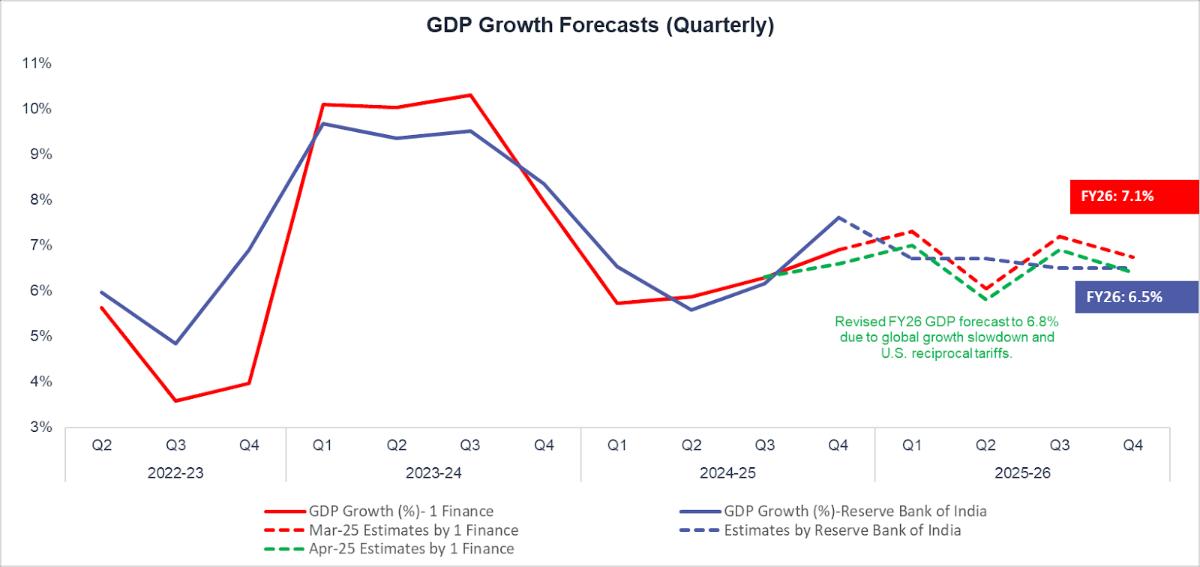

India’s growth story is once again at a pivotal juncture. After a stellar 9.2% GDP growth in FY24, the economy has shown signs of moderation in early FY25, partly due to global headwinds.

The International Monetary Fund (IMF) has recently downgraded the global growth forecast for 2025 to 2.8%, down from 3.3% in January, citing heightened trade tensions and policy uncertainties as significant drags on global economic activity. A major contributor to this slowdown is the resurgence of U.S. protectionist trade policies under President Donald Trump's administration. The reintroduction of steep tariffs has disrupted global supply chains and dampened investor confidence.

While the economy has shown endurance, the looming threat of reinstated U.S. tariffs —currently suspended for 90 days—has added a fresh layer of uncertainty to the global trade landscape, prompting central banks and analysts alike to recalibrate their outlook.

I. India’s Recent GDP Performance: A Quarter of Acceleration

India's economy remains on a steady footing despite growing global volatility. The third quarter of FY2024- 25 (October–December 2024) offered positive signs of growth reflecting endurance and adaptability. Yet, risks from the global environment, especially surrounding U.S. trade policy, have started to impact future projections.

A Look at the Numbers

- FY 2023-24: The economy surged by 9.2%, marking the highest growth in over a decade (excluding the post-pandemic rebound of 9.7% in FY 2021-22).

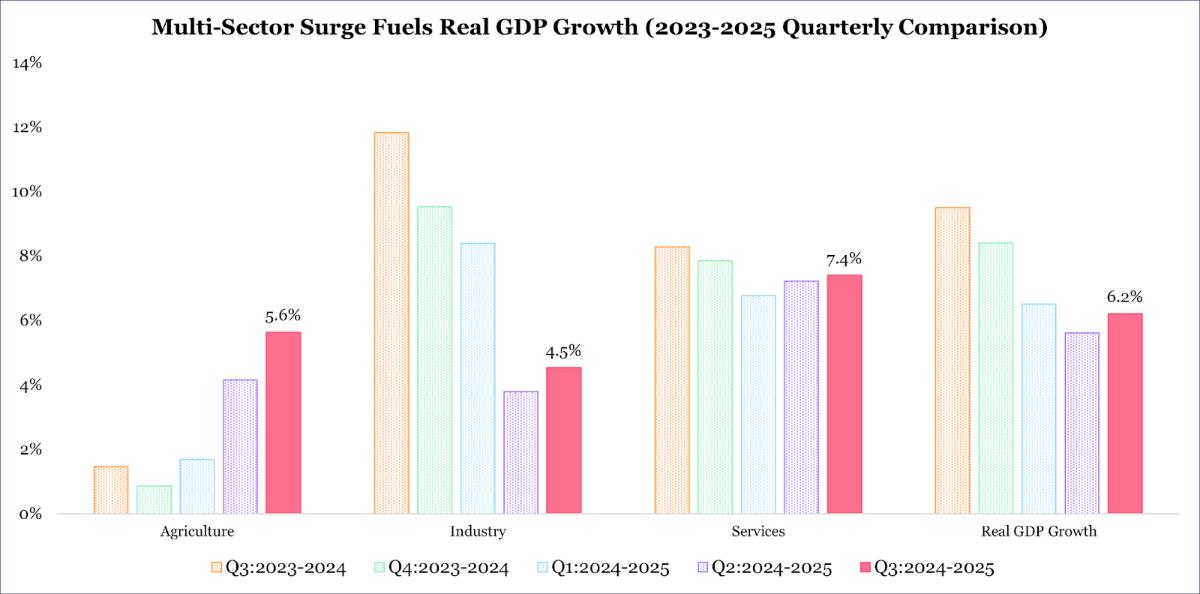

- Q3 FY 2024-25: Real GDP grew by 6.2%, driven by manufacturing, services, and infrastructure.

- FY 2024-25 Forecast: Growth is expected to moderate to 6.5%, reflecting the impact of renewed global trade uncertainties and tariff-related headwinds.

Drivers of Growth: What’s Powering the Economy?

- A key driver of the country's economic growth is Private Final Consumption Expenditure (PFCE), which reflects household spending. PFCE is expected to grow to 7.6% in FY 2024-25, rising from 5.6% in the previous year (FY 2023-24). This growth indicates an increase in disposable income and consumer spending.

- Increased government spending on infrastructure has played an important role in boosting economic activity. Government spending increased by 8.3% in Q3 FY25, up from 2.3% in Q3 FY24.

- Improved consumer sentiment is evident in FMCG sales growth, which nearly doubled to 5% in Q3, up from 2.5% in the previous quarter.

- Exports rose 10.4% YoY in Q3, marking the strongest growth in seven quarters. This was largely driven by a 17.5% surge in services exports, while merchandise exports posted a modest 3.3% growth.

- Despite strong government capex (up 47.7% YoY in Q3), Gross Fixed Capital Formation rose just 5.7% YoY—a seven-quarter low. The investment rate (GFCF-to-GDP) fell to 31.9%, a three-year low, indicating subdued private investment amid global uncertainty and weaker household real estate activity.

Recommended for you

Readers also explored

India’s Economy Meets Fresh Roadblocks

Currency in Circulation: How Much Money Exists in the World?

Sectoral Landscape: Performance and Outlook

Sector | Q3FY25 Growth (%) | Index Value* | Performance Highlights | Near-Term Outlook |

| Agriculture | 5.6 | 60.6 | Strong kharif and rabi harvests; government support via credit schemes and subsidies; and strong rural demand. | Expected to maintain steady growth if monsoon remains normal; food inflation easing supports consumption. |

| Industry | 4.5 | 61.2 | Growth supported by infrastructure spending; manufacturing slowed due to weaker exports and monsoon disruptions. | Moderate growth outlook; risks from global slowdown and U.S. tariffs; government capex likely to sustain momentum in infrastructure. |

| Services | 7.4 | 77.2 | Largest GDP contributor, strong urban demand recovery, growth led by IT, communication, and financial services. | Expected to remain a key growth engine; digital adoption and skilling to support expansion; some exposure to global headwinds remains. |

Quick Takeaway:

- Agriculture held up well and remains important for rural stability.

- Industry is facing headwinds, especially from weaker exports and trade pressures.

- Services continue to lead growth, backed by demand, tech adoption, and government initiatives.

II. Trade Tension: Tariffs and Uncertainty

Trump’s tariff policies, dubbed the “Liberation Day” hikes, have significantly altered the global trade landscape. The initial announcement of reciprocal tariffs sparked widespread market volatility, with fears of a global trade contraction.

However, the 90-day tariff suspension, announced on April 9, 2025, provides temporary relief for India, which initially faced a 26% tariff on its exports to the U.S. This pause, reducing tariffs to a universal 10% for most countries (except China), opens a window for trade negotiations.

While India’s economy is relatively insulated compared to more export-dependent nations, the tariffs introduce both challenges and opportunities that could shape growth in FY25- 26 and beyond.

Macroeconomic Implications:

- Export-Driven Sectors at Risk: Sectors with high export dependency, such as textiles, gems & jewellery, and steel, face greater vulnerability.

- Pressure on Trade Balance: With the U.S. being one of India's largest trading partners, steeper tariffs could widen the trade deficit and suppress earnings from key export sectors.

- Policy Responses & Realignment: The government may need to accelerate trade negotiations, diversify export markets, and ramp up domestic demand support to cushion potential fallout.

Sectoral Vulnerabilities: Who’s the most at Risk?

India’s GDP growth trajectory remains uneven, with certain sectors facing distinct risks if the suspended 26% U.S. tariffs are reinstated. Below is a table highlighting potential vulnerabilities across critical sectors:

Sector | Potential Tariff Impact | Impact of tariffs on India’s exports to USA (%) | Key Data | Implications |

| Electronics | High | (-)12.0% | - $14B annual exports to U.S in 2024. | - Supply chain disruption. - Delayed manufacturing expansion. - Reduced FDI in electronics hubs. |

| Gems & Jewellery | High | (-)15.3% | - $11.9B annual exports to U.S in 2024. -U.S. accounts for 30% of demand. | - Shift to low-cost lab-grown diamonds. - Reduced profit margins. |

| Steel and Iron | High | (-)18.0% | - $487.7M exports to U.S. in 2024. | - Export revenue decline. - Domestic oversupply and price pressure. - Reduced global competitiveness. |

| Automobiles | High | (-)12.1% | -26% tariff on components. - $2B exports at risk. | - Higher input costs for EVs. - Delayed localisation and Make-in-India plans. |

| Textiles | Moderate | (+) 4.2% | - $3.1B exports to U.S. in 2024. -Long-term gains due to relatively lower tariffs compared to countries like China and Vietnam. | - Market share loss in U.S. - Increased competition from Vietnam and Bangladesh. |

| Agriculture | Moderate | (-)13.5%: Spices, coffee and tea (-)12.3%: Cereals (wheat, rice) | -Basmati rice, wheat, and spices face a 26% tariff. | -Price disadvantage in U.S. - Shift to processed/organic exports. |

| Pharmaceuticals | Low | (+) 2.1% | -Exempt from tariffs - $12.7B annual exports to U.S in 2024. | - Stable export revenue. |

Strategic Response

- Tariff Suspension Opens Window: The U.S.’s 90-day pause on tariffs (April 2025) offers India temporary relief and a chance to renegotiate. A reduction to 14.6% could benefit exports like textiles and machinery.

- Shift in Trade Strategy: Diversifying exports to South Asia and Europe could open up a $50 billion opportunity, as per the Federation of Indian Export Organisations (FIEO).

- Currency Risks Persist: A Chinese yuan devaluation could trigger rupee weakness, raising import costs and inflation pressures.

- Monetary Policy Response: The RBI cut rates by 25 bps in April 2025, bringing the repo rate to 6%, signalling support amid global uncertainty.

The next few months will be critical in determining the trajectory of India’s trade relations and economic growth. Ongoing negotiations for a potential Indo-US trade agreement could open new opportunities for exports, tariff concessions, and investment. In the meantime, India’s strength will be tested, but its fundamentals, driven by consumption, infrastructure, and services, remain a solid anchor in an uncertain world.

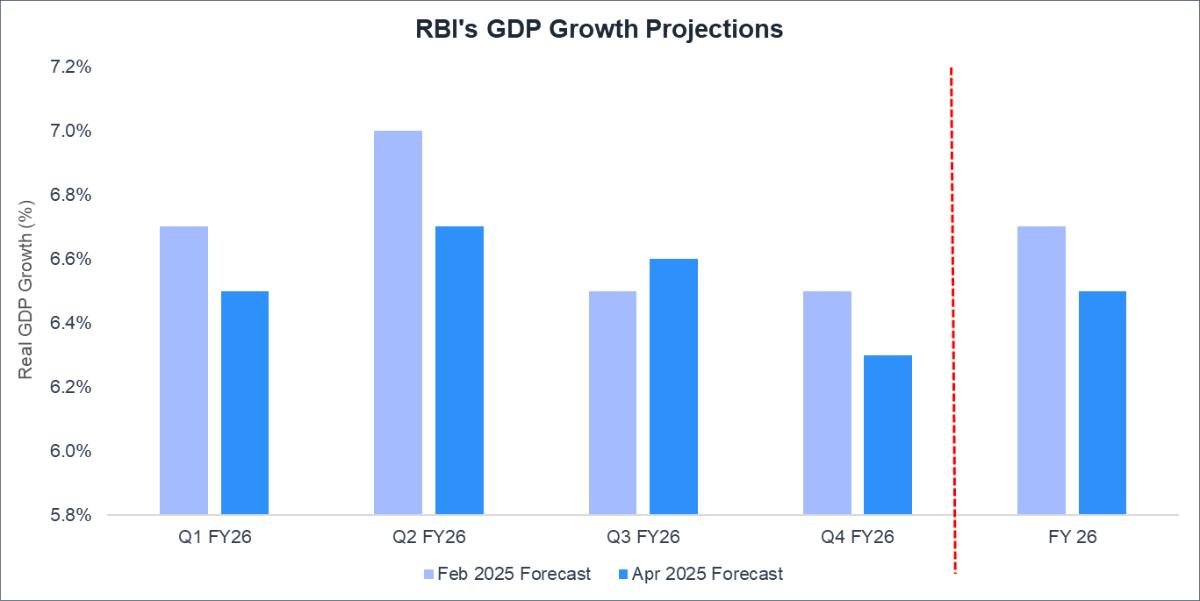

III. GDP Revised Forecast: Growth with Caution

Amid global trade turbulence, the Reserve Bank of India (RBI) has revised India’s GDP growth forecast for FY2024- 25 downward to 6.5%, citing risks from rising protectionism, global demand moderation, and geopolitical uncertainties. This marks a shift from the earlier optimistic estimate of 6.7%, which had reflected strong domestic demand and capital expenditure momentum.

The central bank emphasised that while domestic drivers remain robust, including strong private consumption and public capex, external vulnerabilities must be watched closely.

Our forecast by India Macro Indicators for FY26 reflects a slightly more optimistic 6.8%, incorporating near-term risks from delayed export orders, tariff uncertainty, and muted global growth. However, we expect a rebound in FY26, aided by a pickup in private capex, easing commodity prices, and a recovery in global trade sentiment.

IV. Challenges to Watch Out For

While the medium-term outlook remains constructive, several risks warrant attention:

- Tariff Reimposition Risk: The end of the 90-day tariff suspension could see a return to higher U.S. duties, especially on high-volume export sectors.

- Global Economic Deceleration: Slowing growth in the U.S., EU, and China could drag down India’s export-led industries.

- Monsoon & Agricultural Output – A normal monsoon will be critical for sustaining rural demand and keeping food inflation in check. Any weather-related disruptions could impact consumption trends.

- Private Investment Cycle – While public capex has been robust, private sector investments need to pick up further for long-term economic expansion. Confidence in policy stability will play a key role.

V. Looking Ahead: What will shape India’s Growth?

India’s GDP growth in Q3 signals strength amid global uncertainty. With strong domestic demand, government spending, and sectoral tailwinds, the economy remains on track for its 6.5% FY25 growth target.

That said, the next quarter will be crucial. The following levers will likely define India’s growth narrative over the next few quarters:

- Trade Diplomacy: Outcomes from the ongoing U.S.-India tariff negotiations could reset export trajectories and investor sentiment.

- Monsoon Performance: A normal monsoon would support rural demand, food inflation control, and agri-sector growth.

- Strong Consumption Outlook: A combination of an accommodative monetary policy, low direct taxes, and easing inflation sets the stage for higher disposable incomes and a strong consumption-led growth narrative.

- Policy Stability: Confidence in regulatory clarity and pro-growth policies will be crucial to sustaining domestic and foreign investments.

- Global Demand Recovery: Revival in the U.S. and Eurozone economies would provide a tailwind to India’s external sectors.

India's economic story remains one of resilience, reinvention, and readiness. The external environment may be volatile, but India’s core strengths—its large domestic market, demographic dividend, and reform momentum—continue to offer a strong foundation for growth.

The next few months will test the country’s adaptability in terms of economic policy and trade diplomacy. But if India stays focused on strategic reforms, deepens domestic capabilities, and steers global risks with agility, the long-term growth runway remains compelling.