Introduction

The modern global financial ecosystem is too intertwined for equity markets to function independently, and many external factors significantly influence them. For market aficionados and seasoned investors, the ability to decode the intricacies of the global economy’s impact on domestic equity markets is more crucial than ever. With its rapidly expanding economy and changing market environment, India is positioned at the intersection of these global forces.

Picture the global economy as a vast ocean, where all waves—from geopolitical shifts to technological breakthroughs—send ripples out to all the shores. India's equity markets are especially vulnerable to these turbulences, with its rapidly expanding economy and dynamic market landscape. Hence, India finds itself at the confluence of these powerful global currents.

Historical Evidences

The global financial crisis of 2008-2009 serves as a stark reminder of India's vulnerability to global economic shocks. The collapse of Lehman Brothers which filed for bankruptcy on September 15, 2008, triggered a chain reaction, resulting in widespread fear and anxiety among investors worldwide. This crisis sent shockwaves across Indian markets, leading to:

- A severe stock market decline (38.0% fall) between 15 September and 27 October, 2008 was triggered by massive $3.4 billion net withdrawals by Foreign Portfolio Investors (FPIs) during the same period

- A plummeting rupee against the US dollar (depreciated by 9.0% between 15 September and 27 October) caused a surge in import prices and inflationary pressures

- A sharp contraction in exports by -18.4% between October 2008 and September 2009

- A dramatic decline in real GDP growth from 10.6% in Q3FY08 to a mere 0.2% in Q4FY09

- A surge in unemployment rates to 8.0% during 2007-08

This episode underscores the far-reaching impact of global financial turmoil on India's economy and equity markets.

Global Economic Overview and India’s Position

According to the International Monetary Fund (IMF), global growth is projected to remain stable at 3.2% in 2024 and 3.3% in 2025, rebounding from a historic low of -2.8% in 2020 following the Covid-19 pandemic. This resilience is notable as the world economy has avoided recession, despite geopolitical challenges such as the Russia-Ukraine war, which caused a global energy crisis initially and high inflation. India's economy too has shown remarkable strength in the face of global challenges, solidifying its position as a major economic force in the global economy. However, the global economic recovery remains uneven, with several economies still experiencing significantly slower growth or recession. Argentina's economy is contracting (-2.8%), while the United Kingdom is struggling with a mere 0.5% growth. The Netherlands (0.6%) and Belgium (1.2%) are also facing sluggish growth. This divergence underscores the varying impacts of global economic conditions, with some countries unable to keep pace with the broader global recovery.

As per RBI’s projections, India is expected to grow by 7.2% in FY2025, after an impressive 8.2% real GDP growth in FY2024. India's strong rebound from the 5.8% contraction in FY2021 following the Covid-19 pandemic underscores its robust trajectory. The Nifty 50 index's 25.7% gain as of July 2024 YoY also reflects investor confidence, highlighting India's adaptability to global conditions.

Recommended for you

Readers also explored

India's IT Sector Outlook for FY2026

India’s Unemployment Rate in 2025

Global Macroeconomic Factors Affecting Indian Equity Markets

While India has demonstrated remarkable economic flexibility, it is still interconnected with the global economy and vulnerable to external headwinds. Despite India's rapidly growing economy it remains susceptible to unfavourable global economic trends and cannot fully insulate itself from their effects that can impact its growth trajectory, inflation, interest rates, and investor sentiments. The historical data suggests that equity markets are affected more by the changes in the market’s expectations of the future interest rates in the global arena than the global growth suggesting equity markets are forward-looking. Although the markets digest the policy adjustments by the global central banks in a phased manner, the global growth trajectory always knocks the market mood.

Here is a list of key global macroeconomic factors that have notably influenced the Indian equity markets in recent years:

Price of Crude Oil : As one of the major importers of crude oil, India's economy and equity markets are sensitive to changes in global crude prices. A sharp decline or rise in crude oil prices can trigger a cascade of interrelated economic effects. For example, when oil prices fall, logistics and transportation costs decrease, reducing overall production expenses for companies heavily dependent on crude oil. This can result in higher net operating profit margins and increased after-tax profits for these firms. The cumulative effect of these factors may positively influence the equity markets, potentially boosting stock market performance. On a broader scale, being one of the major importers of crude oil, the Indian economy could benefit from a strengthened current account balance, as lower oil prices typically lead to reduced import costs. This improvement in the trade balance may contribute to an appreciation of the Indian rupee, further lowering the cost of imports. Collectively, these interconnected outcomes stemming from declining crude oil prices can create a more favourable economic environment, potentially enhancing market outlook and investor confidence.

Historically, the correlation between the Nifty 50 Index and crude oil prices has been significantly influenced by three major global events:

- The global financial crisis (2008-2009)

- Surge in crude oil demand amid geopolitical tensions among key oil-producing nations (2013-2014) and,

- The Russia-Ukraine War (2022-2023)

A notable example of this relationship is evident during the Russia-Ukraine conflict, when crude oil prices surged to an unprecedented $126.6 per barrel March 7, 2022, marking a 64.0% increase from January 3, 2022. Concurrently, the Nifty 50 experienced a substantial decline of 1,762.6 points. This inverse correlation underscores the intricate interplay between geopolitical events, oil prices, and stock market performance, particularly in oil-importing economies like India.

US 10-year Bond Yield : Indian equity markets are much influenced by the rates on US Treasury bonds, especially the 10-year yields. When US bonds offer higher interest rates, investors find them more attractive than putting money into riskier investments like stocks from India. Furthermore, higher US yields also increase the opportunity cost of investing in equities, because US Treasury yields are considered a risk-free benchmark, and as they rise, the relative attractiveness of equities diminishes. This tendency causes capital outflows from the Indian market as Foreign Portfolio Investors (FPIs) move money from Indian markets to safer US bonds. For example, The outflow of funds might lead the Indian rupee to depreciate, raising import prices and negatively impacting businesses with dollar-denominated debt. Additionally, rising US yields often signal expectations of higher inflation or tighter monetary policy in the US, which can dampen global risk appetite and lead to a risk-off sentiment, further affecting emerging markets like India.

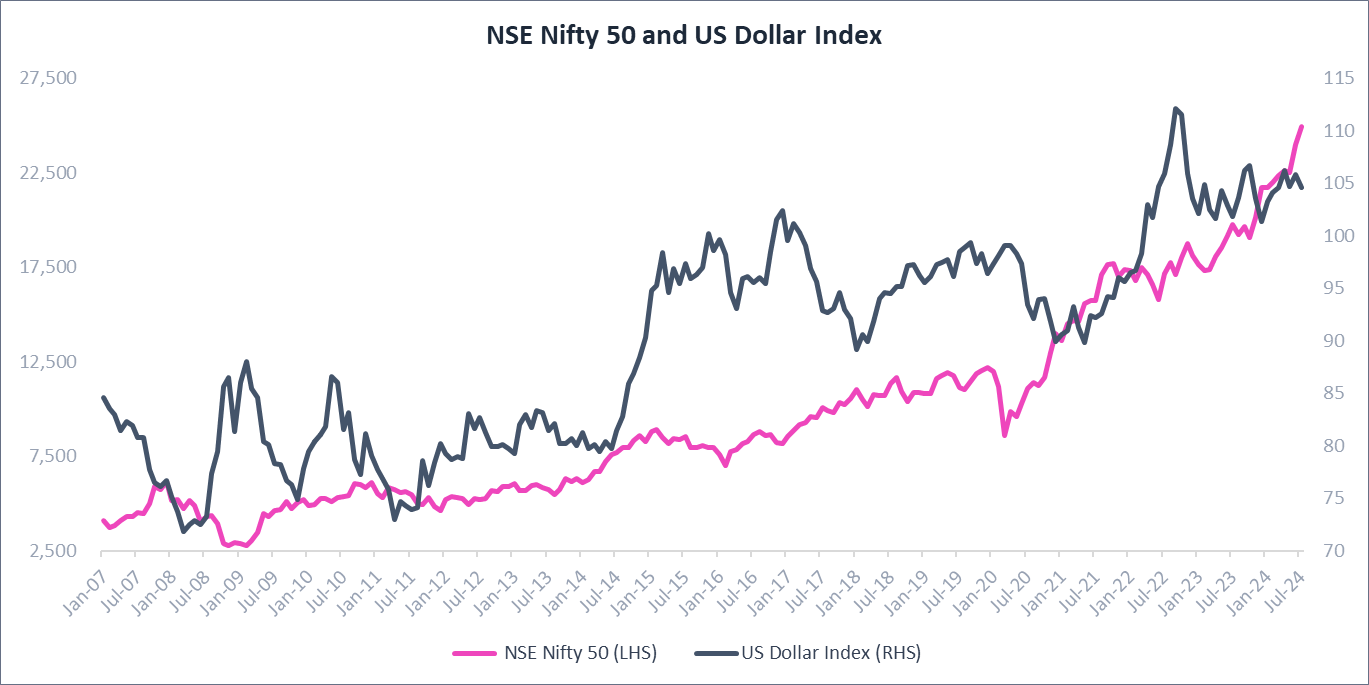

US Dollar Index : The US dollar index (USDX), is an essential indicator in determining the strength of the US dollar relative to a basket of currencies around the world. It is also a quintessential indicator of how equity markets perform in India. For example, as the USDX declines, the Indian rupee appreciates against the US dollar, and imports such as crude oil and other commodities become cheaper for individuals and corporations in India leading to a rise in profitability and stock performance.

Source: CMIE Economic Outlook, https://in.investing.com, 1 Finance Research

The historical correlation between the USDX and the Nifty 50 Index has been significantly influenced by three major global events:

- Global Financial Crisis (2008-2009),

- Covid-19 pandemic (2020-2021), and

- Russia-Ukraine War (2022-2023)

These events highlight the inverse relationship between the two indices, driven by various economic and geopolitical factors. A notable example of this relationship is evident during the Global Financial Crisis, when the USDX surged from 71.8 to 85.6 between March and October 2008, marking a 19.3% increase. Concurrently, the Nifty 50 experienced a substantial decline from 4,734.5 to 2,885.6, a drop of 39.1%. Similarly, during the early stages of the Covid-19 pandemic, the USDX rose from 97.4 to 99.1 between January and March 2020, while the Nifty 50 plummeted from 11,962.1 to 8,597.8. This inverse correlation underscores the intricate interplay between global economic uncertainty, currency strength, and stock market performance, particularly in emerging economies like India.

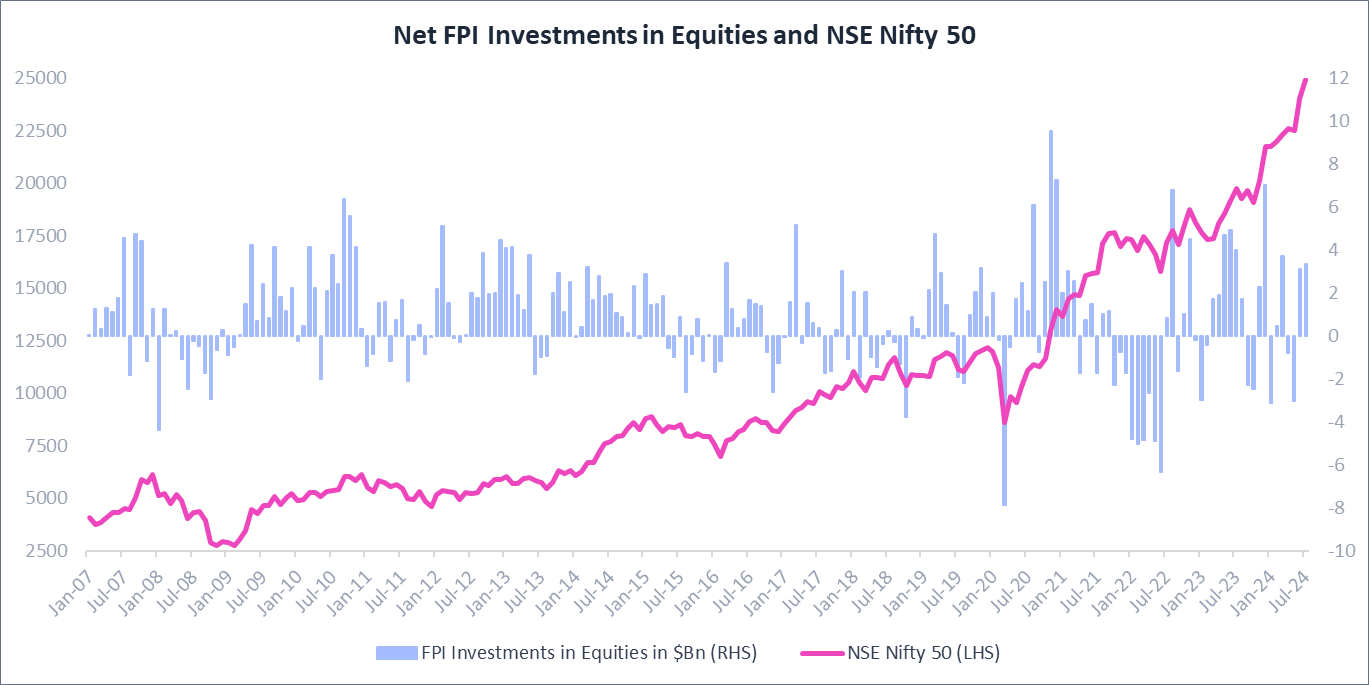

Role of Foreign Portfolio Investors

Foreign investment flows act as a gauge of investor confidence in the Indian economy. Large FPI investments can have a cascading effect, drawing in domestic capital and driving up stock values. At the same time, adverse global events can influence foreign capital outflows and corrections in the stock markets. Sudden FPI outflows, as seen during the 2008 Global Financial Crisis and the early stages of the Covid-19 pandemic have led to sharp market declines.

Source: CMIE Economic Outlook, 1 Finance Research

There were substantial net outflows during the Global Financial Crisis (2008-2009), and FPIs withdrew $4.4 billion in January 2008. The Nifty 50 fell from 5,137.5 in January 2008 to 2,763.7 by March 2009, a drop of nearly 46.2%. This period marks the strong negative impact of foreign outflows on market performance due to economic turmoil.

The Covid-19 pandemic witnessed initial foreign investment outflows of $7.9 billion in March 2020, coinciding with a sharp 23.2% drop in the Nifty 50 (11,201.7 in February to 8,597.7 in March). However, the market showed remarkable resilience thereafter, and FPIs invested a net of $23.5 billion from April to December 2020. The Nifty 50 also recovered from 9,859.9 in April to 13,981.8 in December, a rise of about 41.8%.

During the Russia-Ukraine conflict in 2022 also there were significant FPI outflows. From January to June 2022, FPIs withdrew approximately $28.6 billion. Even with these massive outflows, the Nifty 50 showed relative steadiness, declining by 9% from 17,339.9 in January to 15,780.3 in June 2022. This suggests that domestic factors and investors played a crucial role in moderating the impact of FPI outflows during this period. Overall, while there's generally a positive correlation between FPI flows and Nifty 50 performance, the relationship is not always straightforward, as evidenced by the varying impacts observed during these major economic and geopolitical events.

Conclusion

Equity market performance is a complex interplay of global macroeconomic forces evident from various global indicators, and not limited to domestic factors. Geopolitical events like the Russia-Ukraine war, economic crises such as the Global Financial Crisis, and the Covid-19 pandemic have all influenced multiple macroeconomic variables, including FPI flows, crude oil prices, and the USD Index. Historical evidence shows that sudden changes in crude oil prices have the maximum impact on Indian markets, while geopolitical events such as wars between countries, policy shocks or financial crises also play a major role. For instance, during the Global Financial Crisis, significant FPI outflows led to a 46.2% drop in the Nifty 50, while the Covid-19 pandemic saw a 23.2% decline followed by a robust recovery driven by renewed FPI investments.

Regardless of the challenges, India's long-term economic prospects remain compelling. The country is projected to become the third-largest economy by 2030, surpassing Japan and Germany. Several factors contribute to this optimistic outlook:

- Demographic dividend: With nearly 44% of its 1.4 billion population under 24 years of age, India has a vast young population.

- Supply-chain diversification: Global companies are increasingly looking to India as an alternative manufacturing hub to China.

- Government initiatives: Efforts to ease regulatory burdens, investments in infrastructure, and tax incentives are attracting foreign investment.

- Domestic demand: India's economy is largely driven by local services, making it less vulnerable to global economic shifts.

For investors, understanding these dynamics is crucial. Equities offer higher potential returns during economic expansions and periods of market optimism. In essence, investing in equities requires a nuanced understanding of the global economic landscape. By staying attuned to macroeconomic indicators and geopolitical developments, investors can strategically balance their portfolios optimising returns while managing risks.