Introduction

The global economy is a complex web of interconnected markets, with economic events in one region often having ripple effects across the world. For an emerging market like India that is increasingly integrated with the global financial system, understanding these diverse economic dynamics is crucial - not just at a macro level, but also in terms of how they impact the personal finances of individual investors. With its compelling growth story and favourable dynamics, India’s real GDP expanded by an impressive 8.4% year-on-year in the third quarter of FY 2023-24, surpassing expectations. The country's nominal GDP is estimated to reach ₹293.90 lakh crore (US$ 3.52 trillion) in 2023-24, a significant increase from ₹269.50 lakh crore (US$ 3.23 trillion) in the previous fiscal year.

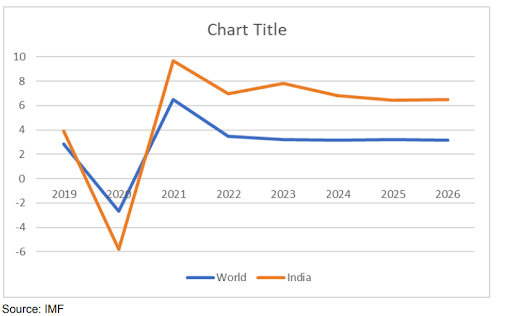

Source: IMF However, the global economic landscape remains challenging, with uneven growth and persistent inflation. The IMF projects global growth to remain at 3.2% in 2024. Inflation, though declining, is expected to remain above central bank targets in most major economies until the end of 2025. Understanding the implications of these global economic dynamics on your investment portfolios, asset allocation strategies, and overall financial well-being is crucial. Geopolitical tensions, such as the evolving conflict between Israel and Hamas, and the larger-than-expected impact of monetary policy tightening might pose downside risks to the near-term outlook. This blog post aims to provide a comprehensive analysis of the key global economic trends shaping FPI flows into India and their potential impact on the domestic investment landscape. By examining global growth prospects, India's evolving trade relations, and the interplay of domestic factors, we can make informed decisions in an ever-changing global economic environment.

Global Economic Trends

Source: IMF United States: The US economy is expected to face headwinds from rising consumer debt and elevated interest rates in 2024. While a recession is not forecasted, consumer spending growth is likely to cool, with overall GDP growth slowing to under 1% in Q2 and Q3 2024. The IMF projects US real GDP growth to be 2.7% in 2024, before moderating to 1.9% in 2025. European Union: Europe's economy has hardly grown in 2023, with mild technical recessions unfolding in the eurozone and UK. The IMF projects eurozone growth to pick up to 1.1% in 2024 and 1.8% in 2025, contingent on substantial rate cuts. However, the economic impact of the war

in Ukraine continues to pose challenges, with the EU facing additional costs of €175 billion in 2022. China: China's growth is forecast to decelerate from 5.2% in 2023 to 4.6% in 2024 and 4% in 2025, as the reopening boost fades and the property sector crisis, triggered by overbuilding and debt limits imposed on major developers by the government deepens. Moreover, doubts about the efficacy of policy easing impart downside risks.

Other Advanced Economies:

Growth prospects vary among other advanced economies. Norway and Denmark are expected to maintain steady growth, with Norway's GDP projected to expand by 2% in 2025. Singapore and South Korea are poised for robust growth, with Singapore's economy forecast to grow by 2.3% in 2025. However, Australia and New Zealand face headwinds, with Australia's GDP growth expected to moderate to 1.6% in 2024 and 2% in 2025. The divergent growth trajectories across regions significantly impact the global economic landscape, shaping international trade, investment flows, and geopolitical relationships, and influence India's evolving trade relations and economic partnerships

India's Trade Relations

India's trade relations and economic partnerships play a crucial role in shaping the country's growth prospects and investment attractiveness amidst shifting global dynamics. The government has been actively pursuing trade agreements and launching initiatives to diversify exports, facilitate market access, and strengthen strategic ties with key partners.

Bilateral and Multilateral Trade Agreements

India has been proactively engaging in bilateral and multilateral trade agreements to boost exports and enhance market access. As of April 2024, India has 13 Free Trade Agreements (FTAs) and 6 Preferential Trade Agreements (PTAs) in force. The India-UAE CEPA and India-Australia ECTA are expected to significantly increase bilateral trade in the coming years. India's FTA negotiations with the EU and the UK are also at an advanced stage, aiming to further expand trade and investment ties.

Attracting Foreign Direct Investment (FDI)

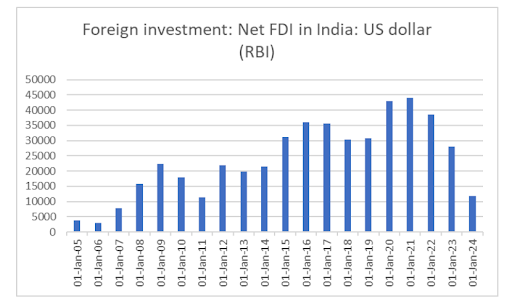

Despite the global challenges, India continues to be a promising destination for foreign direct investment, albeit with some recent setbacks. In FY 2022-23, India received net FDI inflows of US$ 28.0 billion, a 16% decrease from the previous fiscal year's US$ 33.4 billion. The government has liberalised FDI norms in several sectors and launched initiatives like the National Single Window System to facilitate ease of doing business. The development of industrial corridors and logistics infrastructure is also expected to boost manufacturing and attract FDI.

Strategic Economic Partnerships

India has been enhancing its strategic and economic ties with various countries:

- United States, Japan, and Australia: Quad partnership for Indo-Pacific engagement. In March 2021, the Quad leaders launched a Vaccine Partnership to expand manufacturing capacity in India, aiming to deliver 1 billion doses by the end of 2022.

- France: Growing bilateral relations focusing on strategic interests and economic cooperation. In 2023-24, bilateral trade reached €15.2 billion, with over 1,200 French companies operating in India and employing more than 400,000 people.

- United Kingdom: Strengthening ties post-Brexit, leveraging the Indo-Pacific framework. The UK-India trade deal, finalised in November 2023, led to a substantial increase in bilateral trade, reaching £60 billion in 2023-24.

- Germany: Engaging in trade, investment, and technology collaboration. In 2023-24, bilateral trade stood at €28 billion, with over 2,000 German companies active in India, employing around 700,000 people.

- Israel: Deepening economic partnership in areas like agriculture, water management, and innovation. Bilateral trade reached $8.5 billion in 2023, putting them on track to achieve the target of $10 billion by 2025.

- Saudi Arabia and other Gulf countries: Expanding cooperation in energy, trade, and investments. In 2023-24, India's trade with GCC countries grew to $175 billion, with the UAE and Saudi Arabia remaining the third and fourth largest trading partners, respectively.

- Singapore and other ASEAN countries: Collaborating for regional connectivity and supply chain resilience. In 2023-24, India-ASEAN trade reached $90 billion, with Singapore, Indonesia, and Malaysia being the top trading partners. While global headwinds persist, India's strong domestic growth drivers and proactive trade liberalisation efforts are likely to enhance its investment attractiveness in the long run.

Impact on the Indian Economy

The global economic dynamics and India's evolving trade relations have significant implications for the foreign investor sentiments, domestic economy and personal finance. Understanding these interconnections is crucial to make informed decisions about investment portfolios, asset allocation strategies, and overall financial well-being.

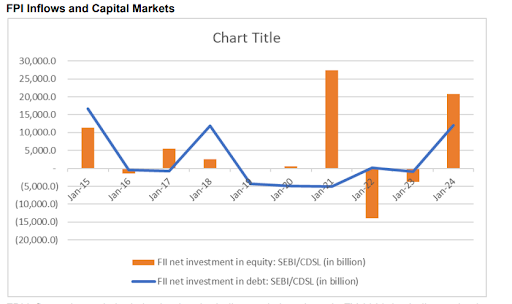

FPI Inflows and Capital Markets

FPI inflows play a vital role in shaping the Indian capital markets. In FY 2023-24, India received a record ₹3.33 lakh crore in FPI inflows across equities, debt, and hybrid instruments, surpassing the previous high of ₹2.67 lakh crore in FY21. Equity inflows alone stood at over ₹2 lakh crore, second only to Japan among Asian markets. In India's debt market, FPI investments witnessed an inflow of over ₹1.2 trillion in fiscal year FY2024, the highest since FY2018. This surge in FPI inflows into the debt market gained momentum from October 2023, following the announcement of Indian bonds' inclusion in various international bond indices, including JP Morgan's widely-tracked Government Bond Index-Emerging Markets (GBI-EM).

Recommended for you

Readers also explored

Inflation Concerns and Interest Rate Outlook

India's IT Sector Outlook for FY2026

Domestic Growth Drivers and Sectoral Opportunities

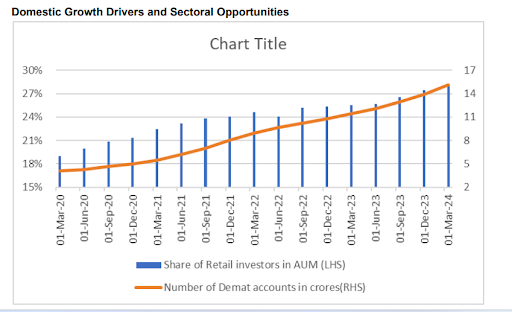

The growing interest of retail investors in the Indian equity markets has become a notable factor contributing to domestic equity markets growth. The number of demat accounts in India has surged from around 4 crores in March 2020 to excess of 15 crores in March 2024. The retail investor's share in net AUM, has surged from 19% in March 2020 to 28% in March 2024. The growing investor awareness and financial education have been instrumental in this shift. Sectors like infrastructure, consumer durables, automobiles, and retail are likely to benefit from the government's initiatives and the rising middle class. For instance, the National Infrastructure Pipeline, with a projected investment of ₹111 lakh crore between FY 2020-25, could boost sectors like cement, steel, and engineering. Similarly, the rising disposable incomes and growing consumer base could drive growth in sectors like consumer durables, automobiles, and retail.

Currency Dynamics and International Investments

The Indian rupee's exchange rate and the country's external sector position also have implications for personal finance, particularly for investors with exposure to international investments. In FY23, the rupee depreciated by 10% against the US dollar, driven by factors like the widening trade deficit, FPI outflows, and the strengthening dollar. This depreciation can impact the returns on foreign investments, as well as the cost of foreign education and travel. However, India's foreign exchange reserves remain robust at $588 billion as of April 2023, providing a cushion against external shocks. Moreover, the government's efforts to promote exports and attract FDI through initiatives like the PLI schemes could help improve the country's external sector position in the long run.

Implications for Personal Finance

The global economic dynamics and India's evolving trade relations have significant implications for the domestic economy and personal finance. As an individual investor, understanding these interconnections is crucial to make informed decisions about your investment portfolio, asset allocation strategies, and overall financial well-being. Diversification and Risk Management The volatility in FPI flows highlights the importance of maintaining a well-diversified investment portfolio. To mitigate the impact of global headwinds on personal finances, investors should:

- Allocate assets across various classes such as equities, bonds, real estate, and alternative investments.

- Diversify within each asset class, investing in different sectors, market capitalisations, and investment styles.

- Utilise systematic investment plans (SIPs) to invest in equity mutual funds, which can help navigate market volatility. Capitalising on India's Growth Story To benefit from India's long-term growth prospects, driven by increasing domestic retail investor participation and steady FDI inflows, investors should:

- Invest in sectors that are likely to benefit from government initiatives, such as infrastructure and manufacturing.

- Invest in companies with strong fundamentals, sustainable competitive advantages, and robust growth prospects.

- Consider investing in small and mid-cap funds that may offer higher growth potential, while being mindful of the associated risks. Managing Currency and Inflation Risks To effectively manage currency and inflation risks in the current global economic landscape, investors should:

- Managing Currency and Inflation Risks

- To effectively manage currency and inflation risks in the current global economic landscape, investors should:

- Invest in currency-hedged international funds or ETFs to mitigate the impact of currency fluctuations on foreign investments.

- Allocate a portion of the portfolio to assets that tend to perform well during inflationary periods, such as real estate, commodities, and value stocks.

- Monitor changes in interest rates and adjust your debt portfolio's duration accordingly, as rising interest rates can negatively impact bond prices. By implementing these strategies and seeking timely professional advice, investors can navigate the complexities of the global economic landscape and work towards achieving their long-term financial goals while managing risks effectively.

Conclusion

The global economic landscape is undergoing significant shifts, with divergent growth trajectories across regions, evolving trade relations, and changing investor sentiments. As an individual investor navigating this complex terrain, staying informed about these trends and understanding their implications for your personal finances is crucial. India's strong domestic growth drivers, favourable demographics, and proactive policy initiatives continue to attract foreign portfolio investors, despite global headwinds. However, the volatility in FPI flows underscores the need for a well-diversified investment portfolio that can withstand short-term fluctuations. The increasing participation of domestic retail investors in the Indian equity markets and the steady inflow of foreign direct investment provide a strong foundation for India's long-term growth. As an investor, aligning your investments with sectors poised to benefit from the government's initiatives and rising consumer demand can help you capitalise on the India growth story. While navigating the complexities of the global economic landscape, it is essential to consider the impact of currency dynamics, inflation, and interest rates on your investment portfolio and overall financial well-being. Seeking professional advice from qualified financial advisors can help you make informed decisions, align your investment strategy with your long-term goals, and build a resilient financial plan. In an ever-changing global economic environment, staying attuned to the interconnectedness of markets, maintaining a well-diversified portfolio, and regularly reviewing your financial plan are key to achieving your financial objectives. By proactively managing your personal finances and adapting to the shifting economic tides, you can chart a course towards financial success and secure your long-term financial future.