Table of Content

Share article:

AUM in Mutual Funds

December 23, 2024

12 min read

By 1 Finance team

AUM in Mutual Funds

Assets Under Management (AUM) in Mutual Funds is a crucial metric in the mutual fund industry, representing the total market value of investments managed by a fund on behalf of its investors. In the broader context of the Indian economy, AUM is much more than a financial indicator for individual funds. It reflects the progress of financial inclusion, the expansion of capital markets, and the growing trust in India’s economic resilience. This article explores AUM’s significance, calculation, trends, and its role as a key driver of the Indian economy.

How Is AUM Calculated?

AUM is calculated by aggregating the total value of all assets held by a mutual fund. The formula is:

AUM = NAV of the mutual fund scheme × Total number of outstanding units

NAV (Net Asset Value) represents the per-unit price of a mutual fund, calculated as the total value of the fund's assets minus its liabilities, divided by the total number of outstanding units. It provides a snapshot of a fund's value, helping investors determine the cost of purchasing or redeeming units on a given day.

For example, if a mutual fund’s NAV is ₹50 and it has 1,000,000 outstanding units, the AUM would be ₹50,000,000 (₹50 × 1,000,000).

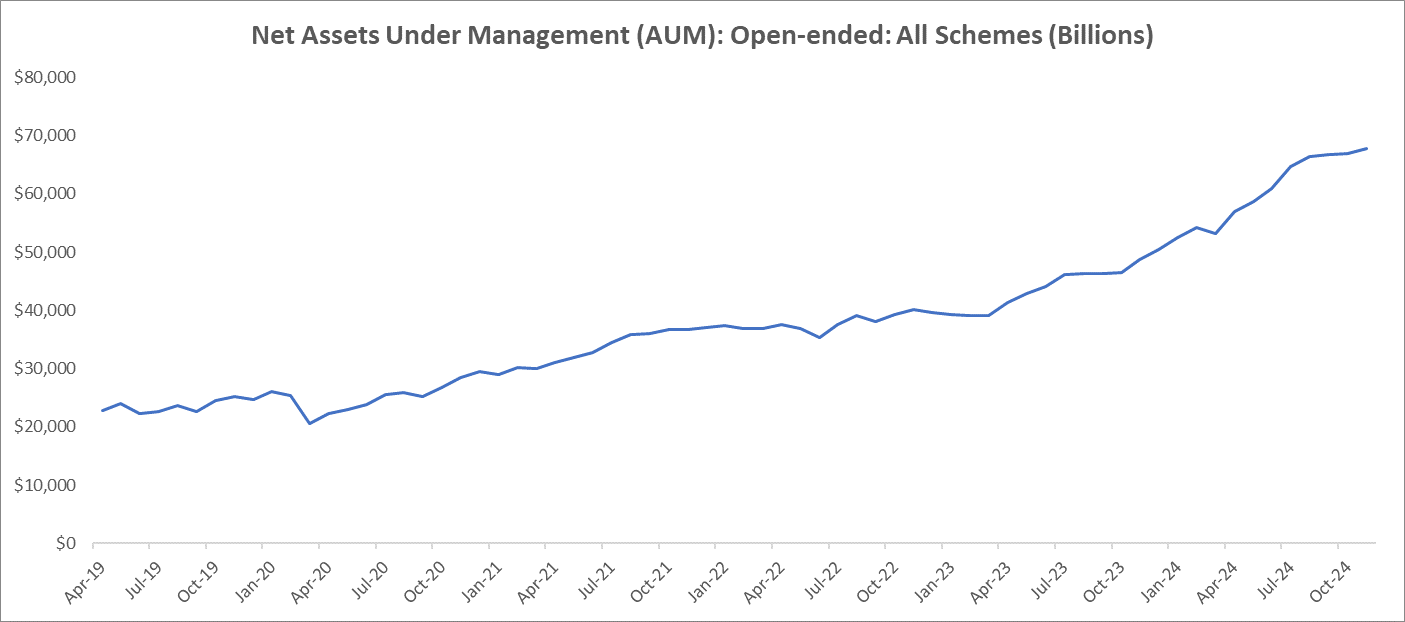

The total AUM of the mutual fund industry is derived by summing up the AUMs of all individual mutual funds operating in the market. For instance, in India, the collective AUM of all mutual funds surged from $22.8 trillion in 2019 to $67.8 trillion by Nov-2024, showcasing the sector’s rapid growth and increasing role in the economy.

Key Factors Influencing AUM

1) Market Fluctuations: Changes in the value of underlying securities can lead to daily variations in AUM.

2) Investor Behavior: New investments increase AUM, while redemptions reduce it.

3) Dividends and Distributions: Reinvested distributions add to AUM growth.

Understanding these factors provides a clearer picture of how AUM, both at the individual fund level and the industry-wide scale, interacts with macroeconomic conditions and market dynamics.

Types of Mutual Funds and Their Historical AUM Growth

Mutual funds cater to diverse investment needs, and their growth over the years reflects the evolving preferences of investors and economic conditions in India.

1) Equity Funds

Equity funds are a cornerstone of the mutual fund industry, focusing on investments in stocks of publicly traded companies. They are particularly favored by investors with long-term financial goals, such as wealth creation and retirement planning. These funds offer the potential for higher returns compared to other mutual fund categories, albeit with greater risk due to market volatility.

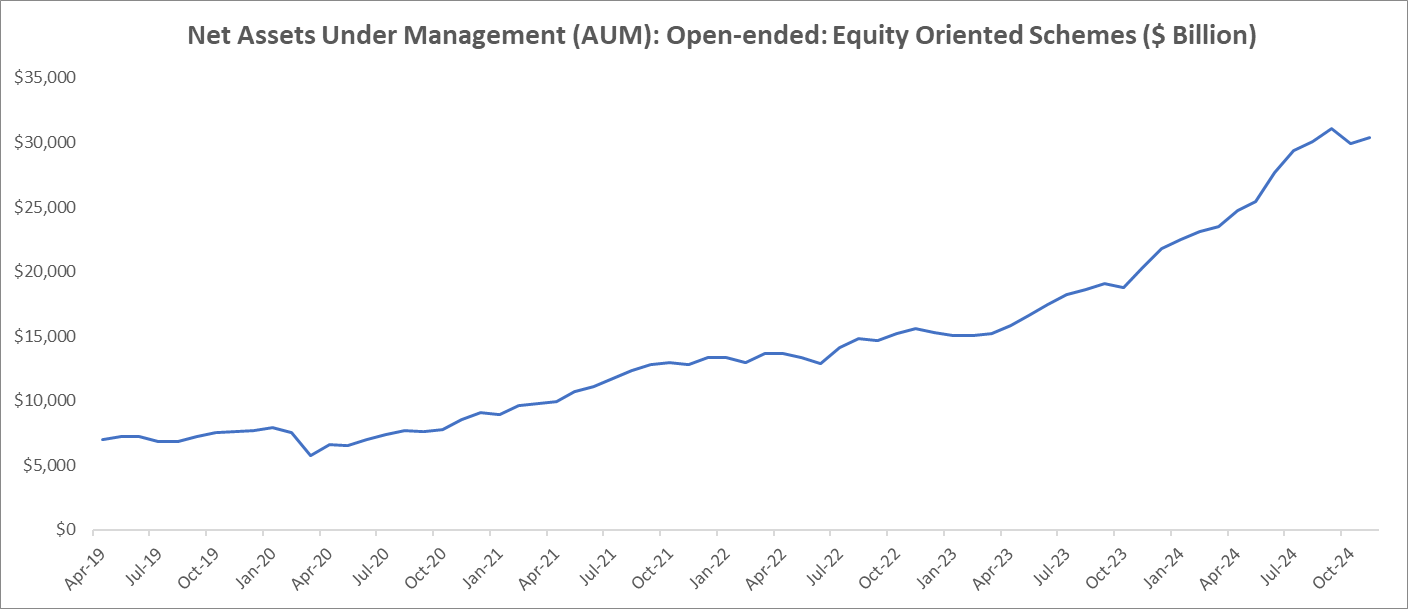

- Historical Growth: Equity funds have demonstrated remarkable growth in recent years, with their AUM rising from $0.7 trillion in 2019 to ₹30.3 trillion by 2024, achieving a compound annual growth rate (CAGR) of 20%. This growth underscores the increasing trust of retail and institutional investors in equity markets and reflects the robust performance of the Indian corporate sector over the years.

- Categories within Equity Funds: Equity mutual funds encompass various sub-categories tailored to investor preferences, including large-cap, mid-cap, small-cap, and sectoral funds. Large-cap equity funds focus on blue-chip companies, offering stability, while small-cap funds target emerging businesses with high growth potential.

- Economic Role: Equity funds play a pivotal role in capital formation by pooling investments from diverse investor segments. These funds direct resources into industries critical to economic growth, such as technology, infrastructure, and manufacturing. By supporting publicly listed companies, equity funds enhance market liquidity and drive innovation.

- Retail Participation and Financial Inclusion: The rise in equity fund investments has been fueled by increasing retail participation, supported by initiatives like Systematic Investment Plans (SIPs). Monthly SIP inflows exceeded ₹15,000 crore in 2023, demonstrating the growing financial inclusion and democratization of equity investing in India.

- Impact on Corporate Governance: With significant institutional investments, equity funds contribute to improved corporate governance practices by demanding transparency and accountability from companies. This oversight aligns the interests of businesses with those of their stakeholders, fostering sustainable growth.

Overall, equity mutual funds not only cater to individual financial aspirations but also serve as a critical driver of India’s economic transformation, fostering innovation, employment, and market efficiency. To make informed decisions and find equity funds best suited to your goals, explore 1 Finance’s scoring and ranking of Equity Mutual Funds.

2) Debt Funds

Debt funds are a pivotal component of the mutual fund landscape, focusing on fixed-income securities such as government bonds, corporate bonds, treasury bills, and other money market instruments. These funds cater to investors seeking steady and predictable returns with relatively lower risk compared to equity funds.

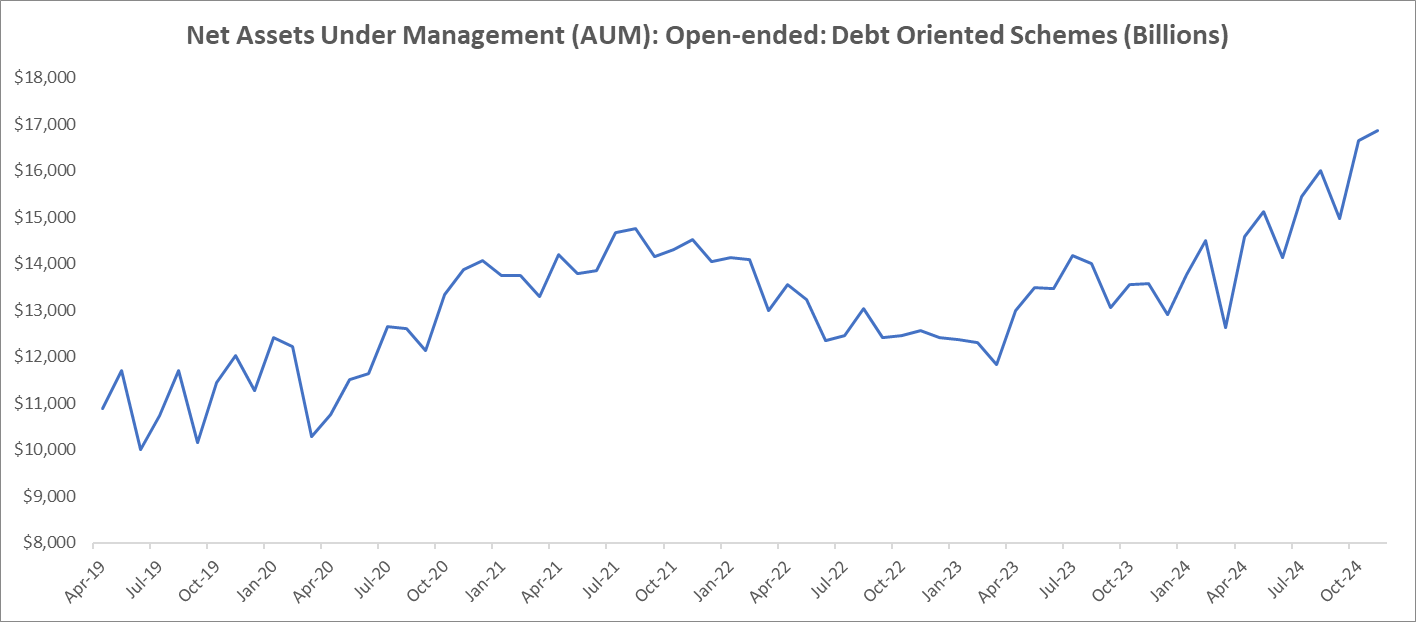

- Historical Growth: Debt funds have witnessed significant expansion, growing from $10.8 trillion in AUM in 2019 to $16.8 trillion in 2024, reflecting a compound annual growth rate (CAGR) of 8.1%. This growth is attributed to increasing investor interest in income-generating instruments, particularly during periods of market volatility.

- Categories within Debt Funds: Debt mutual funds are further classified into sub-categories, including liquid funds, short-term funds, dynamic bond funds, and gilt funds. Each category caters to specific investor needs, ranging from liquidity management to long-term income stability.

- Economic Role: Debt funds play a crucial role in economic stability by channeling investments into government and corporate debt instruments. They provide vital funding for infrastructure development, public sector projects, and private sector growth initiatives. For example, investments in government bonds help finance critical projects like highways, ports, and renewable energy ventures.

- Risk Mitigation and Portfolio Diversification: These funds are preferred by risk-averse investors for their ability to reduce portfolio volatility. By offering a counterbalance to equity investments, debt funds contribute to a diversified investment approach, making them indispensable for holistic financial planning.

- Popularity Among Retail and Institutional Investors: Retail investors utilise debt funds for stable returns and capital preservation, while institutional investors often use these funds for liquidity management and as a parking avenue for short-term surpluses.

- Response to Macroeconomic Trends: Debt fund performance is closely linked to interest rate movements, inflation, and monetary policy. For instance, a falling interest rate environment typically boosts bond prices, benefiting debt fund investors. Conversely, rising rates may pose challenges but also create opportunities in short-term instruments.

In summary, debt funds not only provide a reliable income stream for individual and institutional investors but also act as a backbone for economic development by mobilizing resources into key sectors, ensuring financial stability, and fostering investor confidence. Check out 1 Finance’s scoring and ranking of Debt Mutual Funds to discover funds that align with your financial goals.

3) Hybrid Funds

Hybrid funds are versatile investment vehicles that allocate assets across equities, debt, and sometimes other instruments like gold. This diversified approach aims to balance risk and reward, catering to a wide spectrum of investor profiles. These funds are particularly popular among conservative investors seeking moderate growth with reduced volatility compared to pure equity funds.

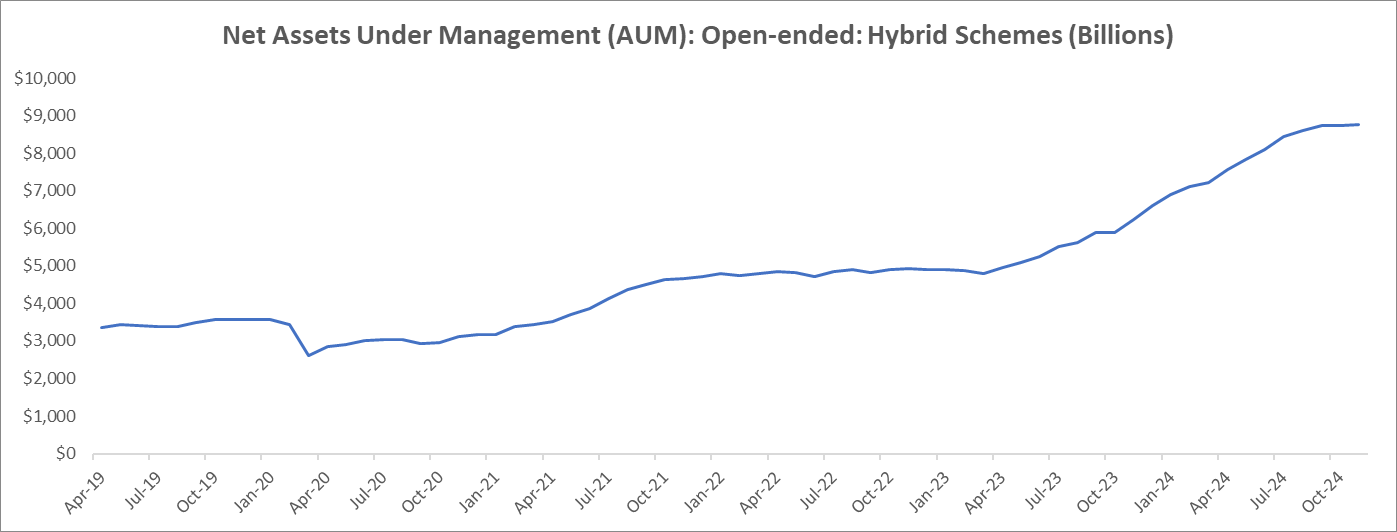

- Historical Growth: Hybrid funds have experienced significant growth over the past decade, with their AUM surging from $33.6 trillion in 2019 to $88.7 trillion in 2024, achieving a CAGR of 18.7%. This reflects their growing acceptance as a middle ground between equity and debt investments.

Categories within Hybrid Funds: Hybrid funds are further classified into:

Balanced Advantage Funds: Dynamically manage equity and debt allocations based on market conditions.

Aggressive Hybrid Funds: Allocate a higher proportion to equities (up to 75%) while keeping the rest in debt instruments.

Conservative Hybrid Funds: Prioritize debt investments, with a smaller allocation to equities.

Multi-Asset Funds: Invest across three or more asset classes, including equities, debt, and gold.

- Economic Role: By spreading investments across different asset classes, hybrid funds enhance market participation. They encourage conservative investors to transition from traditional savings instruments like fixed deposits to market-linked investments. This transition plays a crucial role in mobilizing household savings into productive sectors of the economy.

- Risk Mitigation and Stability: The inherent diversification in hybrid funds reduces portfolio volatility and shields investors from extreme market fluctuations. For example, during equity market downturns, the debt component cushions losses, providing overall stability to the portfolio.

- Popularity Among First-Time Investors: Hybrid funds are often recommended for first-time mutual fund investors due to their balanced risk-return profile. They act as an entry point for individuals hesitant about taking high equity exposure.

In summary, hybrid funds serve as a critical bridge between equity and debt investments, making them an indispensable part of a diversified portfolio. To make informed decisions on choosing the right funds, check out 1 Finance’s Scoring and Ranking of Hybrid Mutual Funds.

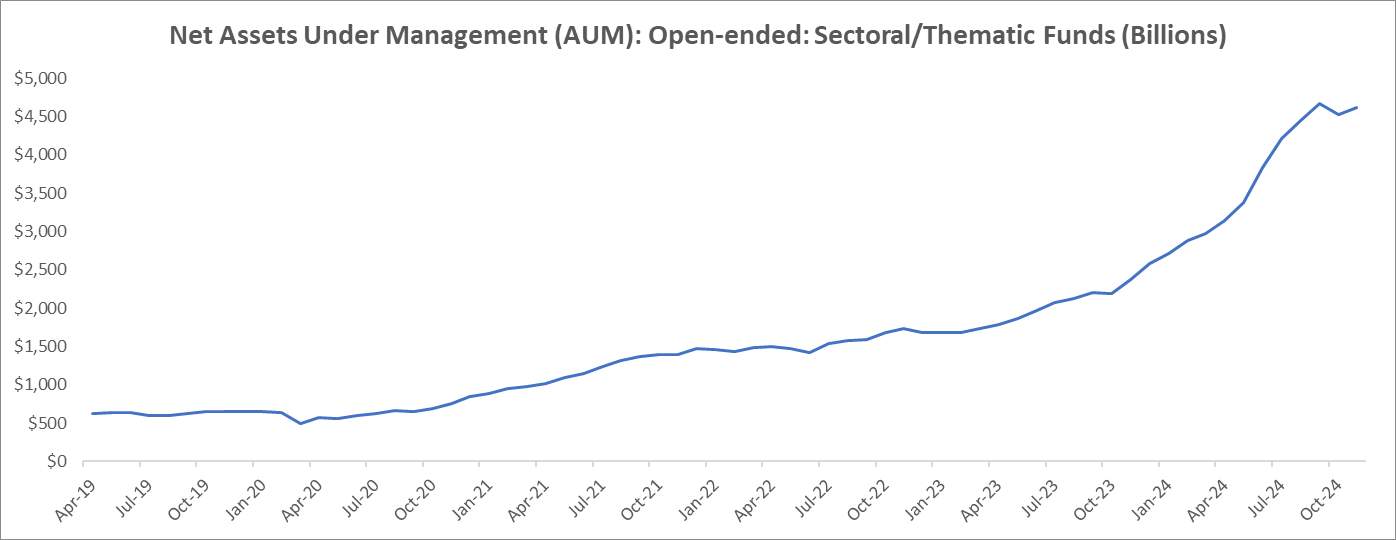

4) Sectoral and Thematic Funds

Sectoral and thematic funds are specialized mutual funds that focus on specific industries or overarching investment themes, catering to investors with targeted objectives and risk appetites.

- Sectoral Funds: These funds concentrate on particular industries, such as technology, healthcare, or energy. For instance, a technology sector fund would invest predominantly in IT companies, aiming to capture the growth potential of the industry.

- Example: The rise of India's IT sector over the past two decades has made technology-focused funds a popular choice among investors seeking exposure to one of the fastest-growing industries in the country.

- Thematic Funds: Thematic funds, on the other hand, invest based on broad investment themes that cut across sectors, such as ESG (Environmental, Social, and Governance), rural development, or digital innovation. These funds identify macroeconomic trends and align investments to benefit from them.

- Example: ESG-themed funds have gained traction globally and in India as investors prioritize sustainable and socially responsible investing.

- Historical Growth: These niche funds have grown steadily, with a significant uptick in AUM in the last decade. Investors with a deep understanding of specific industries or themes have increasingly turned to these funds for focused growth opportunities.

- Economic Role: Sectoral and thematic funds play a vital role in economic diversification by channeling resources into high-growth and innovative sectors. They help drive investments in emerging industries, supporting technological advancements and sustainable development goals.

- Example: Healthcare sectoral funds saw increased investments during the COVID-19 pandemic, providing critical capital to companies involved in vaccine development and healthcare infrastructure.

- Risk and Reward: While these funds offer high growth potential, they also carry significant risks due to their concentrated exposure. Economic downturns or sector-specific challenges can lead to heightened volatility, making these funds suitable for informed and risk-tolerant investors.

In summary, sectoral and thematic funds cater to niche investment preferences, offering opportunities to align portfolios with specific industries or broader economic trends. Their role in promoting innovation, economic diversification, and targeted capital allocation makes them an integral part of the mutual fund landscape.

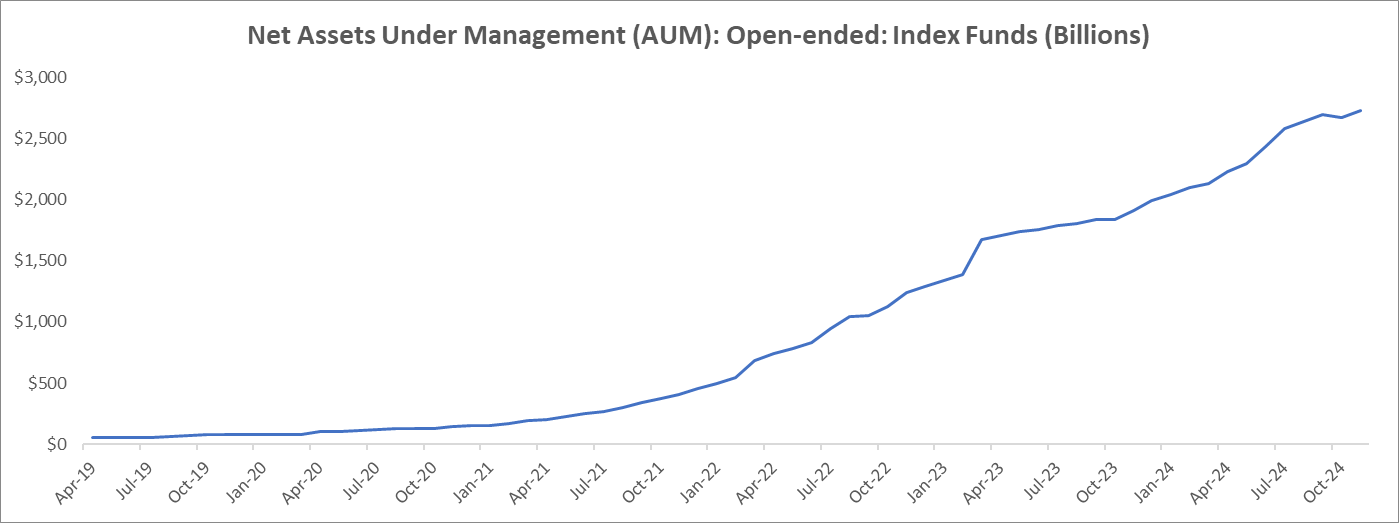

5) Index Funds and ETFs

Index funds and Exchange-Traded Funds (ETFs) are passive investment vehicles that aim to replicate the performance of a specific market index. These funds are known for their simplicity, cost-effectiveness, and wide appeal among both retail and institutional investors.

- Index Funds: These funds track the performance of a predefined index, such as the Nifty 50 or Sensex. Investors gain exposure to a basket of securities that mirror the composition of the index, offering broad market diversification.

- Example: An index fund tracking the Nifty 50 will invest in the top 50 companies listed on the National Stock Exchange (NSE) in the same proportion as the index.

- Exchange-Traded Funds (ETFs): ETFs also track indices but are traded on stock exchanges like individual stocks. This allows investors to buy and sell units throughout the trading day, offering greater liquidity compared to traditional mutual funds.

- Example: The Bharat Bond ETF focuses on public sector debt instruments, providing fixed-income investors a low-cost, liquid option.

- Historical Growth: The AUM of ETFs and index funds has seen exponential growth in recent years, fueled by a combination of low expense ratios, increasing financial awareness, and favorable regulatory policies. In India, ETFs alone have grown from less than $1 trillion in 2014 to over $27 trillion by 2024, reflecting their rising popularity among institutional investors, especially for Employee Provident Fund (EPF) allocations.

Economic Role:

- Market Efficiency: By mirroring market indices, these funds contribute to overall market stability and efficiency.

- Foreign Investment: ETFs attract foreign portfolio investors (FPIs) due to their transparency, low cost, and ease of trading.

- Financial Inclusion: Low minimum investment requirements and simplicity make index funds and ETFs accessible to retail investors, encouraging broader participation in capital markets.

- Advantages for Investors:

- Cost-Effectiveness: Lower expense ratios compared to actively managed funds make them attractive, especially for long-term investors.

- Diversification: Exposure to a wide array of securities reduces the risk associated with individual stock investments.

- Transparency: Investors always know the underlying portfolio, which mirrors the index composition.

- Challenges:

- Limited Returns: Since these funds aim to replicate, not outperform, the index, they may not appeal to investors seeking higher returns.

- Dependence on Market Performance: Returns are entirely dependent on the market index, making them vulnerable to broad market downturns.

In summary, index funds and ETFs are indispensable tools for investors looking to diversify their portfolios with minimal costs and effort. Their ability to democratize investing and attract institutional and foreign investments underscores their importance in India’s evolving financial ecosystem.

AUM as an Economic Indicator

Expansion of Financial Markets

The consistent growth in mutual fund AUM is a testament to India’s evolving financial landscape. This growth signals a shift from traditional savings instruments, such as fixed deposits and gold, to market-linked investments. Factors driving this transformation include rising financial literacy, technological advancements in investment platforms, and increasing investor confidence in capital markets.

India’s financial markets have witnessed unprecedented retail participation, fueled by initiatives like Systematic Investment Plans (SIPs) and digital onboarding processes. This participation not only enhances liquidity in the market but also democratizes access to wealth creation opportunities, contributing to a more inclusive financial ecosystem.

Mobilisation of Capital

High AUM levels indicate the efficient mobilization of household and institutional savings into productive avenues. Mutual funds act as a bridge, channeling this capital into critical sectors of the economy:

Equity Investments

By investing in publicly traded companies, equity mutual funds support corporate growth and innovation. These investments enable businesses to expand, create jobs, and contribute to GDP growth, fostering overall economic development.

- Debt Markets: Debt funds play a vital role in funding infrastructure projects, public sector initiatives, and corporate debt requirements. Investments in government bonds help finance national priorities such as highways, renewable energy, and urban development.

This strategic mobilization addresses funding gaps in key sectors, ensuring the optimal allocation of resources to high-impact areas. As a result, mutual funds enhance the nation’s capital efficiency, driving long-term economic progress.

Regulatory Influence on AUM

SEBI’s Role

The Securities and Exchange Board of India (SEBI) has introduced reforms to improve transparency, reduce costs, and enhance investor protection. Key measures include:

- Expense Ratio Regulation: Capping Total Expense Ratios (TERs) to make funds more cost-effective for investors.

- Risk Disclosure: Standardizing risk metrics through the “Risk-o-Meter” framework.

These initiatives have instilled confidence among investors, attracting both retail and institutional participants to mutual funds.

Taxation and Incentives

Tax benefits under Section 80C for Equity-Linked Savings Schemes (ELSS) have significantly driven AUM growth. These schemes encourage long-term investing while supporting equity markets.

Additionally, the reduction in capital gains tax rates for equity investments has made mutual funds an attractive avenue for wealth accumulation. These fiscal policies directly contribute to higher fund inflows and broader market participation.

AUM’s Contribution to Economic Development

Employment Generation

The growth in mutual fund AUM has created jobs across various domains:

- Financial Advisory: The rise in retail investors necessitates more advisors to guide investment decisions.

- Technology and Analytics: Fintech innovations and data-driven fund management require skilled professionals in AI, machine learning, and big data.

- Operations and Compliance: The increasing size of mutual fund firms demands robust operational teams to ensure seamless fund management and adherence to regulatory frameworks.

Enhancing Domestic Savings

By channeling household savings into mutual funds, AUM growth reduces reliance on foreign capital. This promotes economic sovereignty and ensures that funds are directed toward long-term, productive avenues such as infrastructure and innovation.

Market Stability

Large AUMs act as buffers during economic downturns. Systematic inflows through SIPs offset redemption pressures, providing stability to capital markets. This reduces volatility and builds resilience in India’s financial ecosystem.

Supporting Long-Term Economic Goals

The funds mobilized through high AUM are often directed toward long-term projects, including infrastructure development, technology advancement, and green energy initiatives. These investments align with India’s sustainable growth agenda.

Myths and Misconceptions About AUM

1) Higher AUM Equals Better Returns: While larger AUM reflects stability, it doesn’t necessarily mean higher returns. Performance is heavily influenced by market conditions and fund management strategies.

2) Small AUM Indicates Higher Risk: Smaller funds, despite having fewer resources, often leverage agility and niche strategies to capitalize on emerging market opportunities.

3) AUM Is the Sole Indicator of Success: AUM is a key metric, but factors like expense ratio, risk-adjusted returns, fund objectives, and managerial expertise are equally important.

Conclusion

AUM in mutual funds transcends its financial definition to reflect India’s economic ambitions and progress. As a cornerstone of financial inclusion, market stability, and economic resilience, AUM growth showcases the mutual fund industry’s integral role in shaping India’s future. By channeling resources into productive sectors and fostering investor confidence, mutual funds empower individual wealth creation while driving the nation’s growth trajectory.

The rising AUM in India is a testament to the evolving financial landscape and highlights the mutual fund industry's critical role in achieving long-term economic objectives. With continued policy support and innovation, AUM will remain a vital engine of economic growth in the years to come.

FAQ's

AUM represents the total value of assets managed by a fund. Its growth signifies financial inclusion, capital mobilization, and market stability.

AUM is the product of a fund’s NAV and its total outstanding units.

No, while it indicates fund stability, performance depends on investment strategy and market conditions.

SEBI caps expense ratios, standardizes disclosures, and mandates investor protection measures to enhance transparency and efficiency.

SIPs contribute to consistent AUM growth, offering stability during volatile market conditions.

AUM reflects the economic health of a nation, showcasing the depth of financial markets and investor confidence in long-term growth prospects.

Disclaimer: The information provided in this blog is based on publicly available information and is intended solely for personal information, awareness, and educational purposes and should not be considered as financial advice or a recommendation for investment decisions. We have attempted to provide accurate and factual information, but we cannot guarantee that the data is timely, accurate, or complete. India Macro Indicators or any of its representatives will not be liable or responsible for any losses or damages incurred by the readers as a result of this blog. Readers of this blog should rely on their own investigations and take their own professional advice.