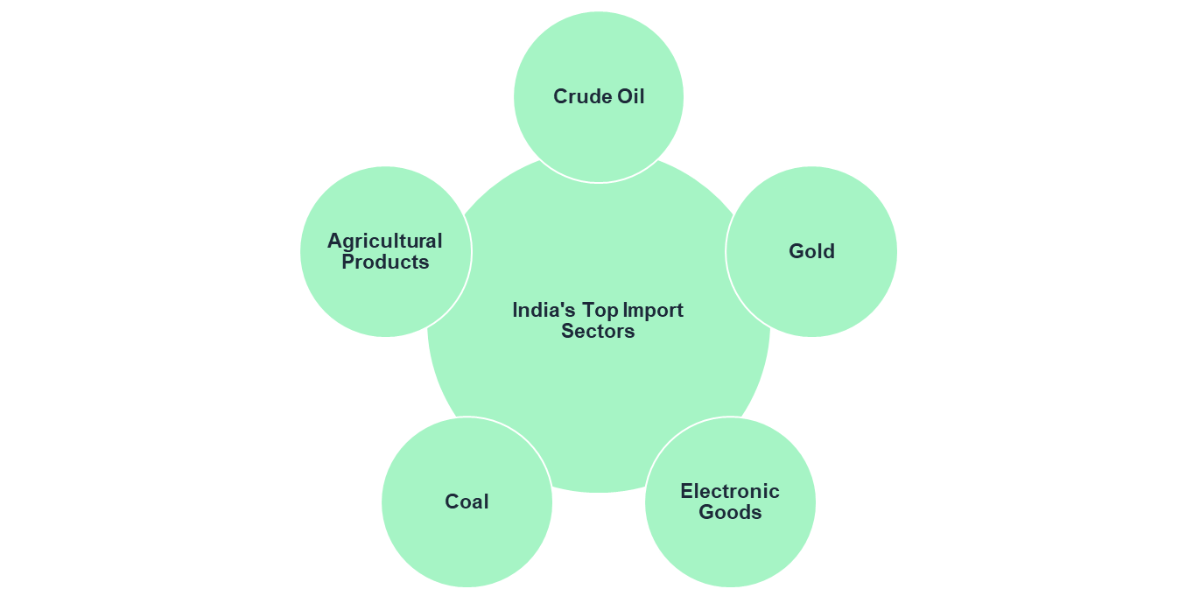

India’s Major Export and Import Sectors

How the pandemic disrupted global supply chains and trade

There has been a significant variation in the impact of the COVID-19 pandemic on trade across different regions and country groupings. Most regions experienced a decline in trade in 2020, but most recovered by 2021, with trade values often surpassing pre-pandemic levels.

The recovery path and changes in trade patterns post-COVID:

| East and South-East Asia | This region demonstrated a faster recovery compared to other regions, with trade values surpassing pre-pandemic levels in 2021. |

| Developing Countries | Developing countries, particularly those in Asia excluding East and Southeast Asia, and Africa, experienced a more severe impact on trade in 2020 and had slower recoveries. |

| Small Island Developing States | These states experienced a more pronounced decline in trade in 2020 and had a slower recovery compared to other regions. |

| Intraregional Trade | While global trade faced challenges, intraregional trade, particularly within East Asia, showed greater resilience during the pandemic. |

| Recovery Rates | The recovery rate varied significantly across regions. While some regions like East and Southeast Asia quickly surpassed pre-pandemic levels, others, like Africa, struggled to regain their pre-pandemic trade levels. |

India’s Future Trade Projections

Expected trade trends based on current policies and global shifts.

Policy Moves and Targets:

India is pushing for $2 trillion in exports by 2030, focusing on diversifying its export base and boosting global trade presence. Programs like the PLI scheme are driving growth in sectors like electronics and pharma.

Global Shifts:

Geopolitical tensions, like U.S.-China trade issues, are opening doors for India to become a manufacturing hub. New trade deals with the EU, UK, and Australia aim to expand market access.

Challenges:

High logistics costs and weak infrastructure still hurt competitiveness. Plus, despite "Aatmanirbhar Bharat," India remains reliant on imports for essentials like semiconductors.

Key sectors poised to drive future export growth.

- Electronics and Machinery: Electronics exports are surging, thanks to the PLI scheme and India's ambition to become a global manufacturing hub. Machinery exports are also climbing steadily, fueled by advanced tech investments.

- Pharmaceuticals and Biotech: India's expertise in generic drugs and growing biotech capabilities position these sectors for strong growth, bolstered by rising global demand for affordable healthcare.

- Services: IT and IT-enabled services continue to shine, with services exports set to grow over 10% in 2024, playing a big role in reaching the $2 trillion export goal.

- Renewable Energy: Investments in solar and wind tech are opening up fresh export opportunities, aligning with the global push for green energy.

- Traditional Sectors: Textiles and garments face tough competition and shrinking shares but still play a vital role in jobs and local economies.

Conclusion

So, what does this all mean? Basically, India's trade deficit is growing, meaning we're importing more than we're exporting. This is partly due to higher prices for things we import, like oil, and global supply chain issues. Plus, with the economy doing well, we're buying more stuff from other countries. This puts pressure on our currency and makes it harder for our own businesses to compete.

+_+Definition%2C+Challenges+and+Key+Factors.jpg)